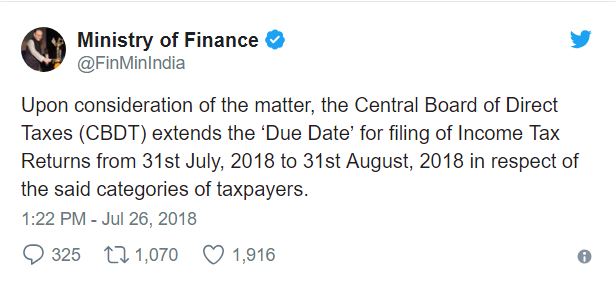

The government on Thursday extended the deadline for filing income tax return for assessment year 2018-19.

The deadline of July 31, 2018 has been extended by a month to 31st August 2018

Assessee can now file their income tax return (ITR) for financial year 2017-18 (AY 2018-2019) by August 31 without any penalty charges.

Relief to the taxpayers: This will be a relief for taxpayers who are yet to file their tax returns as from this year, as per a budget provision, late filing of tax returns will attract a penalty of up to ₹10,000.

Until last assessment year (AY) there was no penalty for filing belated income tax returns. However, this penalty is applicable from AY 2018-19. A new section 234F was inserted by the government in the Income Tax Act. As per the new provision, a penalty of ₹5,000 will be levied if the return is filed after the due date but before 31 December and the penalty will be ₹10,000 after 31 December.

However, if the taxpayer’s income is less than ₹5 lakh, maximum penalty levied is capped at ₹1,000.

Filing Income tax return in quite easy on the Income Tax eFiling website:

- Check which ITR form is applicable to you – Check here If you are a salaried person, most likely you need to file ITR 1 or ITR 2

- If you need to file ITR1, you can directly file it online. See step-step-step guide details

- If you need to file ITR2, then you will need to upload the return in the excel file to the Income tax website (see step-by-step guide)

- Make sure you check your Form 26AS that shows all the Tax deducted against your PAN – Read how to check Form 26AS online

- When you file the returns, and if there is any tax due, then you need to pay it online – see details how to pay the tax

- After you file the returns, you need to validate the return using EVC (Electronic verification code) – see how to verify ITR using EVC

Feel free to ask any tax related questions below.