Exxaro Tiles IPO is opening on 4th Aug 2021

Issue Details of Exxaro Tiles IPO:

| IPO Opens on | 04 Aug 2021 |

| IPO Closes on | 06 Aug 2021 |

| Issue Price band | Rs 118 – Rs 120 |

| Any Discount | NA |

| Issue Size | Rs 161 crore |

| Minimum Investment | 125 shares lot (min amount 15000) |

| Max Investment (Retail) | 13 lots / 1625 shares (amount Rs 1,95,000) |

| Registrar | |

| Book Running Lead Managers | |

| Listing | |

| Download | Red Herring Prospectus |

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Exxaro Tiles IPO Grey market Premium :

- As per market observers, Devyani International grey market premium (GMP) was at around ₹40-45

IPO Issue Allocation:

- QIB = Not More than 50% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 35% of the offer

Background:

Exxaro Tiles started off as a partnership firm in 2007-2008 to manufacture frit and thereafter diversified. It is now primarily engaged in the business of manufacturing and marketing of vitrified tiles used majorly for flooring solutions catering to residential and commercial segments. It claims to have a 2,000+ dealer network across 27 states.

The company operates two manufacturing facilities which are located at Padra and Talod in Gujarat

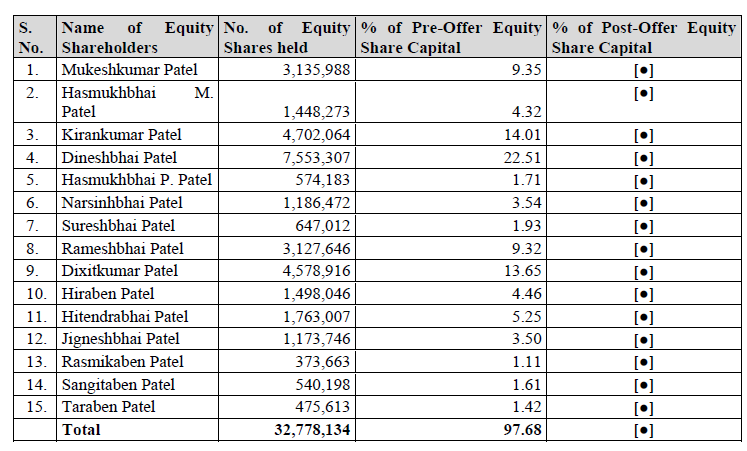

Top Shareholdings:

Objective of the issue:

Under the IPO, the company will issue 111,86,000 equity shares and one of its shareholders will sell 2,238,000 shares. The company proposes to utilize net proceeds from the fresh issue towards payment of borrowings and funding its working capital requirements besides utilizing it for general corporate purposes.

Anchor Investors:

- Vitrified tiles manufacturer Exxaro Tiles has raised Rs 23.68 crore from two anchor investors on August 3, ahead of issue opening.

- Quant Mutual Fund through its Quant Active Fund and Quant Small Cap Fund bought 7,78,250 equity shares each, and AG Dynamic Funds acquired 4,16,825 equity shares, the company added.

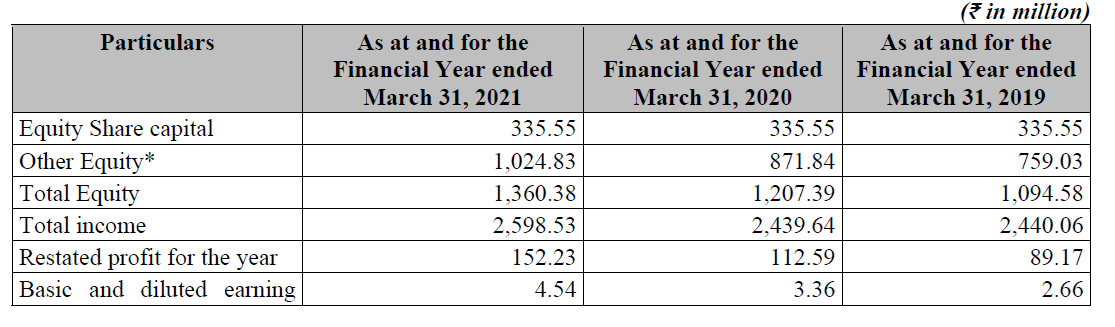

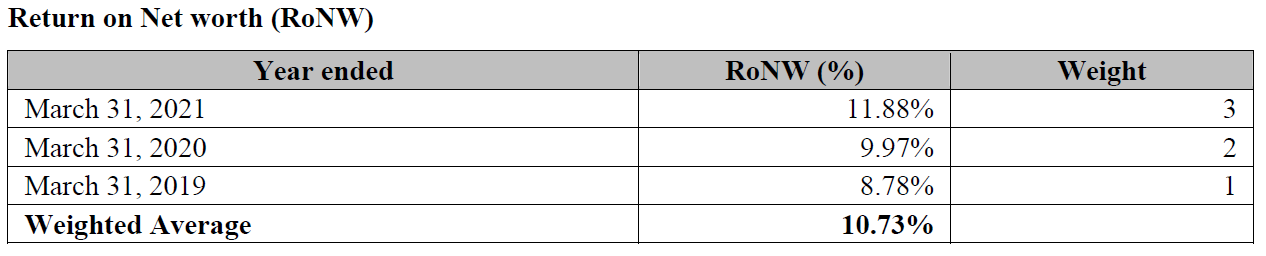

Financials:

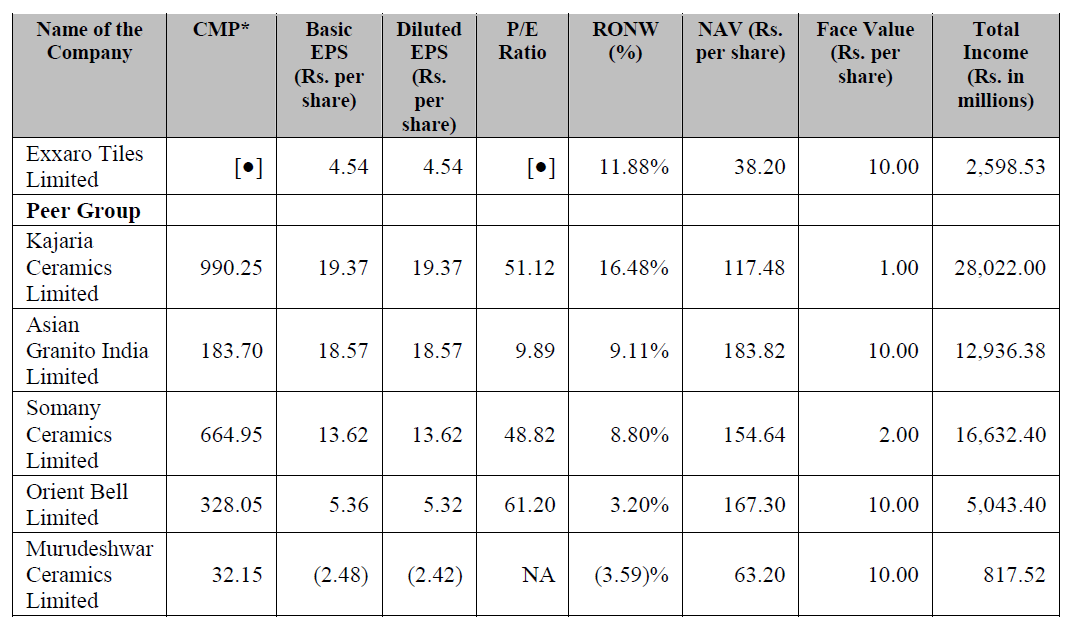

Valuation as compared to its peers:

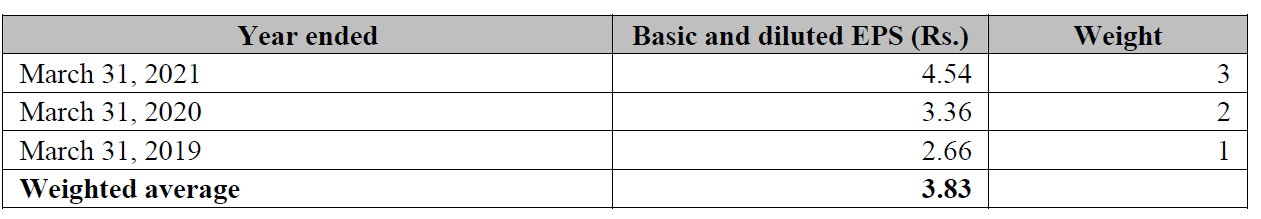

On the issue price of Rs 120 and EPS of Rs 4.54, the approx PE ratio for Exxaro will be 26.4 which is lower than other listed ceramic companies.

Brokerage Recommendations:

| Brokerage | Recommendations |

| Anand Rathi | Subscribe |

| Choice Broking | Avoid |

| Arihant Capital | Subscribe |

Should you invest:

The market is dominated by larger peers like Kajaria, Somany, Asian Granito, Orient Bell. Exxaro will face intense competition. However, this reflects in price band of Exxaro and its PE ratio is half that of listed peers.

With current euphoria in stock market and IPO listings, it is expected that this IPO will also see considerable interest. You can consider to invest in this IPO for listing gains.

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | TBC |

| Initiation of Refunds | TBC |

| Credit of Equity Shares: | TBC |

| Listing Date: | TBC |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | 17.67 | |||

| NII | 5.36 | |||

| Retail | 40.05 | |||

| Employee | 2.53 | |||

| TOTAL | TBC | TBC | 22.65 |

How to apply for Exxaro IPO through Zerodha

Zerodha customers can apply online in Exxaro Tiles IPO using UPI as a payment gateway. Zerodha customers can apply in Exxaro Tiles IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘Devyani International IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.