Diwali Picks for Samvat 2078 – Brokerage Recommendations

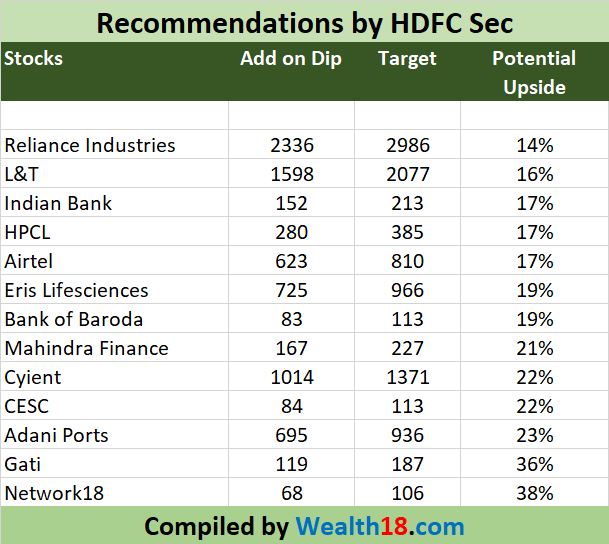

HDFC Sec – Diwali 2021 recommendations

According to HDFC Securities, most stocks are discounting a bright future over the next two years. Hence, the broking house has to shortlist stocks where it think the street is yet to give full value to the future potential. Having said that, equity as an asset class will continue to do well in a market like India. Sectorally, PSU stocks still have steam left even after the Air India sell-off and some progress on BPCL and SCI divestment. Banks (both PSU and private) could come back in the reckoning. Auto and capital goods can also do well after subdued performance over the past few quarters, it said.

Bharti Airtel – Strong market position in the domestic mobile and non-mobile segment, diversification across businesses, healthy operations in Africa, high financial flexibility make Bharti Airtel attractive for investment. Investors can buy the stock at LTP and add on dips to Rs 623 for a target of Rs 810.

HPCL – Economic slowdown, volatility in oil and gas prices and regulatory changes in the oil and gas industry could impact its growth story. On the refining side, HDFC Securities expects margins to bottom out and GRMs are likely to recover H2FY22 onwards. Successful divestment of government holding in BPCL could lead to rerating of other oil marketing companies, including HPCL. Investors can buy the stock at LTP and add on dips to Rs 280 for a target of Rs 385.

Larsen and Toubro | Broking firm remain comfortable on L&T, given its (1) strong order book (Rs 3.2 lakh crore), (2) healthy balance sheet, and (3) robust services business. L&T can deliver high-teens PAT CAGR over FY2020-23 and pay out high dividends. Investors could look at buying the stock at the LTP and add on dips to Rs 1,598 for a target of Rs 2077 by next Diwali.

Reliance Industries | The broking firm remains optimistic on company’s revenue and profitability trajectory with robust execution capabilities, robust balance sheet, steady growth momentum going forward. Long-term prospects and dominant standing of RIL in each of its product and service portfolio, provide comfort for value creation. Investors can buy the stock at LTP and add on dips to Rs 2336 for a target of Rs 2986. (Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.)

Adani Ports | Gradual opening of the world economy will provide much awaited impetus to the demand scenario (led by steel industry) and augment operations across its ports. The management expects to handle 350-360 MMT of cargo volumes for FY22 (with a target of 500 MMT by FY25) and has provided revenue guidance of Rs 18,000-18,800 crore. EBITDA is expected to be in the range of Rs 11,500-12,000 crore. Investors can buy Adani Ports at LTP and add more at Rs 695 for the target price of Rs 936 till next Diwali.

Bank of Baroda | We expect BoB to grow its loan book at 8% CAGR while NII and Net profit are expected to grow at 9.5 percent and 255 percent (due to lower base) CAGR respectively over FY21-23E. ROAA is estimated to improve to 0.8 percent in FY23E from 0.1 percent in FY21. We expect healthy recoveries and upgrades in next two years. Asset quality trend of corporate and MSME would be crucial monitorables. Investors can buy BoB at LTP and add more at Rs 83.3 for the target price of Rs 113.5 (0.85xFY23E ABV) till next Diwali.

CESC | We currently like the stock due to its minimal Capex requirement, existing distribution businesses generating high RoEs, consistent dividend payout, turnaround in all segments, healthy FCF, post-election tariff finalisation and monopoly in Kolkata. Improvement in subsidiary (Dhariwal & Haldia) performance coupled with decline in T&D losses augurs well for the future. CESC could be one of the key beneficiaries of impending distribution sector privatisation. Investors can buy CESC at LTP and add more at Rs 84.5 for the target price of Rs 113 till next Diwali.

Eris Lifesciences | The broking house positive on Eris, given its focus on the domestic market (chronic area), robust operating and net margin profile, strong return ratios, and net cash balance sheet. It is a pure domestic play with little regulatory or currency risks. Also its dependence on Chinese APIs/KSM is very limited. We recommend buy on Eris Lifesciences at LTP and add further on dips at Rs 725 for target of Rs 966.

Gati | We expect the company to gain from (1) its longstanding experience in the logistics sector, (2) Allcargo as its new promoter, (3) diversification of customer base, (4) restructuring measures and (5) revenue offering from different segments. Allcargo’s focus on restructuring the business will improve return ratios and financials and transform the business to an asset-light model.

Indian Bank | Broking firm expect healthy recoveries and upgrades in next two years. Asset quality trend of corporate and MSME would be the crucial monitorables. Most of the concerns arising out of pending write-offs out of restructured/SMA accounts are already in the price. We have assumed higher recoveries and lower slippages going forward. Investors can buy Indian bank at LTP and add more at Rs 152.5 for the target price of Rs 213.5 till next Diwali.

Mahindra & Mahindra Financial Services | Broking firm is betting on a revival in the rural economy in the next two quarters and when that happens, MMFS will be one of the key beneficiaries. Positive news flow could follow performance in the stock price. Investors can buy the stock at LTP and add more at Rs 167 for the price target of Rs 227 till next Diwali.

Network18 Media | Network18’s consolidated free cash flow turned positive for the first time in the last four years, driven by the increase in profitability and favourable working capital changes, leading to the decrease in debt. We expect the company to further pare down its debt levels in the coming years which would aid in profitability improvement. Investors can buy the stock at LTP and add on dips to Rs 68 for a target of Rs 106.

Anand Rathi – Diwali 2021 recommendations

Anand Rathi has recommended six stocks that one can look to buy which includes Infosys, Hindalco, Coforge, Indo Count Industries Ltd, Rossari Biotech Ltd and Vardhman Special Steels Ltd.

Infosys: As per the brokerage, the company benefits from its strong presence across varied industries and markets. The company has stepped up its hiring program. With a strong start to the financial year, good deal momentum in Q2, a robust pipeline, the company is increasing its annual revenue guidance. The buy rating comes with a target price of ₹2,000.

Hindalco: Explaining its rationale, Anand Rathi said that Hindalco’s valuations are still not stretched considering the solid operational performance and ongoing balance sheet deleveraging together with strong opportunities for pursuing growth capex at a comfortable leverage position. It has a target price of ₹578 per share.

Coforge Ltd: “Robust deal pipeline along with strong deal wins momentum and particularly consistency in large deal wins, value creation from SLK Global acquisition and strong FY22 guidance from management,” the note stated with giving a price target of ₹6,465 on the stock.

Indo Count Industries: An uptick in the demand for Home Textile is seen owing to various factors like China+1 strategy, US Ban of Xinjiang cotton, strong demand in value added categories such as health and hygiene. Appropriate Product Mix, Government incentives (RoSCTL, RoDTEP) will aid in strengthening margins, the brokerage pointed. It has a target price of ₹334.

Rossari Biotech: In terms of strategy, management continues to focus on leveraging its R&D capability and introducing new business lines within core chemistries. The stock recommendation comes with a price target of ₹1,840 apiece.

Vardhman Special Steels: Expansion of capacity of rolled products, Increase in utilisation levels and strategic partnership with Aichi Steel Corp. (Toyota Group subsidiary) augurs well inlong term for the company, as per Anand Rathi which has ₹350 target price on the stock.

ICICI Sec – Diwali 2021 recommendations

Axis Securities – Diwali 2021 recommendations

- Small and mid-cap stocks are gaining traction, and balance sheet leveraging is expected to pay off in 2022, with increased return ratios and profitability.

- Because of their improved outlook and present low interest rate regime, housing and banking will be significant subjects to watch in 2022.

- The infrastructural sector is becoming a more prominent theme as the government increases its spending in this area.

- Long-term structural topics such as digital and cloud will continue to be important.

- Travel & Tourism appears to be a more promising theme, which has gained traction following a boost in vaccination rates.

ACC Limited – Capacity Expansion And Premiumization To Drive Growth The brokerage firm recommends ACC buy with a target price of Rs. 2570. The stock was last trading at Rs. 2236, representing a gain of 15 percent. “With its unwavering focus on cost optimization measures through project PARVAT, robust product demand, and improved pricing, we expect the company to register Revenue/EBITDA/APAT CAGR of 9%/13%/14% over CY21-CY23E driven by volume CAGR of 7% over the same period. The stock is currently trading 9x and 8x CY22E and CY23E EV/EBITDA which is attractive compared to other larger peers in the sector. We, therefore, recommend a BUY on the stock with a target price of Rs 2,570/share which implies an upside of 15% from the CMP,” the brokerage has said.

KNR Constructions Limited – Well-positioned To Capitalize On The Industry Tailwinds The brokerage firm recommends KNR Constructions a buy with a target price of Rs. 325. The stock was last trading at Rs. 282, representing a gain of 15 percent. “We expect the company to report Revenue/EBIDTA/APAT growth of 18%/17%/30% CAGR respectively overFY21-24E. The stock is currently trading at 17x and 15x FY23E and FY24E earnings. We recommend a BUY in the stock with the target price of Rs 325/ share, implying an upside potential of 15% from CMP,” the brokerage has said.

Cyient – Resilient Business Structure and Long-term Contracts to accelerate Growth The brokerage firm recommends this stock a buy with a target price of Rs. 1300. The stock was last trading at Rs. 1094, representing a gain of 19 percent. “We believe Cyient has a strong business structure from a long-term perspective and possesses multiple long-term contracts with the world’s leading brands. Furthermore, with depreciation in INR, lower travel cost, and lower on-site expenses, the company’s EBITDA margins are likely to expand in the near term. Against this backdrop, we recommend a BUY and assign a 22x P/E multiple to its FY24E earnings of Rs 59.2/share to arrive at a TP of Rs 1,300/share, implying an upside of 19% from CMP,” the brokerage has said

Mindtree – Encouraging Growth, Superior Visibility With a target price of Rs. 5100, the brokerage company recommends a buy. The stock was last trading at Rs. 4,555, a 12 percent increase. “We believe Mindtree enjoys a resilient business structure and has a proven track record of strong and efficient execution capabilities. With INR depreciation, lower travel cost, and lower on-site expenses, EBITDA Margins are likely to expand in the near term. We recommend a BUY on the stock and assign 39x P/E multiple to its FY24E earnings of Rs 129.3/share to arrive at a TP of Rs 5,100/share, implying an upside potential of 12% from CMP,” the brokerage said in its Diwali report.

ICICI Securities – More Than Just a Broker! With a target price of Rs. 940, the brokerage company recommends a buy on ICICI Securities. The stock was last trading at Rs. 763, a 23 percent increase. “The re-engineered business model will help ISEC remain a formidable player in an intensely competitive landscape and will also enable gains in market share. We continue to like ISEC for its superior ROE profile, better brand recall, and innovative product proposition offered across customer segments, making it an eligible candidate to trade at premium valuations vis-a-vis its peers. We recommend a BUY on the stock, valuing ISEC at 20x Sept’23E EPS and arrive at a target price of Rs 940/share,” Axis Direct

Can Fin Homes– Well-positioned for the next leg of growth With a target price of Rs. 800, the brokerage company recommends a buy. The stock was last trading at Rs. 656 a 22 percent increase. “The management is now focusing more on the growth front. The affordable housing space is still relatively ‘a specialist housing finance arena’ and companies catering to this segment have traded at P/B valuations upwards of 3x. We believe CANF has notable scope for expansion in its valuations and hence we maintain a BUY rating on the stock with a target price of Rs 800 (3x FY23E ABV),” the brokerage has said.

Cholamandalam Investment – Revival On The Cards With a target price of Rs. 690, the brokerage company recommends a buy. The stock was last trading at Rs. 604, a 14 percent increase. “We continue to retain our positive long-term outlook on the company backed by the marquee management and its ability to resiliently sail the business through tough periods. We keenly eye management’s plan to roll out new strategies in the near term and the possibility of a banking license. We recommend a BUY with a target price of 690 (4.5x FY23 P/ABV),” the brokerage has said.

SBI Life Insurance – Huge Potential For Growth With a target price of Rs. 1350, the brokerage company recommends a buy. The stock was last trading at Rs. 1172, a 15 percent increase. “SBIL, among private life insurers, possesses by far the largest bancassurance network, which plays the most critical role in providing scalability. Furthermore, SBIL has low-cost ratios which protect margins during downturns. With the gradual shift toward a profitable product mix and relatively comfortable valuations, SBIL remains well-placed in the life insurance space. We remain positive on the stock and maintain a BUY with a Target Price of Rs 1,350/share (2.6x FY24EV),” the brokerage has said.

APL Apollo Tubes – Robust Performance Backed by Strong Fundamentals With a target price of Rs. 960, the brokerage company recommends a buy on APL. The stock was last trading at Rs. 807, a 19 percent increase. “The current volume expansion plan with a consistent focus on growing market share, improving contribution from value-added products and leaner balance sheet bode well from the medium to long-term growth perspective. We recommend a BUY on the stock with the TP of Rs 960 (adjusted for 1:1 bonus) valuing it at 30x P/E of FY24E EPS,” the brokerage has said.

Safari Industries – Set to Pack and Roll as Normalcy Kicks In With a target price of Rs. 930, the brokerage company recommends a buy. The stock was last trading at Rs. 840, an 11 percent increase. “We remain believers in the promising Indian Luggage Industry growth story given multiple growth levers such as 1) accelerated shift from unorganized labels to brands, 2) rising preference for leisure travel, 3) increased focus on strengthening the Safari brand, and 4) de-risking of sourcing from China to alternate sources in Bangladesh and India. We recommend a BUY on the stock with the TP Rs 930/share valuing the stock at 45x P/E on its FY24E EPS as we expect Safari to report strong 40% Revenue CAGR over FY21-24E,” the brokerage said in its Diwali report.

SMC Global – Diwali 2021 recommendations

With the expectation of a strong recovery in corporate earnings, the Indian market is positioned to continue its bull run, said brokerage house SMC Global in a report.

SBI: State Bank of India appears well positioned to report strong uptick in earnings, led by moderation in credit cost from FY22. The brokerage has a Buy rating on the stock with a target price of ₹577 in 8 to 10 months time frame.

ICICI Bank: The bank is focusing on growing the core operating profit in a risk calibrated manner instead of loan growth. Thus, “it is expected that the stock will see a price target of Rs.874 in 8 to 10 months’ time frame.”

L&T: The company will maintain leadership in the E&C segment in India, and is positioned to benefit from the large infrastructure spending in India, over the medium term. SMC has a target price of ₹2120.

DLF: The company has sustained business performance despite its operations being impacted by the second Covid-19 wave. The buy rating comes with a target price of ₹474.

Endurance Tech: “A strong balance sheet and liquidity position enable the company to move forward on its growth journey without any compromises and the Government announced various schemes to strengthen and give the much-needed boost to the automobile sector,” the note stated. SMC has a price target of ₹2,047 in 8 to 10 months’ time frame.

Welspun India: The Buy rating with a price target of ₹193 comes as the company remains committed in its long-term aspiration of delivering sustainable and profitable volume led growth, the brokerage said.

Prestige Estates: “Despite the challenging environment, Prestige has clocked highest quarterly sales and collections. The new sales were backed by the healthy response to its newly launched project, Prestige Great Acres and the existing inventories across geographies. Thus, it is expected that the stock will see a price target of ₹529.”

KEC International: As per the brokerage, the company is doing well and the management believes T&D domestic, Railways and Civil segment would be the main growth drivers. Thus, it is expected that the stock will see a price target of ₹555 in 8 to 10 months.

Phillips Carbon Black: “The volume growth may be driven by improvement in freight movement along with steady pace of road construction, pick-up in mining activity amid government focus on infrastructure and continued e-commerce demand and it would also be aided by prospects for import substitution.” SMC has a Buy with a target price of ₹294.

5Paisa – Diwali 2021 recommendations

As we welcome Samvat 2078, near-term challenges such as surging prices of energy and commodities, higher valuations and possible unwinding of the accommodative monetary policy in both US and India await us. On the flip side, presence of long term catalysts such as continued improvement in the domestic economy and improving earnings growth of India Inc lend comfort.

Hindustan Unilever : HUL needs no introduction. Every Indian uses several products from HUL’s stable ranging across the categories of home and personal care to foods and refreshments. The company is looking to optimize its portfolio and the value offered to customers, besides driving digitalization across its channels. While HUL has a strong reach in every nook and cranny of the country, it is now focusing on hyper-localization through its Win in Many India’s (WiMI) strategy. Focus on premiumization of its brands is likely to augur well for HUL, and resonate well with mid-premium to value consumers. Growing investments in Artifical Intelligence and Machine Learning capabilities will help HUL personalize customers’ experiences while driving cost optimization for distributors and other business partners.

HDFC Life Insurance Company, a joint venture between HDFC Ltd. and Standard Life Aberdeen, is a leading private life insurer in India. Growing distribution reach is a key internal growth driver for the company, with highly underpenetrated life insurance market being an external one. Post-acquisition of Exide Life, HDFC Life will become the second largest private life insurer with a market share of ~16.5% in total new business APE (Annualized Premium Equivalent). Improving product portfolio, customer-centricity, solid financial profile and growing protection business will drive the company’s future performance. Rising share of annuity and protection products, coupled with strong operating leverage should support consistent margin expansion for HDFC Life.

Larsen & Toubro or L&T is a large Indian conglomerate present in several sectors including technology, engineering, construction, manufacturing and financial services. It is a proxy play on the Indian economy, given its vast presence in the infrastructure sector. Company has a robust order book and management is confident of strong order inflows in the foreseeable future. Water, Heavy Engineering, Power T&D and Transportation infra are likely to drive order inflows and market share gain for L&T, given the government’s continued emphasis on these segments. L&T’s ability to execute its order book efficiently, reduce working capital, drive cost optimization and leverage digital technologies make it stand out from its competitors. Robust prospects of its IT subsidiaries (L&T Infotech, L&T Technology Services and Mindtree) also augur well for the consolidated entity.

Tech Mahindra is one of India’s leading IT services company. After languishing its peers in terms of growth as well as profitability for quite some time, the company seems to have achieved high visibility and consistency on these fronts. Robust deal wins (especially in key verticals of telecom and enterprise), resilient margins and enhanced capital allocation are some of its key strengths. Management expects to clock in double digit growth in revenues during FY22 and maintain margins at ~15%. The stock, though, continues to trade at a sharp discount to peers (~30%) and can catch up significantly from here on.

Inox Leisure is one of the largest multiplex chains in India and had 156 multiplexes and 658 screens in 70 cities, as of October 2021. The company is one of the worst hit from the pandemic as multiplexes remained closed for the longest time. Hence, it is one of the key beneficiaries from reopening of multiplexes across the country. Inox Leisure plans to take its total screen count to 692 by March 2022. As restrictions around vaccinations ease and good content releases across languages, occupancies and ticket prices can reach pre-pandemic levels. Company is also focusing on non-movie revenues (live sporting events, corporate events, games, etc.) to reduce seasonality of the business. Its strong position and net debt-free balance sheet are some of the other key positives.

Max Healthcare Institute (MHI) is the second largest listed healthcare provider in India and operates 17 healthcare facilities (total 3,400 beds). MHI enjoys dominant position in northern India. The company is also present in preventive & pre/post-hospitalization care at home and diagnostics services segments. Its focus on premium markets (Mumbai, Delhi NCR) augurs well for its Average Revenue Per Occupied Bed (ARPOB). MHI enjoys better ARPOB than peers owing to more number of operational beds. Its plans to add another 1,630 beds by FY28 lend high visibility to future growth. Company is also looking for strategic inorganic opportunities. Overall, it is well placed to capture emerging opportunities in the healthcare space.

Bata India is one of the oldest players in the Indian footwear market and offers products across all categories (men, women, kids) and price points (mass market to premium). The company’s nationwide footprint (over 1,500 stores) and strong brand recall are its key strengths. Additionally, it has scaled up focus on e-commerce which contributed 15% to FY21 revenues. Its omni-channel solutions provide superior experience to customers. Company’s strategic focus areas include change in product mix towards casual footwear, cost optimization, expanding reach through the asset-light franchisee model and enhancing potential of omni-channel. It is on the right path to improve growth as well as profitability in the future.

Sharekhan- Diwali 2021 recommendations

Broking firm Sharekhan retain its positive stance on the equity market and believes that any corrective phase would be healthy for the market and should be used to accumulate quality companies.

APL Apollo Tubes | Robust growth outlook (expect PAT to register 37% CAGR over FY21-FY24E), high RoE of 30%, strong balance sheet and superior business model (high market share and de-commoditised product portfolio) makes us constructive on APL Apollo Tubes. The key risks include lower demand from construction and infrastructure projects and a substantial rise in steel prices could hurt earnings outlook. Any rise in competition could impact volume growth.

Balrampur Chini Mills | The company will be one of the key beneficiaries of reducing cyclicality in the sugar industry. Higher contribution from distilleries will help margins to improve and PAT to clock a CAGR of 19% over FY2021-24. • The company’s return ratios are expected to improve above 20% by FY2024; higher cash generation ability might lead to higher dividend payout in the coming years.

Divis Laboratories | Divis Laboratories sales and PAT are expected to clock a 24% and 30% CAGR over FY21-FY23E. Given the strong growth prospects, the rich valuations are expected to sustain. The key risks includes any adverse change in regulatory landscape and unfavorable forex movements could impact the earnings growth prospects.

ICICI Bank | Overall business momentum is likely to increase further in the retail, CV and personal loan segments, which were sluggish but are likely to improve going ahead. Similarly, in the corporate loan segment, the bank is adopting a calibrated approach to target better rated corporates. Sharekhan believe that valuations are attractive, considering the overall franchise value as a whole, strong capitalisation and a high PCR are some of the key comforting factors.

ISGEC Heavy Engineering | Strong order backlog with recent order booking, despite a challenging environment provides healthy revenue visibility. Order intake outlook is positive led by government-led infrastructure push and a revival in private capex. The key risks are a decline in revenue due to lower order book execution, or sizeable reduction in profit margins and cash flow generation on sustained basis.

ITC | Company’s core cigarette sales volumes are expected to grow by 12-13% in FY2022 (likely to reach COVID levels by Q2/Q3). Improving mobility and no tax rate hike on cigarettes in GST meet will help the cigarette sales volume to grow at good pace. • It has strong cash generation ability and has generated cumulative FCF of over Rs. 50,000 crore in the last five years.

Larsen & Toubro | The management expects a domestic recovery with a focus on growth in both revenues and order inflows for FY2022. Hence, the management has guided for low to mid-teens growth in order intake and revenues for FY2022. OPM and working capital requirement (as a percentage of sales) are expected to remain same as FY2021 as in FY2022. Despite the second wave of COVID-19, the order prospects at 8.96 lakh crore are healthy.

LIC Housing Finance | We believe that company is likely to benefit from healthy home loan disbursements going ahead, aided by strong demand for larger spaces and affordability. Further, with improved ECL coverage (stage 3 coverage 5.93% in Q1FY22 vs. 2.83% in Q1FY21) and recent capital infusion by LIC, the leverage concerns has been addressed. The key risks are any deterioration in the asset quality specifically developer book and its impact on profitability.

NOCIL | Improved pricing environment for rubber chemicals and ramp-up in capacity utilisation would expand margins by ~ 715 bps over FY21- 24E to 21.3%. Sharekhan expect a robust 3x rise in PAT to ~ Rs 291 crore over FY21-24E, considerable improvement in RoE to 17.5 and annual FCF generation of ~ Rs 200 crore. Potential market share gains, robust earnings growth outlook and better return ratios could aid re-rating of NOCIL.

PVR | PVR is well-placed to capitalise on the strong pent-up demand and is expected to report strong revenue growth over FY2022E-FY2024E. Further, PVR is expected to add screens aggressively post normalisation, which would aid revenue growth. A strong recovery in occupancy rates with the release of big-starrer movies and anticipated improvement in profitability and return ratios are expected to re-rate PVR’s multiples going ahead.

Radico Khaitan | Efficient working capital management and improved profitability would help company generate high free cash flows in the coming years. With no major capex on books, the higher cash generated will be utilised for developing more premium brands and potential higher payouts to shareholders. The company is well-poised to achieve strong revenue and earnings CAGR of 17% and 22% over FY21-24.

State Bank of India | State Bank of India (SBI) is better-placed with respect to asset quality, capitalisation and underwriting strengths. It expects the asset quality to normalise from H2FY22 onwards. Additionally, recent developments on Vodafone-Idea debt are positive for the bank and are likely to provide comfort on one-time provisions. On the credit growth front, the pick-up is gradual and we expect improvement in momentum going ahead, specially on the improving corporate credit cycle.

Tata Elxsi | We believe company’s growth is likely to remain strong in the coming years, as it focuses on high-growth sectors (media and healthcare) and emerging technology areas (connected, autonomous, OTT, digital health, and medical devices, etc.), where the client allocates a higher budget.

Tata Motors DVR | The company is expected to become earnings’ positive in FY2022E and a 64.8% y-o-y PAT growth in FY2023E, driven by a 16.7% revenue CAGR during FY2021E-FY2023E and a 120-bps improvement in EBITDA margin to 13.4% in FY23E from 12.2% in FY21. The key risks are higher-than-expected delay in easing of semiconductor chips’ shortage may further affect our earnings estimates.

Titan Company | Opening up of malls, improved mobility, introduction of new products would help watches and eyewear businesses to post consistent improvement in the performance in the near to medium term. This will also help profitability of these businesses to consistently improve in the coming years.

IDBI Capital- Diwali 2021 recommendations

Max Healthcare Institute (MHI) : Target Price: Rs 475

”MHI is the second largest healthcare provider amongst the listed players in India. It operates 17 healthcare facilities with a total capacity of around 3,400 beds. Besides the core hospital business, MHI has also launched two related businesses that are run as separate business units (SBUs), Max@Home which provides preventive and pre/post-hospitalization care at home, and MaxLab which offers diagnostics services that are currently in nascent stages of development. It primarily operates assets in metro cities such as Delhi NCR and Mumbai

Valuation: The stock is trading at a PER of 33x FY23 Bloomberg EPS estimates which looks attractive,” IDBI Capital said in a report.\

Maruti Suzuki India Limited (MSIL) – Target Price:Rs 10,100

Maruti Suzuki is the market leader in the passenger vehicle segment in India. ”Over the last 12 months, MSIL has faced barrage of bad news including Covid -19 lockdown, unprecedented rise in commodity prices, bumper to bumper insurance and semiconductor chip shortages etc. We anticipate majority of these events are temporary in nature and may not last beyond 12 months.,” said IDBI Capital. ”Although MSIL has witnessed tepid volume growth over FY12-21, it has tripled its distribution outlet from 1100 to 3200+ and has well established itself to serve upcoming 4W demand in India. MSIL’s rural sales grew by 9.6 per cent CAGR and its contribution has gone up from 22 per cent to 38 per cent of its volumes over FY12-21,” it added.

”We remain super bullish on MSIL’s growth prospects. Over FY22-24E, we expect MSIL to report 20.1 per cent volume CAGR and 46.7 per cent PAT CAGR. At ₹ 7,201, the stock quotes at PER of 20.6x FY24E. We recommend BUY and upgrade our price target from ₹ 8,585 to ₹ 10,405,” IDBI Capital said in its report.

HDFC Life Insurance – Target Price: ₹ 980

HDFC Life Insurance Company Limited – a joint venture between HDFC Limited and Standard Life Aberdeen, provides insurance services. The issuer offers protection for life, health, properties, and automobile, amongst others. ”The acquisition of Exide Life would enable HDFC Life to increase its market share to 16.5 per cent (15.1 per cent for FY21), as per the total new business APE. This would make HDFC Life the second-largest life insurer, enabling it to narrow the gap with private sector leader SBI Life Insurance which had an Individual APE market share of 22.6 per cent as of FY21,” said IDBI Capital. ”In Q1FY22, company’s new business grew by 40.2 per cent YoY to ₹ 408cr and VNB margin expanded to 26.2 per cent from 24.3 per cent in Q1FY21,” it added.

HDFC Life’s improving product portfolio, strong channel building coupled with customer-centric business approach would continue to drive growth. COVID-related claims and growth in protection are the key trigger points to be noted. However, keeping company’s agile nature to capture growth opportunities through innovation and better servicing capabilities, make it a Buy,” IDBI Capital said in its report.

Marwadi Financial – Diwali 2021 recommendations

Motilal Oswal – Diwali 2021 recommendations

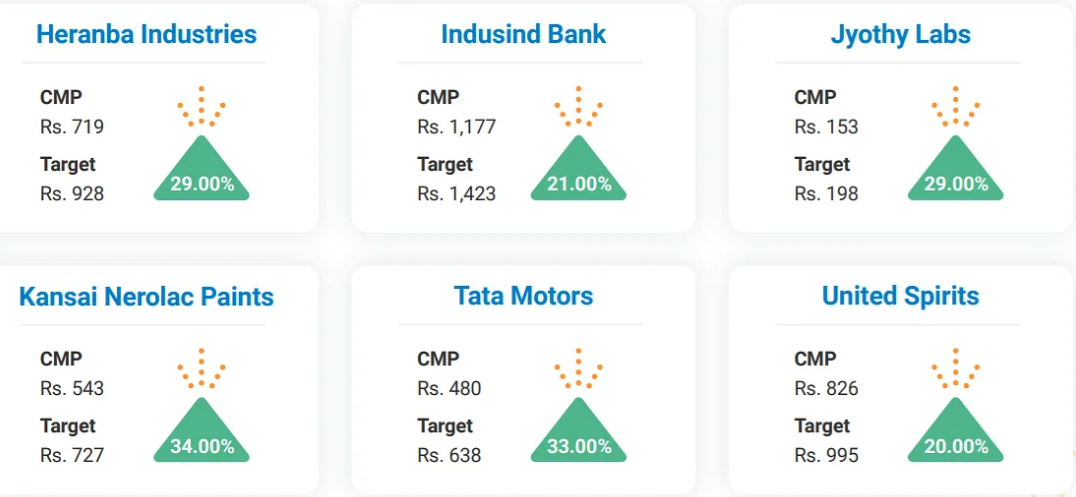

As part of its Diwali 2021 stock picks, domestic brokerage and research firm Motilal Oswal has recommended fifteen stocks that one can look to buy. Its top picks includes public lender State Bank of India (SBI), Tata Motors, United Sprits, Indian Hotels, VIP Industries, UltraTech Cement, Infosys, SBI Life. The brokerage’s top stock picks for Diwali also includes Tata Power, Varun Beverages, Jubilant Food, Trident, APL Apollo, Orient Electric, and Macrotech Developers.

Angel One (Angel Broking) – Diwali 2021 recommendations

Indian brokerage and resource firm Angel One (formerly Angel Broking) has selected 16 stocks for Diwali, which investors can buy during Muhurta trading or Diwali. Angel One Diwali stock picks include Ashok Leyland, PI Industries, HDFC Bank, Federal Bank (Federal Bank), Shobha (Sobha), Stove Craft, Safari Industries ( Safari Industries), AU Small Finance.

Stocks picked by Angel One in the automobile sector include Ashok Leyland (target price Rs 175), Sona BLW Precis (target price Rs 775), Ramkrishna Forgings (target price Rs 1,545) and Suprajit Engineering (target price Rs 425). .

In the banking sector, Angel One has AU Small Finance Bank with a target price of Rs 1520, Federal Bank with a target price of Rs 135, HDFC Bank with a target price of Rs 1859 and Shriram City Union with a target price of Rs 3002. Recommended to buy with.

In Chemical sector, the brokerage has included PI Industries only one share in its top pick and has a buy call with a target price of Rs 3,950.

Other stocks in Angel One’s Diwali top picks include Carborundum Universal (target price Rs 1,010), Stove Craft (target price Rs 1,288), Safari Industries (target price Rs 979), Shobha (target price Rs 950), Whirlpool India (target price Rs 2,760), Lemon Tree Hotel (target price Rs 64) and Emble Enterprises (target price Rs 4,150).

Yes Securities – Diwali 2021 recommendations

As part of its Diwali 2021 stock picks, domestic brokerage and research firm Yes Securities has recommended twelve stocks that one can look to buy with the time frame of 12 months. Its top picks includes Prince Pipes, Greenpal Industries, Apollo Pipes, Acrysil, Dalmia Bharat, IndiaMart, PNC Infra, Polycab, ICICI Bank, Gland Pharma, SBI Cards, and CRISIL.

Prince Pipes: The brokerage reckons that the company’s strong brand image & strategic tie-ups company is likely to expand their market-share. Moreover, industry is witnessing a meaningful transition from unorganized to organized segment which will further enable the company to outperform industry growth. It has a target price of ₹1,091.

Greenpanel Industries: Yes’ buy tag with ₹470 target price comes on the back of the company strengthening its balance sheet by reducing their total debt.

Apollo Pipes: The brokerage believes, as Apollo Pipes is on the cusp of becoming a leading pan-India player, it should fetch similar valuations compared to other pan-India player. Yes has a target price of ₹2,250 apiece on the stock.

Acrysil: Acrysil Ltd is likely to become one of the biggest beneficiaries of the robust global demand for Quartz sinks, as per the brokerage which has a target price of ₹995 on the stock.

Dalmia Bharat: “Strong balance sheet to support future CAPEX: Supported by the strong profitability, we expect Dalmia to generate a robust free cash flow.” Yes Securities has a target price of ₹2,640 per share.

IndiaMart: Strong revenue growth outlook along with growing margin trajectory led by positive operating leverage makes it an attractive play in online classified space. The brokerage sees the stock to potentially surge to ₹10,200 apiece in twelve months period.

PNC Infra: “Recent order inflows, continued focus on asset monetization and comfortable balance sheet provide comfort.” (Target price 460).

Polycabs: The stock is trading at significant discount to electricals peers. The brokerages buy rating comes with target price of ₹3,300.

ICICI Bank: “In ICICI, we see an ability to increase, prospectively, the share of higher-yielding loans in a risk calibrated manner.” (Target price 1,112).

Gland Pharma: Foray in to complex injectables like peptides, hormones and newer dosage forms like pens, cartridges to support growth beyond next 2-3 years. Longer term ambition in biosimilar is a pivot in right direction, Yes Securities said while suggesting target price of ₹4,925.

SBI Cards: The brokerage sees the stock to potentially rise to ₹10,200 apiece as New card issuances, spends and receivables and profits should start recovering from Q2 FY22 after being impacted in the preceding quarters due to pandemic waves.

CRISIL: “Expected revival in domestic rating business would support an already improving growth and margin trajectory of CRISIL,” said Yes Securities in the note with ₹4,460 price target for the stock.