Now you can e-verify your Income tax returns and there is no need to send physical ITR-V to Income Tax office.

As per new notification by Income Tax department (Notification 02/2015 dates 13th July 2015), you can online verify your Income tax return using Electronic Verification Code (EVC).

Presently, individual taxpayers had to send the physical copy of ITR acknowledgment (ITR V) to CPC Banglaore. Only taxpayers having digital signatures could sign it online. But with this new Electronic Verification Code (EVC) facility, tax payers can e-verify their Income tax rteturns.

As the due date for income tax is 31 July, you need to make sure that te returns are file on time. From April 2018, tax rules have changed and a penalty of upto Rs 10000 will be levied if the return is not filed on time. Also, the ITR revision time limit is also changed from 2 years to 1 year. See details

In this post, we will explain about what is EVC, How to get EVC, What will happen if you cannot generate EVC etc.

A. What is Electronic Verification Code (EVC)?

Electronic Verification Code (EVC) is a 10 digits alpha numeric code to verify the identity of the taxpayers and your income tax return online.

- The EVC would be unique for an Assessee PAN and will not be valid for any other PAN at the time of filing the ITR.

- One EVC can be used to validate only one ITR.

- The EVC remains valid for 72 hours but can be generated various times through various modes.

- The EVC could be used to verify ITR 1 (Sahaj) / ITR 2 / ITR 2A / ITR 3 / ITR 4 /ITR 4S (Sugam).

- In case the tax returns are already filed or uploaded, the verification needs to be done within 120 days of filing of return.

B. How to Generate Electronic Verification Code (EVC)?

CBDT has notified following four methods to generate Electronic Verification Code (EVC):

- through Income tax efiling website

- through linking Aadhar card with PAN

- through Bank ATM

- through netbanking

1. Generate EVC through e-filing website

If your salary income is up to Rs.5 lacs and you are not claiming any tax refunds, you can use this method of generating EVC. Before generating EVC, please ensure that the mobile number and email address registered with the CBDT is correct.

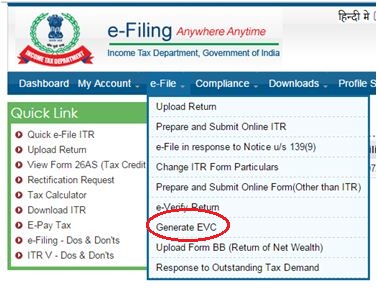

- Login to your efiling account with PAN number as user id and your password.

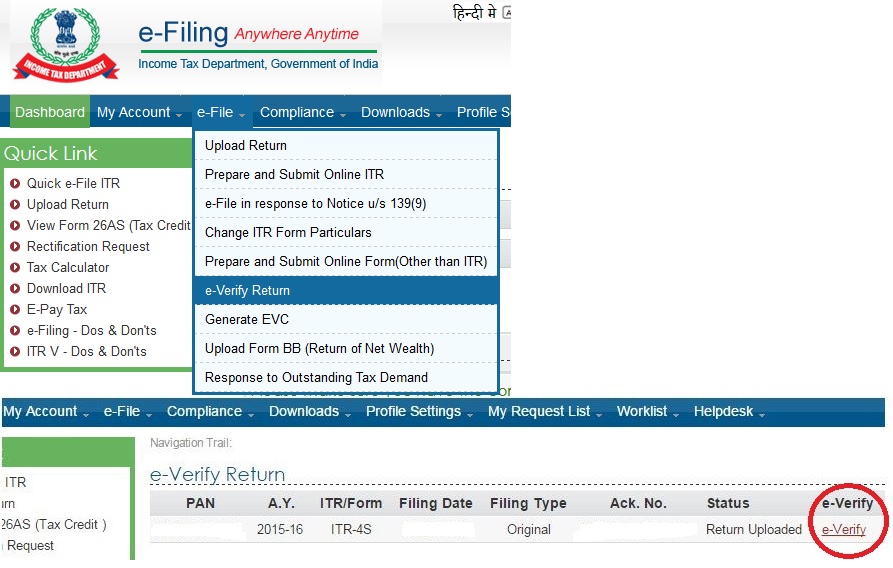

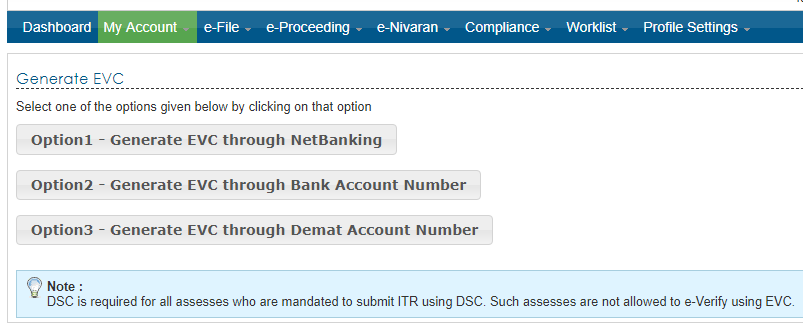

- Click on the e-file tab and select Generate EVC as shown in the screenshot below:

- You would receive EVC on your registered mobile number as well on your registered email address

- You can then use this EVC code after e-filing the returns.

2. Generate EVC through Linking Aadhaar Card with PAN

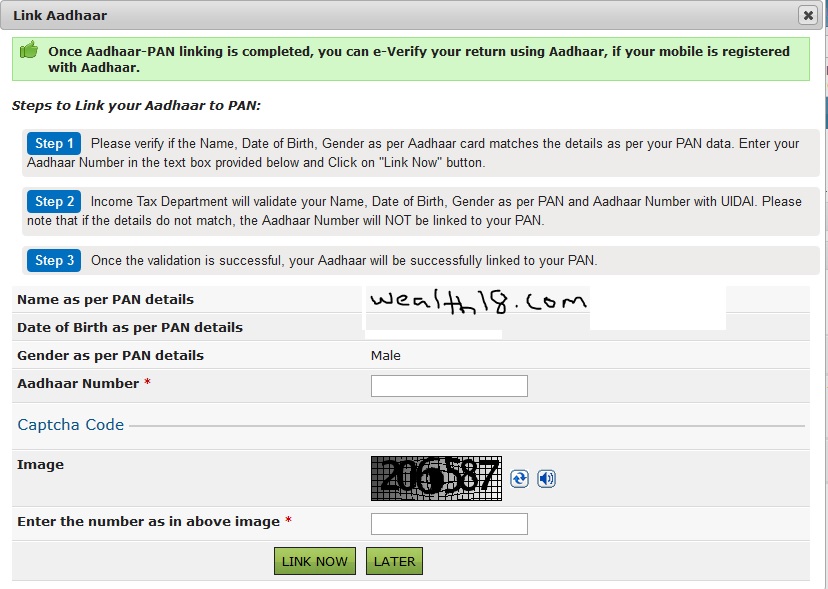

Before generating EVC through Aadhaar Card, make sure that your mobile number is registered with your aadhaar.

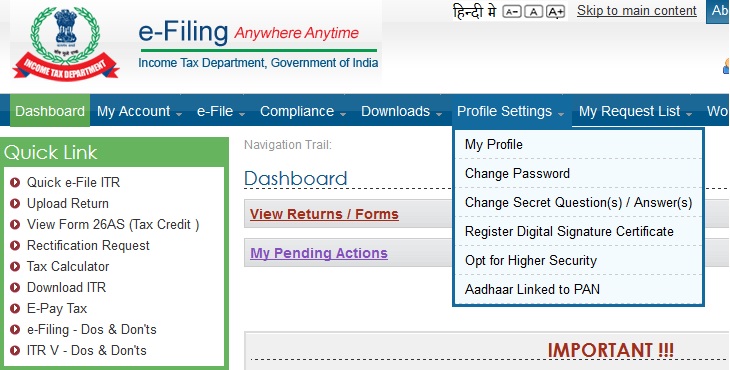

- After login, you would see “Profile Settings” Tab besides downloads. Click on it and a drop-down menu would appear, select Link Aadhaar with PAN.

- Fill in the required details and click on Link Now to complete the process.

- Once you have linked the Aadhar number with PAN, then you can generate EVC at the time of e-verifying your tax return.

3. Generate EVC through Bank ATM

For this option you have to use the ATM card of the bank which is registered with the IT department. You can generate EVC by selecting “generate EVC for ITR filing” appears on the ATM Screen. The EVC would be sent to your registered mobile number with Bank.

4. Generate EVC through Net Banking Facility

You can generate EVC using Net Banking when you route the tax return filing process of through the bank which is registered with IT Department.

You would have to login into your net banking account and then click on the link to income tax e-filing website where you can generate EVC. The EVC would be sent to your registered mobile number with Bank.

You can use this option only if the PAN is linked with your Bank account and ITR is for same PAN number.

5. Generate EVC through DMAT Account Number

C. How to use Electronic Verification Code (EVC) to verify Income Tax Return?

Electronic Verification Code (EVC) for e-verification process of Income Tax Return can be used while:

- Uploading of Return using Net Banking

- Uploading of Return without using Net Banking

- For already Uploaded Return

| Uploading of Return without using Net Banking |

|

| Uploading of Return using Net Banking – you got routed to e-filing website through net banking account |

|

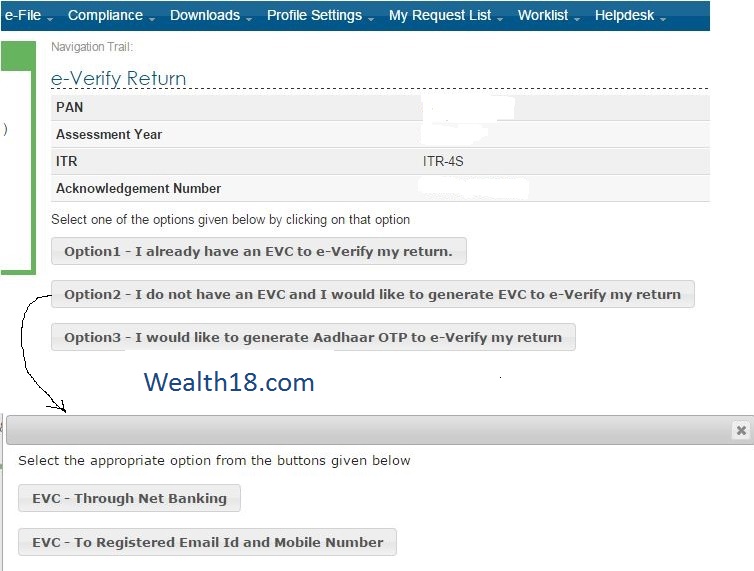

3. Verification of Already Uploaded Returns requires you to verify them within 120 days of submission or uploading by following below mentioned steps:

- Login to your income tax e-filing website.

- Click on e-file button and select e-verify in the drop-down menu.

- You will see the List of all the ITRs which are pending for e-verification.

- Click on the e-verify link as shown in the image

Select any of the options to complete the e-verification process of Income Tax Return.

- Once you submit EVC (generated through any of the above options), the entire process of verification of ITR is complete. There is no need to send physical copy of ITR V physical copy . You can also check the status of your ITR, it should be displayed as ‘successfully e-verified’.

If you have any queires, feel free to comment below.

Important Links – Must Read

How to File Income Tax return (ITR) online – Step by Step Guide for eFiling

How to quick e-file ITR1 & ITR 4S online for FREE – Step by Step Guide

How to other ITR forms online (using excel upload) for FREE – Step by Step Guide

[How to] get Electronic Verification Code (EVC) to e-Verify Income tax return for AY 2015-2016

[How to] View your Form 26AS online – Check Tax Credit Statement