Arbitrage Funds, as the name suggests, are the funds which make money from Arbitrage opportunities. Many investors are not familiar with this type of Mutual Funds. They normally know Equity Funds and Debt Funds etc and think Arbitrage Funds are just other fancy schemes under Equity Funds. However this is not the case.

Arbitrage Funds Definition / Meaning

“Arbitrage” means – The simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Actually, Arbitrage Funds are niche category of mutual funds that aim to take advantage of arbitrage opportunities between spot (cash) and future markets. The arbitrage is sought by taking advantage of the mis-pricing between the cash and the derivatives market. So they trade in Equity & Equity derivatives but generate income similar to Fixed Income.

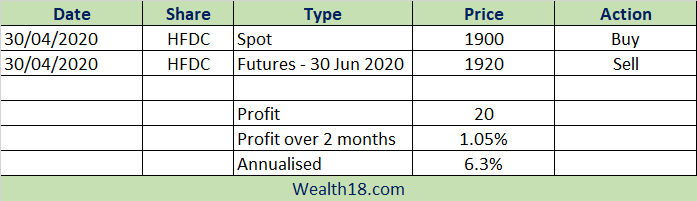

Let’s understand through an example

This return is risk free as both contract (buy & sell) are taken at the same time. Irrespective of market price on 30/06/2020, the profit will be Rs 20 per share.

- If the share goes above 1920, the trader will loose on Futures but gain on spot shares.

- If the shares goes below 1920, the trader will gain on Futures but loose on spot shares.

How do they generate returns?

The ability of these funds to generate higher returns depends on the volatility in equity markets – the higher the better. Fund Managers use sophisticated software’s that flag any mispricing the moment it occurs.

Arbitrage funds taxation aspects

Taxation is one of the USP for Arbitrage funds. While it is a substitute for debt products on a risk-return basis, arbitrage funds are taxed as equity.

-

- So, the long-term returns (after 1 year) will be taxed at just 10%. Note that the returns upto Rs 1 lakh is tax free.

- The short-term capital gains are taxed at a special rate of 15%, plus surcharge.

Arbitrage funds can act as an alternative to short-term debt funds as they have generated higher returns in the short-term.

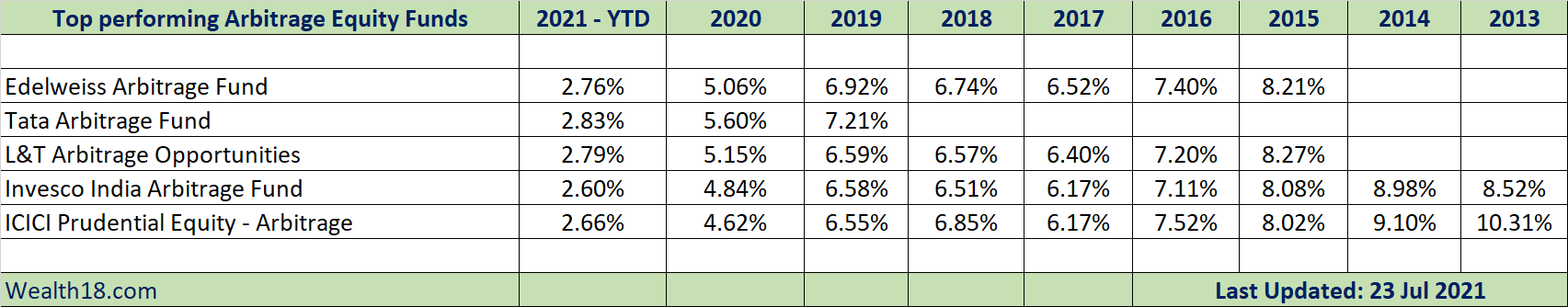

Returns of Arbitrage Funds (Best performing Arbitrage Funds)

Mostly for other type of funds, I show the CAGR return over 1 year, 3 year and 5 years, but for Arbitrage funds, it is better to see their returns over a short term. Therefore, the

Point to Note

-

- Arbitrage & Arbitrage Plus – Investors need to differentiate between pure arbitrage and arbitrage plus funds. In the former, the equity component is completely hedged while the latter can take unhedged positions and carry a higher risk.

- These funds should have an equity holding of over 65% to be classified as equity funds.

- Returns are similar to Interest rates prevailing in the market but are more tax efficient.

- The main difference between Arbitrage funds & debt funds are Taxation aspects as discussed above.

- Debts funds invest in Fixed Income Securities and have interest rate risk while Arbitrage funds are almost risk free.

Summary

Arbitrage funds are good option for Investors in higher tax bracket as they generate risk free income and are tax efficient.

Feedback

Have you heard about these funds before reading this article? Have you invested in Arbitrage funds before? What are your views on such funds? Do you have any query related to such Arbitrage funds?