Paras Defence & Space Technologies IPO is opening on 21st Sep 2021. Paras Defence operates in five verticals viz. defence and space optics, defence electronics, heavy engineering, electromagnetic pulse protection solutions and niche technologies. Its major clients include defence public sector undertakings such as Bharat Electronics, Bharat Dynamics and Hindustan Aeronautics, and companies in Belgium, Israel and South Korea.

Paras Defence & Space Technologies IPO is opening on 21st Sep 2021. Paras Defence operates in five verticals viz. defence and space optics, defence electronics, heavy engineering, electromagnetic pulse protection solutions and niche technologies. Its major clients include defence public sector undertakings such as Bharat Electronics, Bharat Dynamics and Hindustan Aeronautics, and companies in Belgium, Israel and South Korea.

Issue Details of Paras Defence IPO:

| IPO Opens on | 21 Sep 2021 |

| IPO Closes on | 23 Sep 2021 |

| Issue Price band | Rs 165 – Rs 175 |

| Any Discount | NA |

| Issue Size | Rs 181 crore |

| Minimum Investment | 85 shares lot (min amount 14875) |

| Max Investment (Retail) | 13 lots / 1105 shares (amount Rs 193375) |

| Registrar | Link Intime |

| Book Running Lead Managers | Anand Rathi |

| Listing | BSE/NSE |

| Download | Red Herring Prospectus |

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Paras Defence IPO Grey market Premium :

As per market observers, Paras Defence IPO grey market premium (GMP) was at around

- Rs 220 – 20 sep (expected to trade at 385-395 on the unlisted grey market)

IPO Issue Allocation:

- QIB = Not More than 50% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 35% of the offer

Background:

- Paras Defence is engaged in the designing, developing, manufacturing, and testing of a variety of defence and space engineering products.

- It is the only company in India with design capability for space-optics and opto-mechanical assemblies.

- Paras Defence is one of the leading providers of optics for various Indian space and defence programs. They also deliver customized turnkey projects in the defence segment.

- Current projects include: hyperspectral space cameras, multi and hyperspectral cameras for drones and space, ARINC-818 based avionic display and naval periscopes, UAVs, CubeSats, and anti-drone systems.

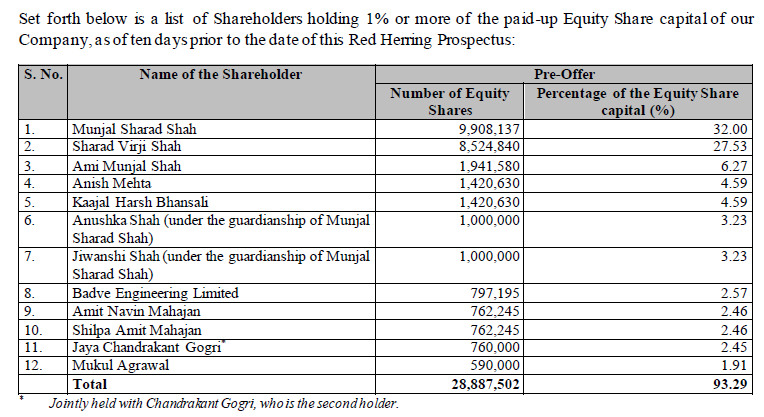

Top Shareholdings:

Objective of the issue:

The Paras Defence IPO has an issue size of Rs 170.78 crore and it also consists of a fresh issue and an offer for sale (OFS). The fresh issue aggregates up to Rs 140.60 crore, while the OFS comes up to Rs 30.18 crore with a total of 1,724,490 equity shares.

- The proceeds will fund the capital expenditure requirements as well as fund the incremental working capital requirements.

- A portion of it will also go towards the repayment and prepayment of all or a portion of certain borrowings/outstanding loan facilities that were availed by the company.

- The rest of the funds will go towards general corporate purposes.

Anchor Investors:

Paras Defence and Space Technologies on September 20 garnered Rs 51.23 crore from five anchor investors ahead of its initial public offering (IPO). The bidding for the offer will begin from September 21 till September 23. The company and selling shareholders in consultation with merchant bankers have finalised allocation of 29,27,485 equity shares to anchor investors, at a price of Rs 175 per equity share, said Paras Defence in its circular published on the exchanges.

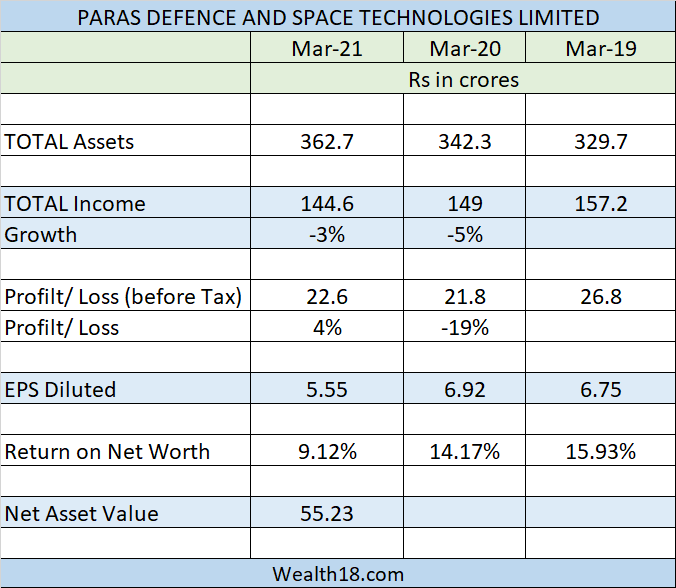

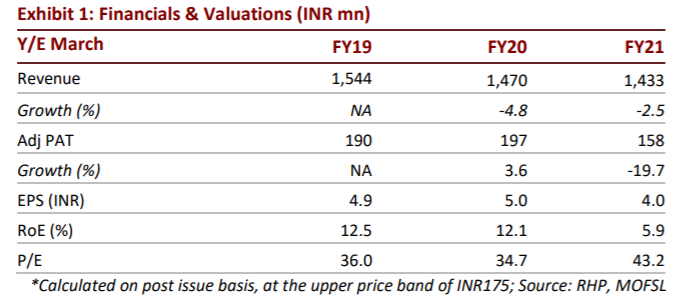

Financials:

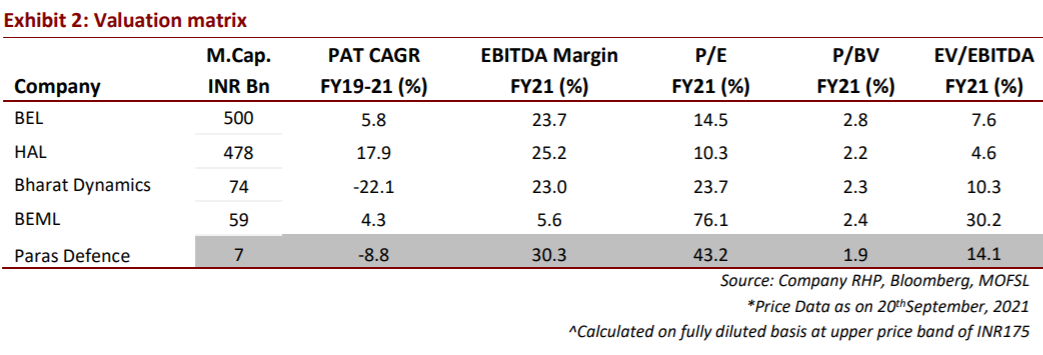

Valuation as compared to its peers:

While the company has indicated that there are no comparable competitors, larger defense majors such as Hindustan Aeronautics (15 times) and Bharat Dynamics (29 times) are trading at lower valuations.

Pros

- The company has a strong order book of around Rs. 305 crore as on June 30, 2021 with a well diversified product portfolio in defense and space optics, defense electronics, heavy engineering and niche technologies. Paras Defence’s topline has been in the range of Rs 143- Rs 154 crore over the last three years. On similar lines, the bottomline performance has also been lacklustre over the last 2-3 years, with profit in the range of Rs 16 crore to Rs 20 crore. Both topline and bottomline have declined over the last three years

- The government focus on ‘Make in India’ and higher budgetary allocation for defense sector may prove beneficial to such companies. Also, liberalised policies and PLI scheme for drones will further benefit such companies

- Paras Defense is the sole Indian supplier of critical imaging components such as large size optics and diffractive gratings for space applications in India. It has developed strong R&D capabilities.

Cons

- “However, on the operational front, top and bottom line growth seems to be muted. At the upper band of Rs.175, post fresh issue the asking PE comes around 43X. While the company has indicated that there are no comparable competitors, larger defense majors such as Hindustan Aeronautics (15 times) and Bharat Dynamics (29 times) are trading at lower valuations.

Brokerage Recommendations:

| Brokerage | Recommendations |

| Arihant Capital | Subscribe |

| Motilal Oswal | Subscribe |

| KR Choksey | Subscribe |

| Subscribe |

Should you invest:

The company’s top line and bottom line is pretty flat over last 3 years. Also the valuation is high as compared to other listed defense players like HAL, BEL. However, the company’s order book is strong and it is sole supplier of some critical imaging components. Also, there is focus by Govt on Make in India. So investors can consider investment in this IPO for long term.

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Disclaimer: This is not an investment advice and is only for educational purposes. Please consult your financial advisor before taking any financial decisions.

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | 28th Sep |

| Initiation of Refunds | |

| Credit of Equity Shares: | |

| Listing Date: | 1st Oct |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Day-1 | Day-2 | Day-3 |

|---|---|---|---|

| QIB | 0.01 | ||

| NII | 3.77 | ||

| Retail | 31.36 | ||

| Employee | |||

| TOTAL | 16.57 |

How to apply for Paras Defence IPO through Zerodha

Zerodha customers can apply online in this IPO using UPI as a payment gateway. Zerodha customers can apply in this IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘Devyani International IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.