The last date for filing return is quite near (31st July). Before filing the returns, check your Form 26AS to make sure that TDS deducted are appropriately credited to your account. As the due date for income tax is 31 July, you need to make sure that tte returns are file on time. From April 2018, tax rules have changed and a penalty of upto Rs 10000 will be levied if the return is not filed on time. Also, the ITR revision time limit is also changed from 2 years to 1 year. See details

When your employer deducts TDS from your Salary or your bank deduct TDS on your FD Interest, they need to deposit this amount to Government against your PAN. If they enter your PAN incorrectly, you will not get credit for that TDS amount.

So, It is always better to check your Tax Credit Statement (Form 26AS) before filing your Income Tax return.

What is Form 26AS

Form 26 AS is consolidated tax statement which includes details of

- tax deducted on behalf of the taxpayer by deductors

- tax collected on behalf of the taxpayer by collectors

- Advance tax/self assessment tax/regular assessment tax, etc. deposited by the taxpayers (PAN holders)

- Details of paid refund received during the financial year

- High value Transactions in respect of shares, mutual fund etc.

Also Read – 13 things to know before filing Income Tax returns

What if your TDS details not appearing on Form 26AS or appearing wrong

If you think that the details under yoru Form 26AS is not correct, you should immediately contact your employer / bank who has deducted the Tax for rectification. Common mistakes are wrong PAN number with the deductor (employer / bank etc)

How to check or view Form 26AS online ?

There are 3 ways / options to check Form 26AS

- Income Tax India efiling website

- NetBanking of Authorised banks

- through registration at TRACES Website

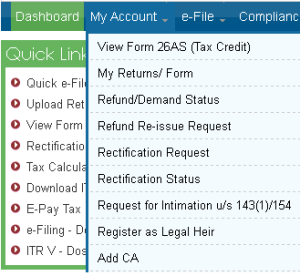

Option 1 – View Form 26AS on Income Tax India efiling website

To check Form 26AS online on Income Tax efiling website, you need to visit

https://incometaxindiaefiling.gov.in/e-Filing/UserLogin/LoginHome.html?nextPage=taxCred

- Register on website for FREE

- After you login, you will find the option to view Form 26AS under “My Account” tab

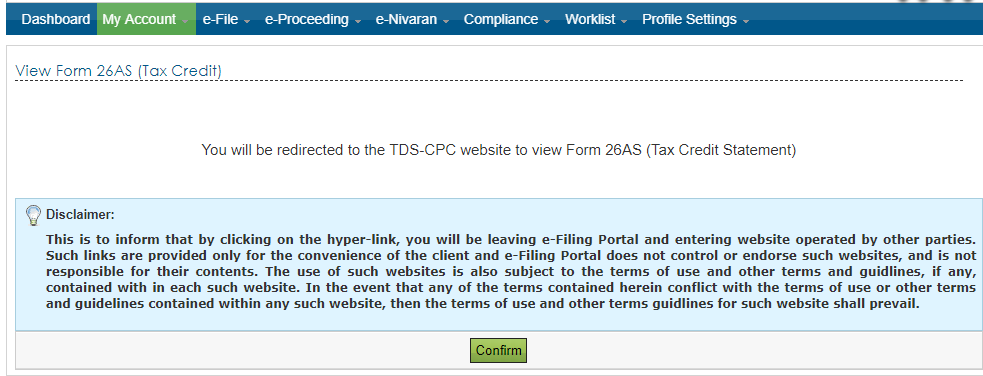

You will be re-directed to TDS-CPC tool where you can see your FOrm 26AS

You will need to enter Date of Birth verification & Confirm and then select the relevant Assessment year to check the relevant Form 26AS

Option 2 – Check Form 26AS via NetBanking of Authorised banks

You can check your Form 26AS, if you have internet banking at one of the 35 authorized banks. Y can check by logging into your net banking account – there will be an option called View 26AS or View Tax credit Statement. See the List of Authorized Banks.

You can check your Form 26AS without registration at efiling site.

Option 3 – View Form 26AS through TRACES Website

![]()

This facility is available to PANs that are registered with TRACES website for view of 26AS statement.

The PAN holder has to Register as new user (as taxpayer) and then fill in the required details from Step 1 to Step 4 during which an activation link and activation code will be sent to the registered e-mail ID and registered mobile number.

After successful registration and login, the taxpayer will be able to view his 26AS statement free of cost in three modes i.e. HTML, PDF and Text format. Link to TRACES portal.

While accessing TRACES website, you might get an error – Site is not available due to technical reason. If you are accessing this asite from outside India, you will get this error.

For NRI who want to check 26AS from outside India, they need to use this link below

TDSCPC services for NRIs is available through https://nriservices.tdscpc.gov.in/nriapp/login.xhtml . Kindly register and access TDSCPC NRI services through same.

Summary

You should check your Form 26AS at least before end of year as well as before filing Income Tax returns. It is convenient to check your Form 26AS either via Net Banking or Income Tax efiling website.

Common Errors (faced mainly by NRI) – Form 26AS site down

Some people gets following error when trying to check their Form 26AS – “ Site is not available due to technical reason.”

The reason is that this service is available within India only. So NRIs who are trying to check their Form 26AS from outside India are getting this error.

For NRI who want to check 26AS from outside India, they need to use this link below

TDSCPC services for NRIs is available through https://nriservices.tdscpc.gov.in/nriapp/login.xhtml . Kindly register and access TDSCPC NRI services through same.

Also Read – 13 things to know before filing Income Tax returns

Important Links – Must Read

Which ITR form to use for filing IT returns – FY 2017-2018 (AY 2018-2019)

How to File Income Tax return (ITR) online – Step by Step Guide for eFiling

How to quick e-file ITR1 & ITR 4S online for FREE – Step by Step Guide

[How to] get Electronic Verification Code (EVC) to e-Verify Income tax return for AY 2015-2016

[How to] View your Form 26AS online – Check Tax Credit Statement