Mutual funds are one of the best options available to small retail investors to diversify their investment and earn superior returns. Through Mutual Funds, you can invest in various types of products – for e.g. Equities, Bonds, Fixd Income, Gold, Commodities companies, Index etc.

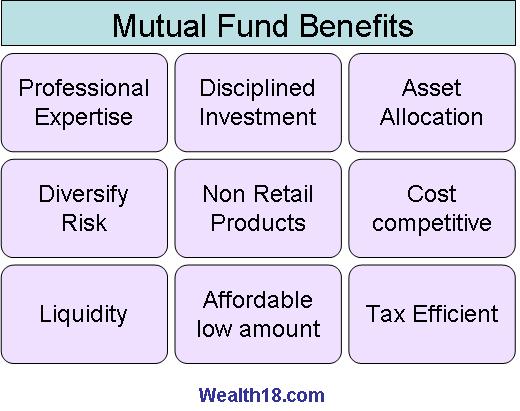

In this post, I have tried to list some major benefits of investment in mutual funds

1) Professional Expertise

As we can’t be experts in everything, so it is better to leave certain things with professionals.

Fund managers are highly qualified & experienced, track the market activities closely, speak to company management on on-going basis, understand the economic & sector indicators better and are in better position for investment decision making.

For e.g. Prashant Jain of HDFC Mutual Fund is IIT & IIM Alumni with 20+ years of experience in managing & research in Mutual funds industry and managing more than INR 20000 crore.

2) Disciplined Investment

Retail investors always tend to buy when market has already gone up & do not sell when market is going down. Or they regret of not buying stocks at low price or selling shares when price was high few months back.

Mutual funds offer a discipline to investors where they can invest without emotional attachments. You can invest systematically every month/ fortnight / week by choosing the option of Systematic Investment Plan (SIP). Irrespective of market, a fixed amount will be invested in selected schemes, so you will not loose the market upward movement.

3) Asset Allocation

Based on your goals, horizon & risk appetite, you can allocate your money in various asset class.

Mutual funds offer you various investment options like:

- Equity Mutual Funds – Large Cap, Mid Cap, Small Cap, Diversified, Sector, Thematic, International, Arbitrage, Balanced etc

- Fixed Income – Long term debt, Short term, ultra short term , liquid etc

- Gold – Gold ETF, Gold Savings Fund

- International Funds

- Fund of Funds

4) Risk Diversification

You can diversify your risks across asset classes, across industry, across companies. For e.g. if you invest Rs 10000 in Infosys shares, you are taking risk on one company’s performance. If you are bullish on IT sector, you can diversify your risk by investing in IT sector fund, or a diversified mutual fund.

5) Allow to participate in products not available to retail investors

Mutual fund also allows you to invest in products like High value government bonds, corporate bonds, commercial papers, etc which are normally not available to small retail investors.

6) Cost competitive / charges

When you buy / sell shares you need to pay broker charges, DMAT charges etc. Also, when you buy gold, you need to pay VAT. When you buy Mutual fund, there are no charges applicable. However, there is a fund management charges ranging from 0.5-2.5% (adjusted in NAV) to cover the administrative costs, salaries & expenses. But you are getting lot of benefits especially professional management of your funds for this small fee.

7) Liquidity

Investment in mutual funds is highly liquid. You can sell the fund units on any business day & will get your money credited in your account within 1-2 business days.

8) Affordable – Low Starting point (Investment starting from Rs 500)

Mutual funds also come handy when you have small amount to invest. For e.g. if you just want to invest Rs 2000, you will get just 1 Infosys share, but via mutual fund, you can take exposure to multiple companies & sector through this small amount.

Normally minimum investment in mutual fund is

- One time – Rs 2000 – Rs 5000

- SIP – Rs 500 – Rs 2000

9) Tax Efficient

Investment in Mutual Funds is tax efficient also.

a) Dividend received from Mutual funds is tax free in hands of Investor. However, in case of non-equity fund, a dividend distribution tax is paid by Mutual fund which is actually going out of Investors money.

In case of physical gold, you can claim long term capital gain only after 3 years. However in case of Gold ETF / Savings fund, you can claim LTCG after 1 year itself.

Read my post – Taxation Aspects of Mutual Funds

10) Regulated

In India, Mutual funds are regulated by Securities and Exchange Board of India (SEBI) and needs to meet stringent criteria. There is a body of trustees who looks after the interest of investors whose money is being managed under different schemes. Parties involved are Sponsor Company, AMC, and Trustee.

There are stringent norms regarding periodic portfolio disclosures to show where the money has been invested. These are also audited by independent audit firms.

Read my other articles on – Best Mutual Funds to Invest in 2014 – Top Performing Funds in India.

How to Invest in mutual Funds in India – Online / Offline options