As the due date for income tax is 31 July, you need to make sure that te returns are file on time. From April 2018, tax rules have changed and a penalty of upto Rs 10000 will be levied if the return is not filed on time. Also, the ITR revision time limit is also changed from 2 years to 1 year. See details

Must Read – Step by Step Guide to file Income tax returns online

Step to File Income Tax return Online for FREE on Official Website (using excel upload)

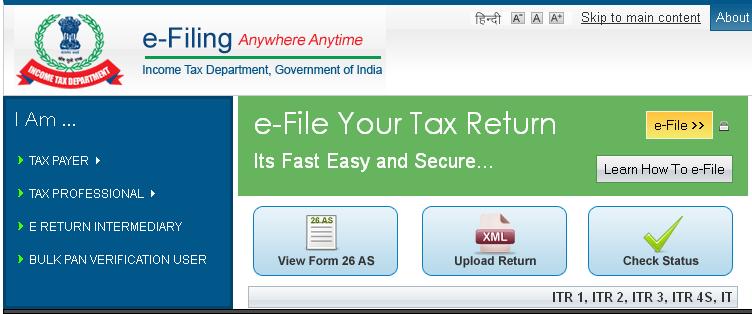

1. Go to Income Tax India Website – https://incometaxindiaefiling.gov.in

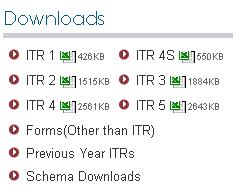

2. Download the relevant Income Tax form

On the Right Had Corner, you will see the Excel Files to Download

3. Extract the Excel file into a folder. ( using Winzip / Winrar software)

These files are in ZIP Format.

You need to extract these files to a folder using free software like WinZIP, WinRar etc Normally these softwares are already on your PC. If not you can download these for FREE from

https://www.winzip.com/win/en/prod_down.htm

https://www.rarlab.com/rar/wrar50b6.exe

4. After Downloading, open the Excel file and Enable Macros

Go to Tools –> Macro –> Security and Select Medium.

Open the File again. It should ask whether to Enable or Disable Macros. Select “Enable Macros”

5. Fill in the details in this excel file based on your Form 16 , other TDS Certificates, Bank Statements – Interest etc

6. After filling details on all sheets, Click on Validate button to check if you have missed anything

7. Once you have validated every sheet, Click on “Calculate tax“

7a. If you have taxes to pay, then these can be paid online through the Link below.

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Use Challan No / ITNS 280 to make the tax payment.

Once that’s done, details of the counterfoil of the tax paid challan must be entered in “Self Assessment Tax” Section on the excel file.

8. Then Click on Generate XML. This will generate an XML file at same location as that of excel file.

9. To upload this XML file on Income Tax India Website – https://incometaxindiaefiling.gov.in

10. Create User ID & Password on Income Tax Dept Website

Go to Submit Return Section Click on Assessment year 2013-2014 (for Income earned during April 2012- Mar 2013) & select the related form

11. Upload XML Form generated earlier

12. IMPORTANT – your ITR-V form is generated (sometimes the ITR-V form will not be mailed to you, so please save the ITR-V form which is generated on the screen).

13. Print ITR V form, sign it & send on the address mentioned above the ITR V form within 120 days of using only normal post or speed post (No Private courier)

Dispatch it in an envelope that can hold an A4 size paper without folding it.

13a. In case the return is Digitally Signed (using Digital signature) , there is no need to send the acknowledgement.

14. Once the IT department receive the duly signed ITR V, they will send you the acknowledgment mail to your email-id.

Now you can relax and get peace of mind.

Important Points to Note

- Make sure you have chosen correct form

- In case the acknowledgement is not sent within 120 days , it will be deemed that the return is not filed. Make sure you get a confirmation email from IT Dept within 30 days of sending the acknowledgement to them. If not, then send the ITR V acknowledgement again.

- ITR V Acknowledgement is also sent to you on your registered email ID. This form is password protected. See my post – How to Open ITR V / ITR Acknowledgement ? What is the Password ?

———–

Important Links – Must Read

How to File Income Tax return (ITR) online – Step by Step Guide for eFiling

How to quick e-file ITR1 & ITR 4S online for FREE – Step by Step Guide

How to other ITR forms online (using excel upload) for FREE – Step by Step Guide

[How to] get Electronic Verification Code (EVC) to e-Verify Income tax return for AY 2015-2016

[How to] View your Form 26AS online – Check Tax Credit Statement

How to pay balance Income Tax online

Which ITR form you need to file