AU Small Bank Finance IPO Allotment Status Check Online – You can check the allotment status at the Registrar website link below using your PAN number.

You can also send your PAN by comment below and we can check the status for you. As the retail quota was oversubscribed, you may get less or no allotment.

[xyz-ihs snippet=”ad1″]

Registrar Website link to check allotment

https://www.linkintime.co.in/PublicIssues/

Final day: AU Small Bank Finance IPO is over-subscribed 54 times – QIB – 78 times, HNI – 143 times, Retail 3.3 times

AU Financiers (India) Limited is a retail focused non-banking finance company (“NBFC”) primarily serving low and middle income individuals and businesses that have limited or no access to formal banking and finance channels.

Issue Details of AU Financiers IPO:

- IPO Open: 28th June – 30th June 2017

- Issue Price band: Rs 355 – 358

- Issue Size: 53,422,169 Equity Shares

- Market lot: 41

- Minimum Investment: Rs 14678

- Max Investment for Retail: 533 shares @ 358 = Rs 190814

- Book Running Lead Managers: ICICI Securities Limited, HDFC Bank Limited, Motilal Oswal Investment Advisors Limited and Citigroup Global Markets India Private Limited

- Registrar: Link Intime

- Listing: BSE / NSE

IPO Issue Allocation:

- Employee Reservation Portion – 2% of the total issue size.

- Qualified institutional buyers (QIBs) – 49% of the total issue size.

- Non-institutional investors (NIIs) – 15% of the issue size.

- The retail quota limit in the issue = 34% of the issue size.

Background:

AU Financiers (India) Limited is a prominent, retail focused non-banking finance company (“NBFC”) primarily serving low and middle income individuals and businesses that have limited or no access to formal banking and finance channels. The company operates in three business lines: vehicle finance; micro, small and medium enterprises (“MSMEs”) loans; and small and medium enterprises (“SMEs”) loans. It is categorized as a “Systemically Important, Non-Deposit Accepting Asset Finance Company” (NBFC-ND-AFC) by the Reserve Bank of India.

The company received a license from the RBI to set up a ‘small finance bank’ (“SFB”) on December 20, 2016 and it is the only NBFC categorized as an asset finance company to obtain such license.

AU Financiers (India) Limited has adopted a strategy of contiguous expansion across regions and as of December 31, 2016, conducted its operations through 300 branches spread across 10 states and one union territory in India, with significant presence in the states of Rajasthan, Gujarat, Maharashtra and Madhya Pradesh and employed 6,092 personnel serving 270,692 active loan accounts.

It has access to diverse sources of liquidity, such as term loans and working capital facilities; proceeds from loans assigned and securitized; proceeds from the issuance of non-convertible debentures (“NCDs”) and commercial paper; and subordinated debt borrowings from banks, mutual funds, insurance companies and other domestic and foreign financial institutions to meet its funding requirements.

It was also featured in the September 2013 publication of Forbes India as one of the 14 hidden gems of India and was awarded the ‘Best PE-Backed Financial Services Company 2012’ at the VC Circle Awards.

Its main business is vehicle finance business (new and pre-owned vehicles and for refinancing of vehicles), MSE & SMSE loans.

However, once the company sets up the “Small finance bank”, then it will offer other products like Current Accounts, Savings, Loan (housing, Gold loan etc), investment products, financial advisory etc.

Promoters & Promoter Group holdings / Shareholder:

| Shareholder | Shares | % |

| Redwood Investment | 59,770,794 | 21.03 |

| Sanjay Agarwal | 58,477,128 | 20.57 |

| IFC | 30,288,678 | 10.66 |

| Labh Investments Limited | 22,537,530 | 7.93 |

| Ourea Holdings Limited | 21,149,064 | 7.44 |

| Ms. Jyoti Agarwal | 14,182,272 | 4.99 |

| Ms. Shankuntala Agarwal | 14,094,756 | 4.96 |

| Mr. Chiranji Lal Agarwal | 8,119,770 | 2.86 |

| MYS Holdings Private Limited | 7,460,466 | 2.62 |

| ICICI Prudential Life Insurance | 4,857,144 | 1.71 |

| SBI Life Insurance | 4,857,144 | 1.71 |

| 245,794,746 | 86 |

Objective of the issue:

The objects of the Offer are to achieve the benefits of listing the Equity Shares on the Stock Exchanges and for the Offer for Sale of 53,422,169 Equity Shares. The Company expects that listing of the Equity Shares will enhance visibility and brand and provide liquidity to its existing shareholders. Listing will also provide a public market for the Equity Shares in India. The Company will not receive any proceeds from the Offer. All proceeds from the Offer will go to each of the Selling Shareholders, in proportion to its portion of the Offered Shares.

Anchor Investors: AU Small Finance Bank has raised Rs 563 crore on Tuesday by allotting 1.57 crore shares to 34 anchor investors at the upper end of the price band of Rs 358 per share.

The government of Singapore, Kuwait Investment Authority, Blackrock India Equities, Nomura, HSBC Global Investment, Wells Fargo, Jupiter South Asia Investment Company, Wasatch Emerging, Amansa Holdings, Driehaus Emerging Markets, Pacific Horizon Investment Trust were some of the anchor investors. Among domestic mutual funds, ICICI Prudential, Reliance, Birla, SBI, Kotak, Sundaram, Motilal Oswal, BNP and IDFC have subscribed to the issue.

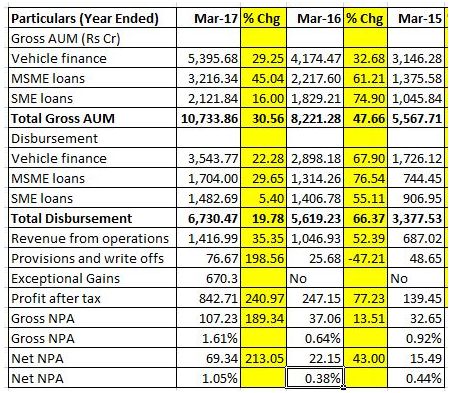

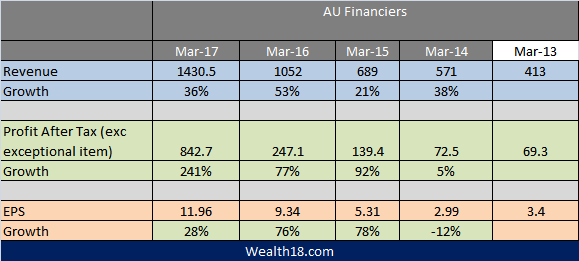

Financials:

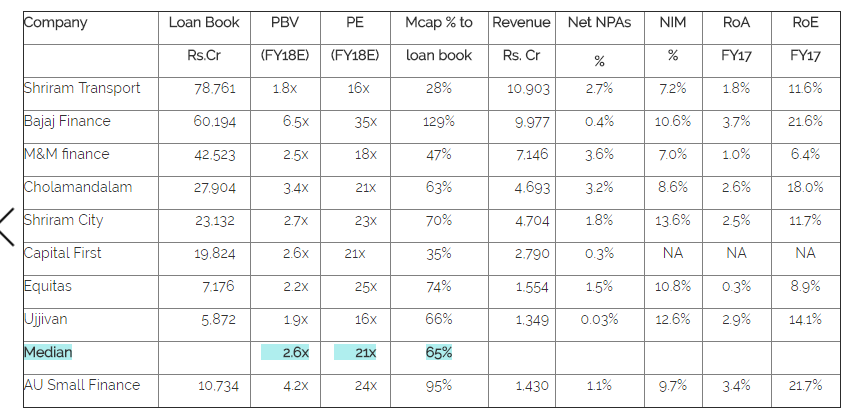

Valuation as compared to its peers:

Brokerage Recommendations:

| K R Choksey | Subscribe | for long term |

| Antique Broking | Subscribe | for long term |

| IIFL | Subscribe | |

| SMC | 2.5 / 5 rating | |

| Sharekhan | Subscribe | |

| S P Tulsian | Avoid | Good stock but expensive valuation |

Should you invest:

At Rs 358 with FY 2017 EPS of 12, the issue is priced at PE of 30, which seems aggresive. The company has given good growth rate in revenue and profits as well as potential to diversify earning as well. However, as it is bit expensive compared to its listed peers, investors can avoid this IPO, even though the company financials are strong. If someone wants to invest, they should invest for long term.

[xyz-ihs snippet=”ad1″]

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.