Equity Mutual funds are one of the best investment option for long term. Over a long term, equity investments have given better returns than fixed deposit, gold etc. So as part of investment strategy, one should definitely consider some exposure to equity funds.

Based on your risk profile, you should allocate a portion of your investment amount into Equities. Mutual funds is the best route for retail investors to invest in Equities.

Options to select

When you have decided to invest through mutual funds, you should consider selecting following options:

-

-

-

- Direct option – If you are investing directly, you should select DIRECT option. You save distribution commission as the mutual fund company is not paying any commission on such mutual funds and those benefits are passed on to the investors. Normally the returns of DIRECT funds are approx 1% higher than normal funds.

- Growth option – In this option the earnings are getting accumulated and helps to build corpus over long term. The other options are Dividend and Dividend re-investment

- SIP mode – This is an option to invest systematically on a periodic basis (e.g. monthly). So rather than making one time investment, you should consider investing via SIP mode. This helps to average the cost price and risk.

-

-

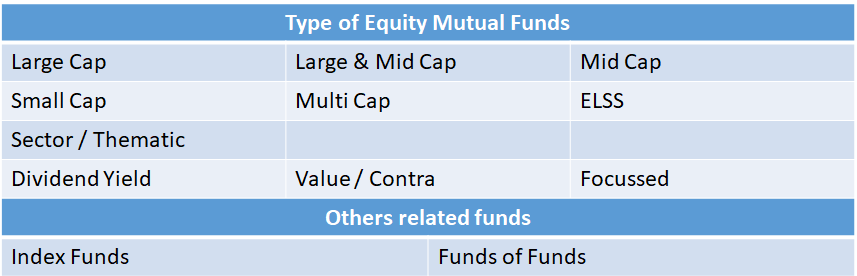

Categories of Mutual Funds

There are various categories of Equity funds and you should select one / combination based on your risk profile, time horizon etc. Different type of funds available are:

Which Mutual funds should I select?

It depends on your investment objective, time frame and risk apettite. Depending on your situation, you need to create an optimal combination for yourself. You should consult your financial advisor.

Following is just an example of how you can allocate your investment in different funds based on your risk appetite.

-

- Aggresive Investor: 50% in Small Cap, rest 50% in Large, Mid and Multicap

- Moderate investor: 25% in Small Cap, 25% in Large cap, 50% in Midcap and Multiap

- Passive Investor: 50% in Large Cap, 25% in Midcap, 25% in Multicap

Mutual Fund Performance (Historic and Year-on-Year)

In this post, I have shared various performance parameters for best mutual funds:

- the historic performance of some of the best performing funds

- historic returns in SIP mode.

- the year-on-year returns

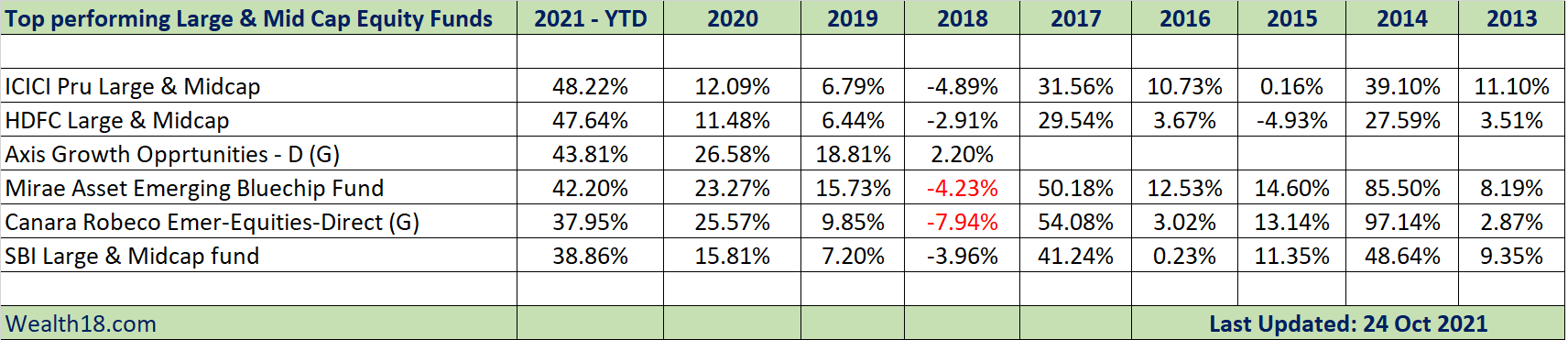

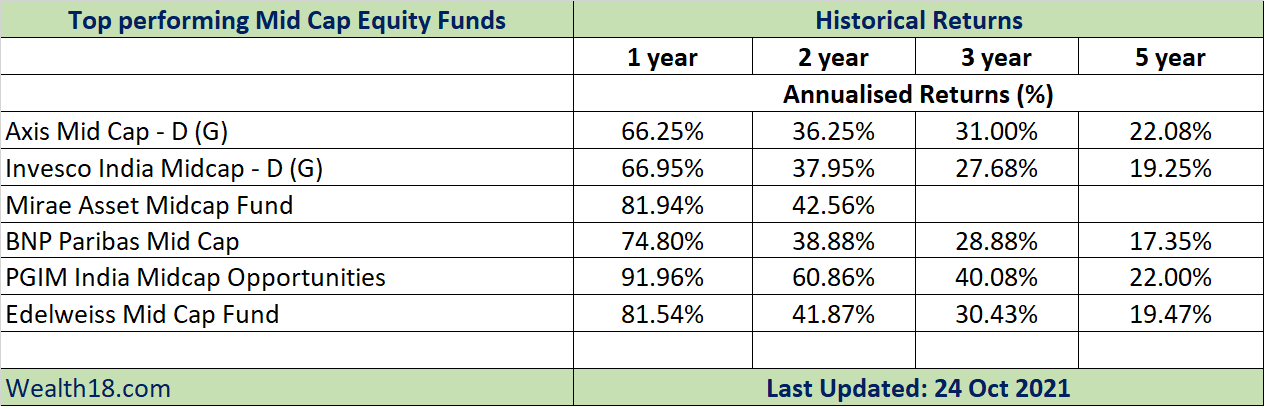

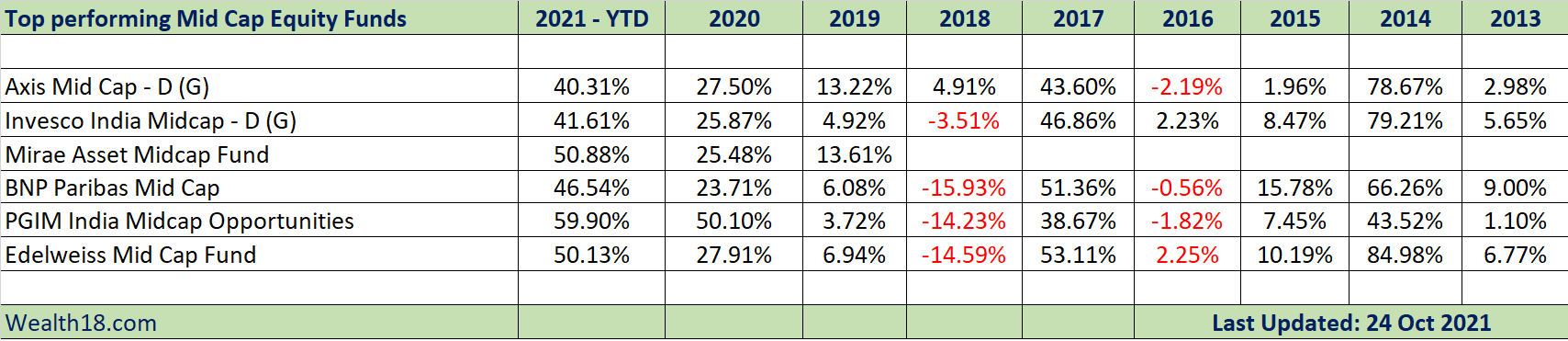

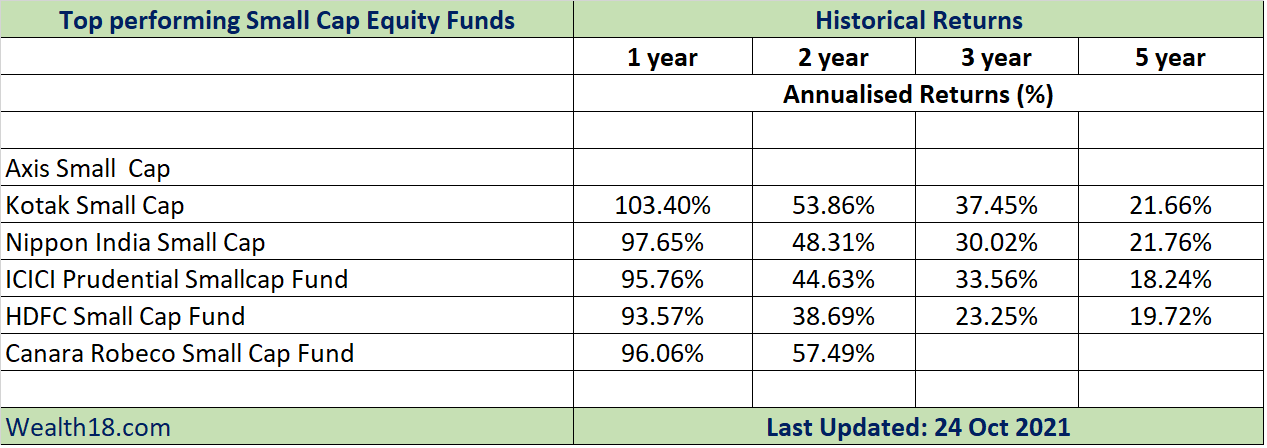

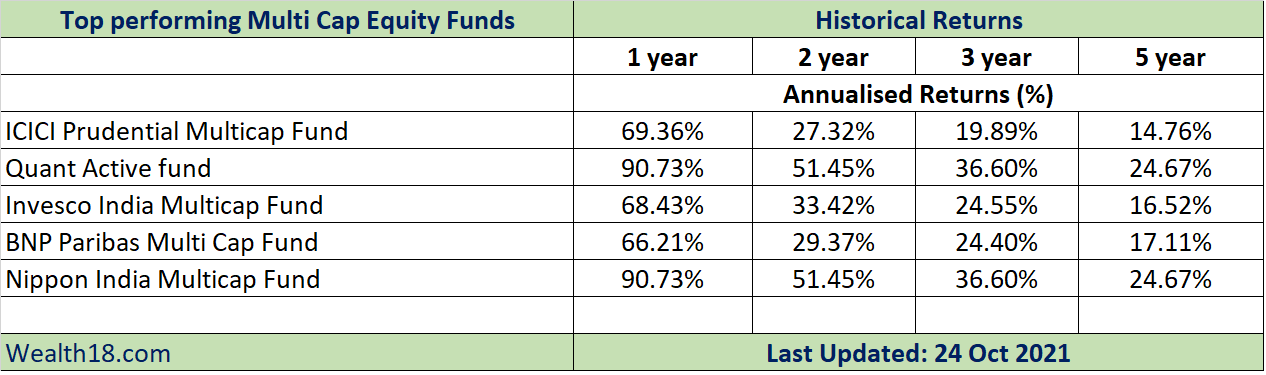

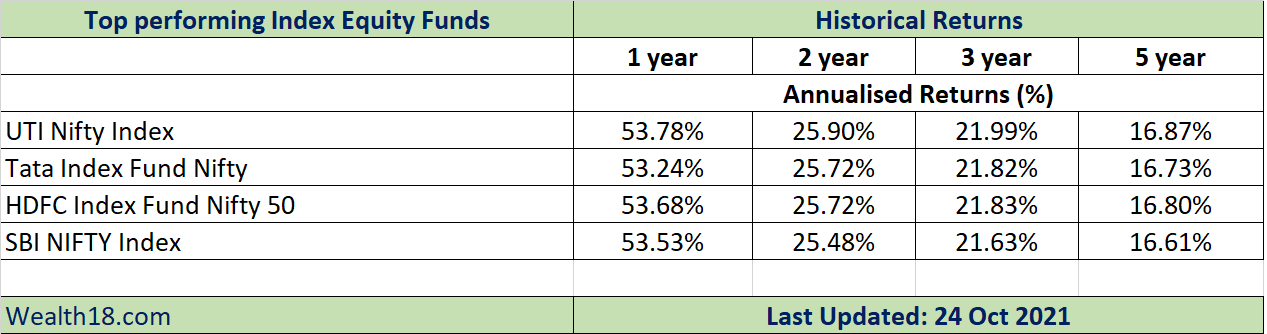

Based on the historic performance, please see below the list of Best performing Equity Mutual Funds. You can consider these funds for your investment. However, please note that the past performance is not guaranteed for future performance, but it is good indicator of how the fund has performed in the past.

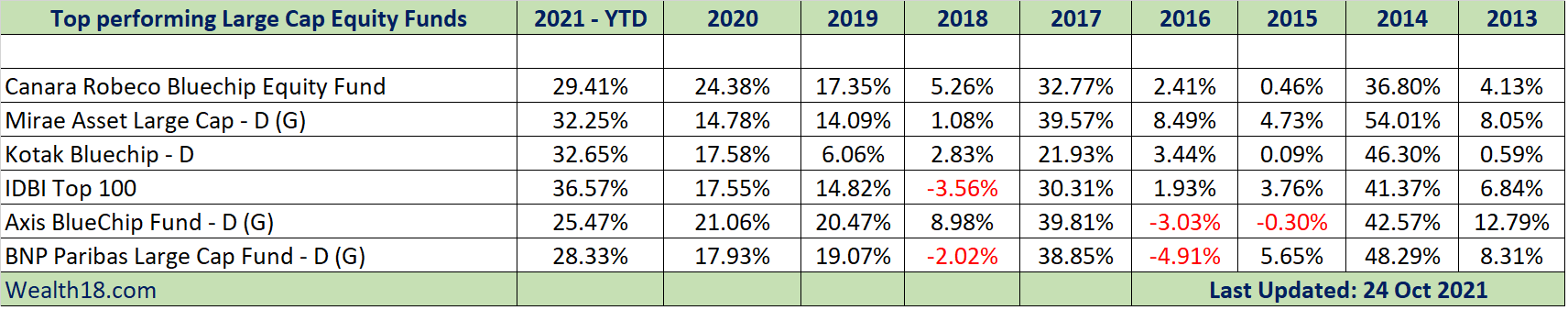

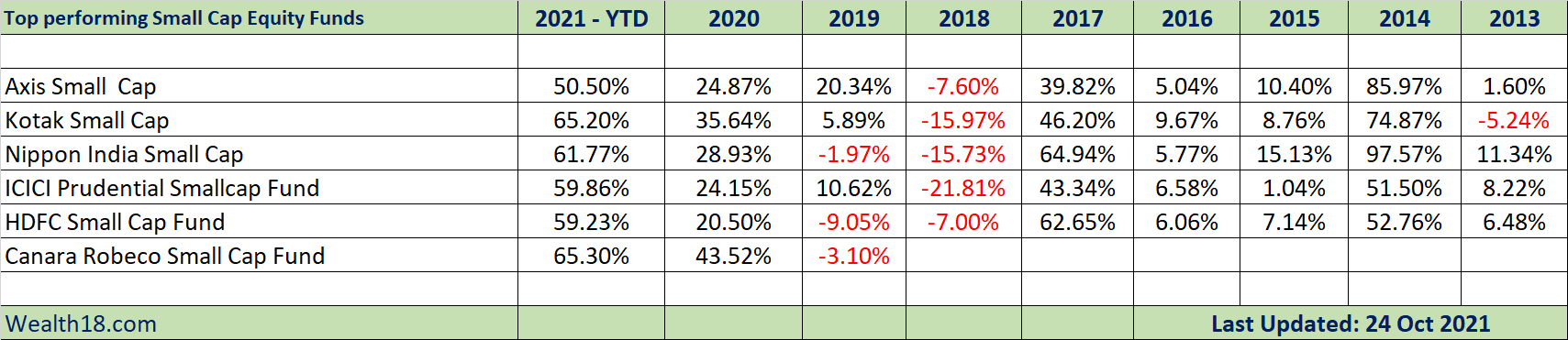

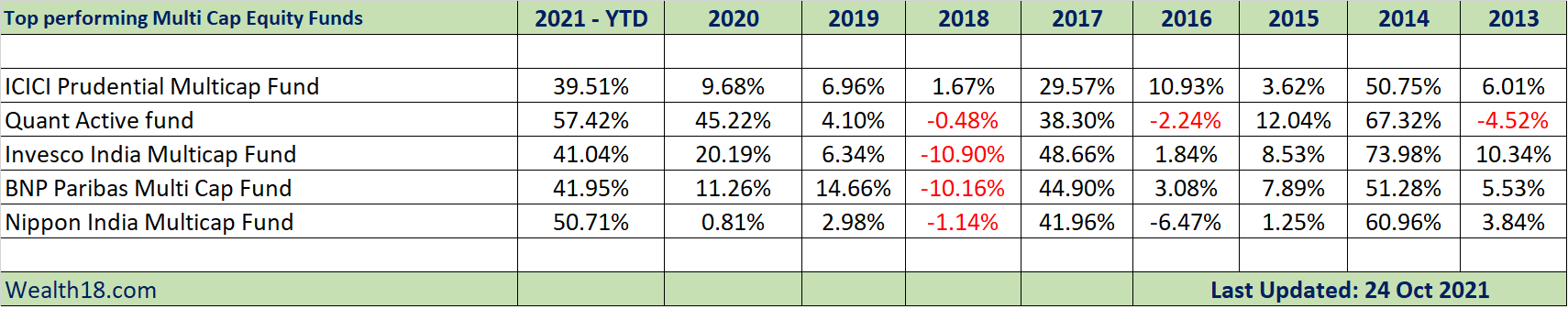

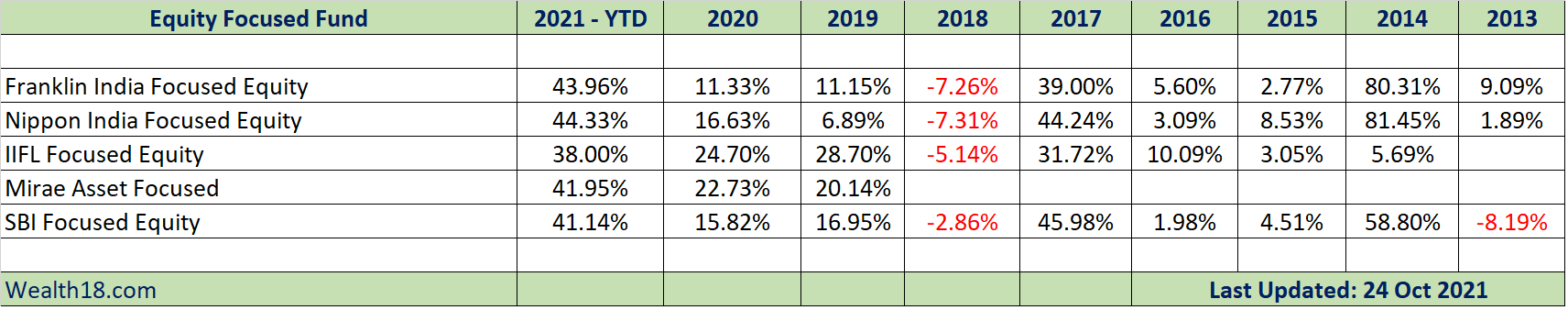

I have also shared the Year by year returns for these funds – You can see that the returns are volatile, so you should have long term view. So, if any year the returns are not good, you should not panic.

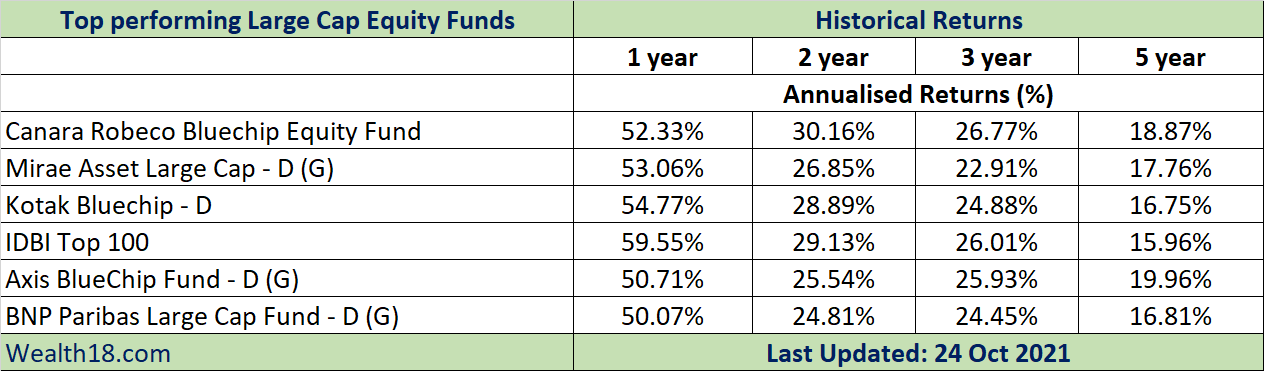

Top performing Large Cap Equity Funds

Large Cap Equity Funds are mutual funds that select stocks from the largest 100 stocks listed in the Indian markets (highest market capitalization). Larger stocks are expected to be less risky whereas smaller stocks may have higher potential to grow.

Top performing Large Cap Equity Funds:

-

-

- Canara Robeco Bluechip Equity Fund

- Mirae Asset Large Cap – D (G)

- Kotak Bluechip – D

- Franklin India Bluechip – D

- IDBI Top 100

- Axis BlueChip Fund – D (G)

- BNP Paribas Large Cap Fund – D (G)

-

Please check the Year-on-Year returns. This will help you to understand that returns from equity funds can be volatile

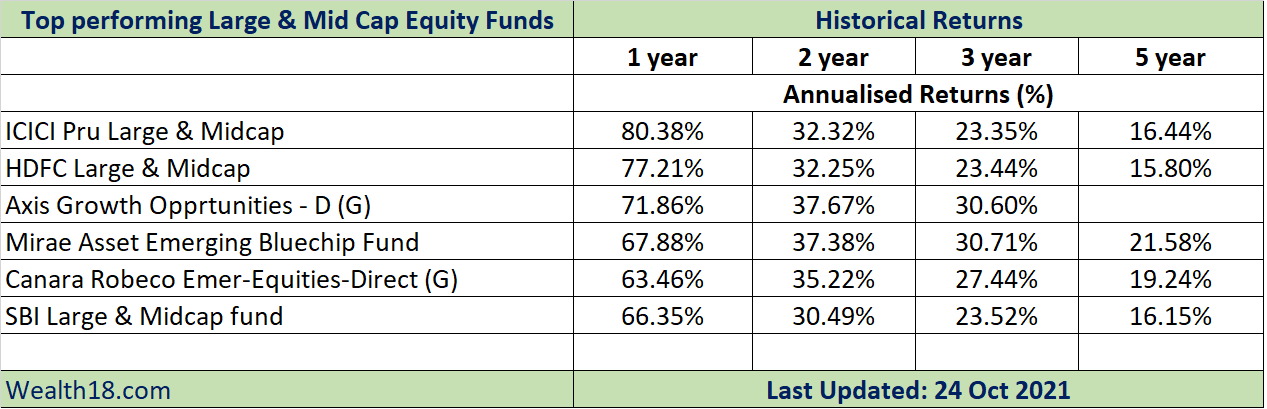

Top performing Large & Mid Cap Equity Funds

Large & Mid Cap Equity Funds select stocks from the largest 250 stocks listed in the Indian markets (highest market capitalisation).

Top performing Large & Mid Cap Equity Funds:

- Axis Growth Opprtunities – D (G)

- Mirae Asset Emerging Bluechip Fund

- Canara Robeco Emer-Equities-Direct (G)

- UTI Core Equity Fund

- Franklin India Equity Advantage

- SBI Large & Midcap fund

Top performing Mid Cap Equity Funds

Mid Cap Equity Funds select stocks from the mid cap category – stocks ranked between 100 to 250 by size ( market capitalisation).

Top performing Mid Cap Equity Funds:

- Axis Mid Cap – D (G)

- Invesco India Midcap – D (G)

- Mirae Asset Midcap Fund

- BNP Paribas Mid Cap

- PGIM India Midcap Opportunities

- Edelweiss Mid Cap Fund

Top performing Small Cap Equity Funds

These mutual funds select stocks for investment from the small cap category, which includes all stocks except largest 250 stocks (by market capitalisation).

Top Performing Small Cap Mutual Funds:

-

-

- Axis Small Cap

- Kotak Small Cap

- Nippon India Small Cap

- ICICI Prudential Smallcap Fund

- HDFC Small Cap Fund

- Canara Robeco Small Cap Fund

-

Top performing MultiCap Equity Funds

These mutual funds primarily invest in stocks selected from all the listed stocks in the Indian market (NSE/BSE).

Top Performing Multi Cap Mutual Funds:

- ICICI Prudential Multicap Fund

- Quant Active fund

- Invesco India Multicap Fund

- BNP Paribas Multi Cap Fund

- Nippon India Multicap Fund

Top performing ELSS (Tax Saving) Equity Funds

Top performing Sector / Thematic Equity Funds

These mutual funds creates a portfolio which mimics given index. So these funds are expected give similar returns as per index. Best Performing Equity Thematic or Sector Funds

- Best Performing International Funds (funds that invest overseas market e.g. international stocks like Google, Apple etc)

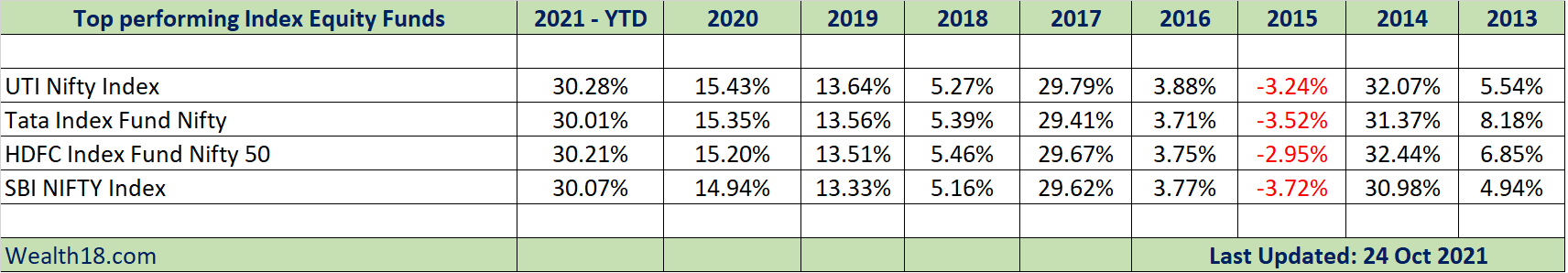

Top performing Index Equity Funds

These mutual funds creates a portfolio which mimics given index. So these funds are expected give similar returns as per index.

Top Performing Index Equity Mutual Funds:

-

-

- UTI Nifty Index

- Tata Index Fund Nifty

- HDFC Index Fund Nifty 50

- SBI NIFTY Index

-

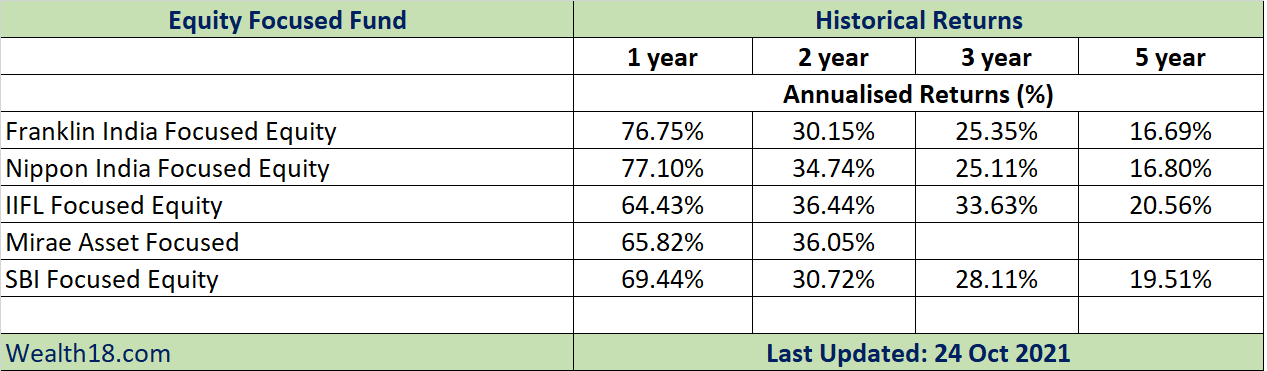

Top performing Focused Equity Funds

These mutual funds invest in stocks but restrict the number of stocks in the portfolio to a maximum of 30.

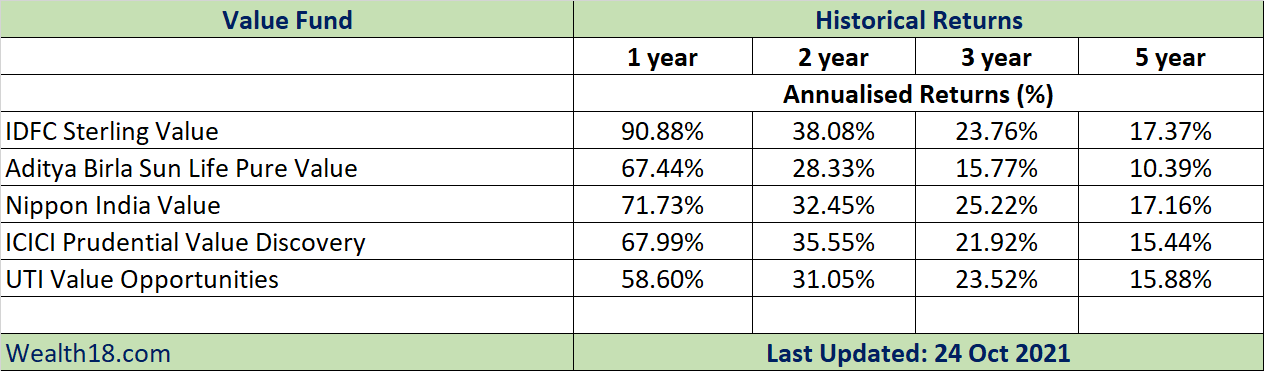

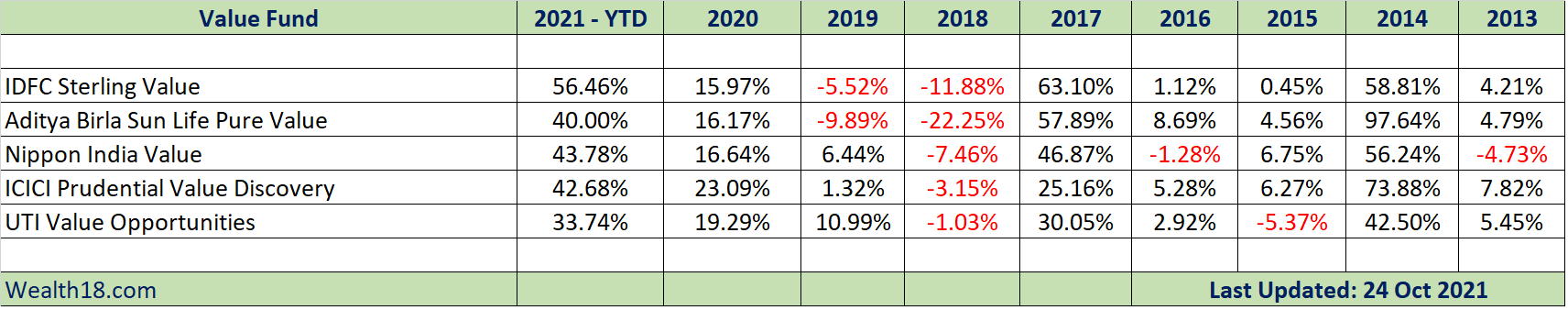

Top performing Value Oriented Equity Funds

These mutual funds invest in stocks which are undervalued. The underlying assumption is, stocks may be undervalued due to temporary factors and will provide higher returns compared to peers once valuation is at par.

Notes

Following the new SEBI classification requirements issued in 2017, many mutual funds have changed their name as well as mandate. Many funds have been merged as well. So, the past performance may not be representative of the new mandate.

Summary

- Don’t just invest in a fund if they have performed better in last year. Select the mutual funds based on your objective, time horizon, risk apettite and funds performance.

- Review your portfolio at least once in 6 months.

- If you are investing in Equity funds, be prepare for volatile returns. So you should be investing for long term (5-7 years minimum).

Related Posts

- Best Performing ELSS funds (Tax Savings Funds)

- Best Performing International Funds – Invest in Google, Facebook, Amazon, Apple

- Best Performing Sector Funds -Pharma, Banking, Technology, Consumer

- Best Performing Arbitrage funds ( almost risk free and can be used as alternative to Fixed Deposits)

- Read – New Central KYC process must for new Mutual Fund Investors.