Day 1: 0.48 times subscription (Retail subscribed 1.23 times)

The much-awaited IPO of One97 Communications, the holding company that owns and operates the PayTM super app and other allied apps (such as PayTM Money and PayTM for Business), opens on November 8, 2021.

One 97 Communications Ltd. (PayTM) is India’s largest payments platform based on the number of consumers, number of merchants, number of transactions and revenue as of March 31, 2021. It is the biggest IPO in India (Coal India’s IPO in 2010 for Rs 15200 crore is the biggest currently)

Issue Details of PayTM IPO (One97 Communication) IPO:

| IPO Opens on | 08 Nov 2021 |

| IPO Closes on | 11 Nov 2021 |

| Issue Price band | Rs 2080 – Rs 2150 |

| Any Discount | NA |

| Issue Size | Rs 18916 crore |

| Market Capitalisation | approx Rs 1,40,000 crores |

| Minimum Investment | 6 shares lot (min amount 12900) |

| Max Investment (Retail) | 15 lots / 90 shares (amount Rs 1,93,500) |

| Registrar | Link Intime |

| Book Running Lead Managers | Morgan Stanley, Goldman Sachs |

| Listing | BSE/NSE |

| Download | PayTM Red Herring Prospectus |

PayTM IPO (One97 Communication IPO) Grey market Premium :

- As per market observers, grey market premium (GMP) was at around ₹XX

[sc name=”ad1″][/sc]

IPO Issue Allocation:

- QIB = Not More than 70% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 15% of the offer

Background:

One 97 Communications Ltd. (PayTM) is India’s leading digital ecosystem for consumers and merchants as it has built the largest payments platform in India based on the number of consumers, number of merchants, number of transactions and revenue as of March 31, 2021, according to RedSeer. It offers payment services, commerce and cloud services, and financial services to 337 million registered consumers and over 21.8 million registered merchants, as of June 30, 2021. PayTM’s two-sided (consumer and merchant) ecosystem enables commerce, and provides access to financial services through our financial institution partners, by leveraging technology to improve the lives of consumers and help merchants grow their businesses.

The company offers products and services across “payment services”, “commerce and cloud services” and “financial services”. Its products and services are carefully developed to address large markets, and in areas where the consumers and merchants are underserved.

The company launched “PayTM App” in 2009 that was the first digital mobile payment platform for cashless payment services. The company is one-stop payments service provider via e-wallets, UPI platform, postpaid, credit cards, POS – point of sale terminals, and all in one QR codes.

- It’s wholly-owned subsidiary ‘Paytm Money‘ has achieved the distinction of becoming India’s biggest investment platform within its first year, and is now one of the largest contributors of new Systematic Investment Plans (SIPs) to the Mutual Funds industry; it has already received approvals to launch Stock Broking, Demat Services and National Pension System (NPS) services, and strives to continue to broaden the financial services and wealth management opportunities to the unbanked and underserved Indians.

- Paytm First Games, which is another group company (a joint venture between One97 Communications Ltd and AG Tech Holdings), has quickly become India’s go-to gaming and stay-at-home entertainment option for millions of users across the country. The platform caters to all types of gamers with an exhaustive array of games for amateurs as well as esports for gaming pros.

- Paytm Insurance is a wholly-owned subsidiary of One97 Communications Ltd (OCL) and has secured a brokerage license from IRDAI. It offers insurance products to millions of Indian consumers across four categories including two-wheeler, four-wheeler, health and life. The company aims to simplify insurance and create a seamless, easy to understand online journey for its customers.

Acquisitions

Acquisitions have also fuelled Paytm’s growth, especially over the past five years. In 2016 they bought education marketplace EduKart and fashion platform Shopsity, while adding social apps insider.in and NearBuy along with deal app Little a year later. Four acquisitions, led by TicketNew, followed in 2018. Following a breather, Paytm Brough CreditMate on Oct. 4, 2021.

Paytm has made 19 investments, including 12 as the lead. A highlight has been multiple investments in HungerBox, a full-stack B2B food and beverage technology company.

[sc name=”ad1″][/sc]

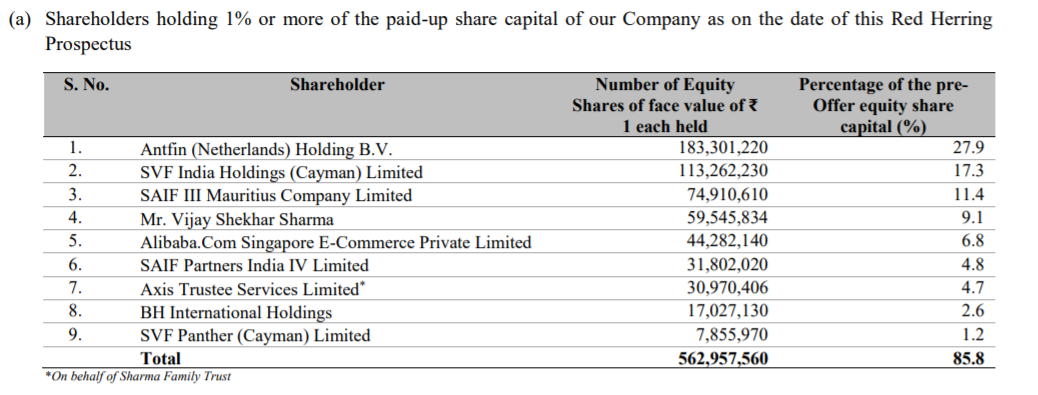

Top Shareholdings:

Objective of the issue:

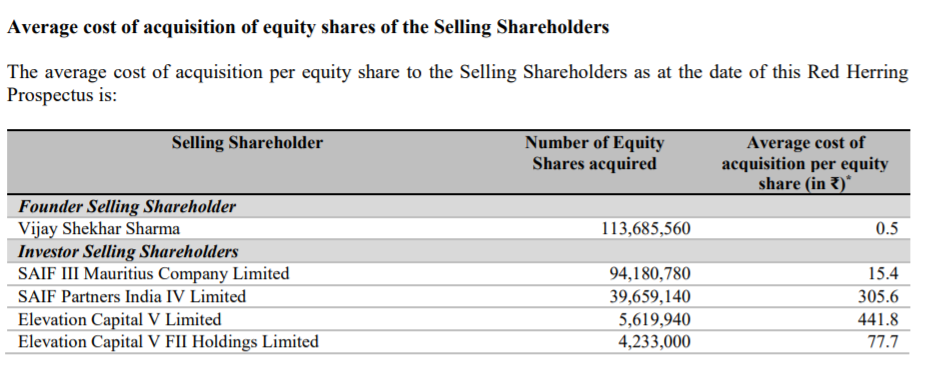

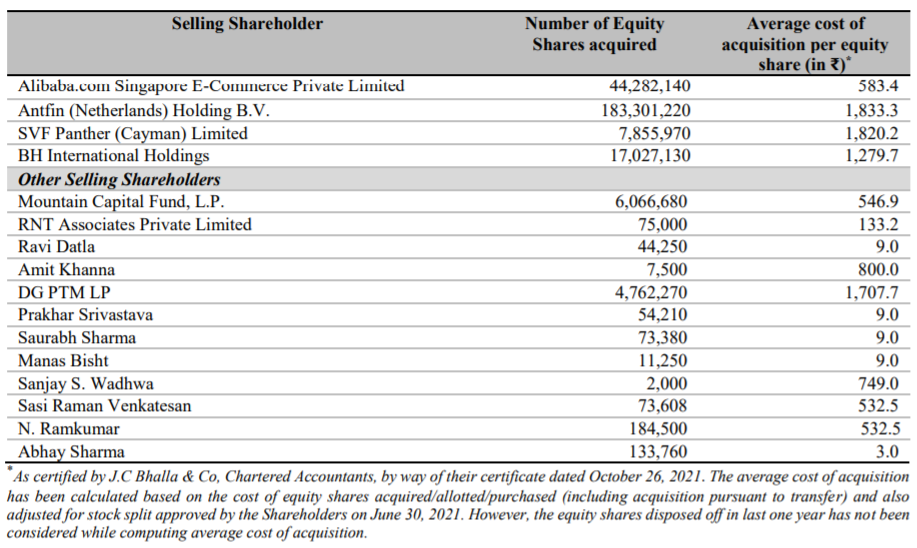

- 50% of the offer value will be paid to existing shareholders. Almost half of the secondary portion in the offer for sale is by Ant Financial and the remaining by Alibaba, Elevation Capital, Softbank and other existing shareholders.

- for growing and strengthening its PayTM ecosystems including acquisition and retention of customers (Rs. 4300 cr.),

- investment in new business initiatives/acquisitions/strategic partnership (Rs. 2000 cr.) and

- general corporate purpose

Anchor Investors:

Paytm has already raised Rs 8,235 crore from anchor investors. Top sovereign wealth funds and financial investors such as Singapore’s GIC (Rs 533 crores) , Canada’s CPPIB (Rs 938 crores) , BlackRock, Alkeon Capital, Abu Dhabi Investment Authority are among those 122 names that have picked up stakes in the fintech major. This includes four domestic mutual funds–HDFC, Aditya Birla, Mirae Asset and BNP Paribas — that took nearly 13 per cent of total anchor allotment

With this Paytm has already secured 45% of its Rs 18,300 crore initial public offer.

Anchor investors are big institutional investors and have a 30-day lock-in period which means they can’t sell their shares before 30 days from the date of allotment.

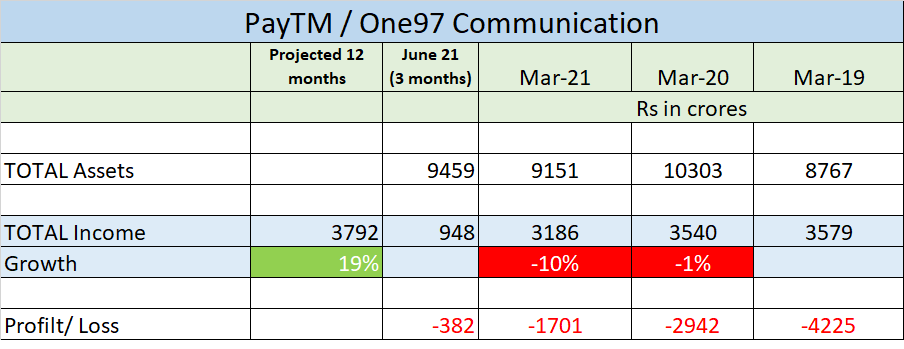

Financials:

The company revenues have been flat over past 3 years. However, base don Q1 2021 numbers, it is expected that revenues in 2021-2022 may grow by 20%

The company has not been profitable yet.

Valuation as compared to its peers:

Considering the trailing twelve month (TTM) sales of Rs 3,142 crore on post issue basis, the company is going to list at a market cap/sales of 44.36 with a market cap of Rs 1,39,379 crore

Paytm is seeking to raise as much as $2.4 billion at a valuation of $20 billion. In Nov 2020, Paytm raised $1.1 billion at a valuation of $15.6 billion. So in just one year, the valuation ask is up by 25%

As you can see from above that many big investors who are selling in this OFS have low acquisition cost and are set to make huge profits.

[sc name=”ad1″][/sc]

Strengths:

- leading digital payment service platform in India with strong customer base

- GMV increasing over past 3 years

- you get exposure to other startups

Cons:

- Revenues are flat in last 3 years, despite the surge in the use of digital wallet and mobile payments in Fy 2021 (due to pandemic)

- The company is yet to deliver a profit despite being in the business for over two decades.

- Increased competition from competitors like PhonePe, Google Pay and others may further impact the revenues from its payment services.

Should you invest:

No doubt this company is a mega player in the digital ecosystem segment and has a lion share, but its top line has remained almost static for the last three fiscals and has been incurring losses for all these years. It has huge carried forward losses and negative earnings.

[sc name=”ad1″][/sc]

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | Nov 15, 2021 |

| Initiation of Refunds | Nov 16, 2021 |

| Credit of Equity Shares: | Nov 17, 2021 |

| Listing Date: | Nov 18, 2021 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | ||||

| NII | ||||

| Retail | ||||

| Employee | ||||

| TOTAL |

How to apply for PayTM IPO (One97 Communication IPO) through Zerodha

Zerodha customers can apply online in this IPO using UPI as a payment gateway. Zerodha customers can apply in this IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘PayTM (One97 Communication) IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.