You can file ITR 1 & ITR 4S online (without using the excel ITR file). In this post, I am providing step-by-step guide to file these returns on Income tax efiling website. As the due date for income tax is 31 July, you need to make sure that te returns are file on time. From April 2018, tax rules have changed and a penalty of upto Rs 10000 will be levied if the return is not filed on time. Also, the ITR revision time limit is also changed from 2 years to 1 year. See details

Filing returns on Income tax wesbite is completely free and easy.

Must Read – Step by Step Guide to file Income tax returns online

Things to note:

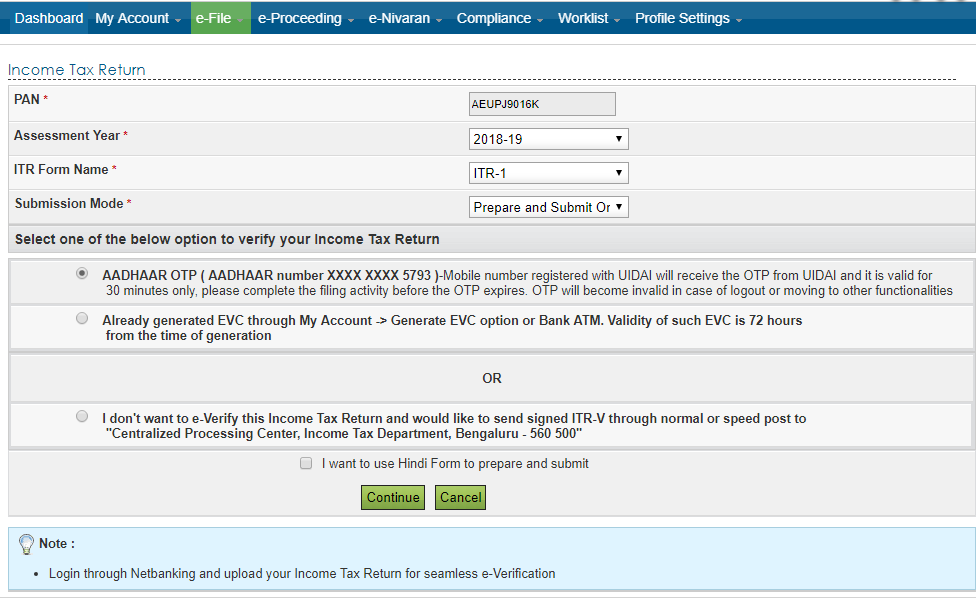

- Make sure that you choose right ITR form. ITR forms depends on what kind of Income you have. See my other post on Which ITR form to use?

- Check your Form 26AS to see the TDS deducted – See my other post on How to check your Form 26AS

Step by Step Guide

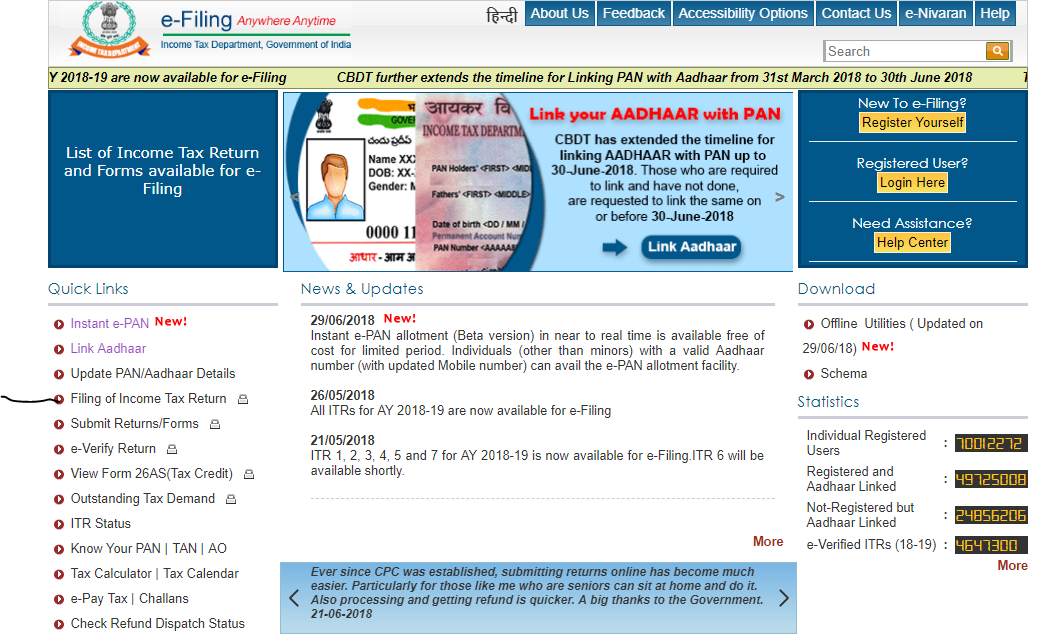

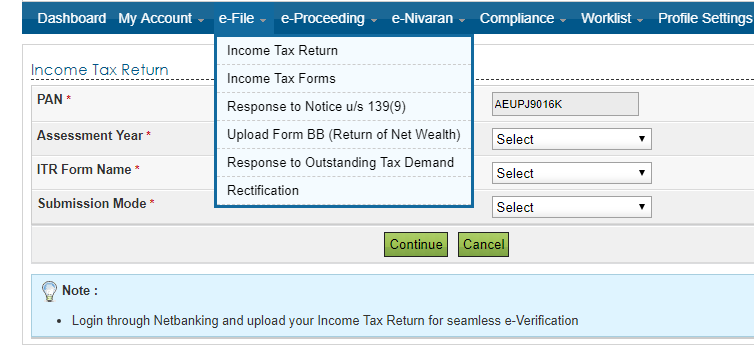

1) Go to Income Tax efiling website – https://incometaxindiaefiling.gov.in/

2) On left hand column, you can see the Button “Filing of Income Tax Return“

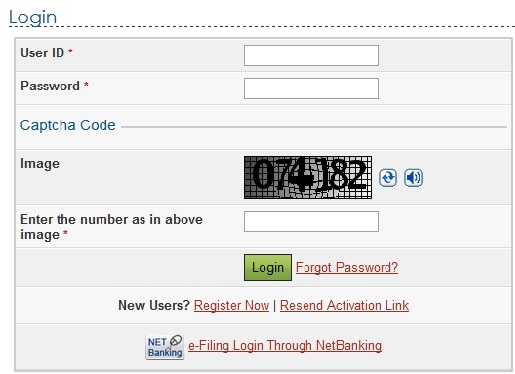

3) You will then get the Login Form – please enter your login details (enter PAN number in small letters)

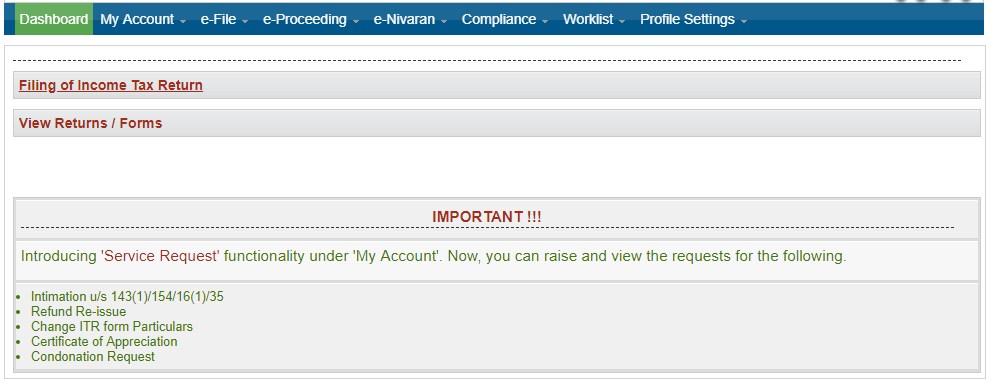

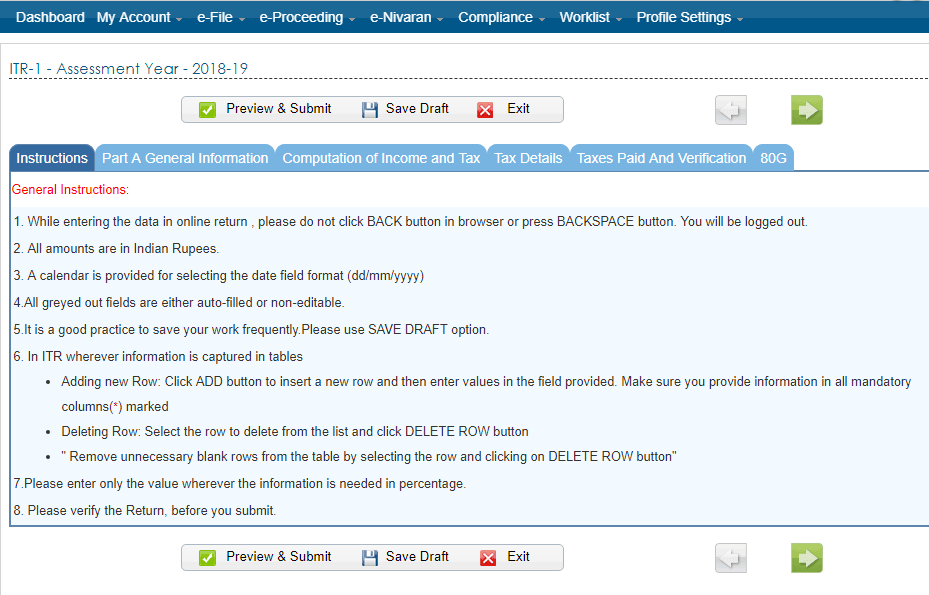

4) Once you are logged in, you will see the ITR form with various tabs (in this case, I have taken example of ITR 1)

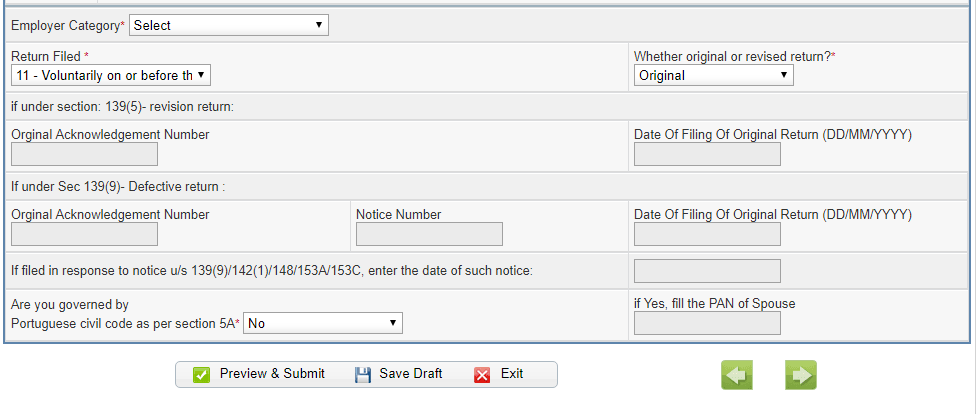

5) Click on “Personal Information” tab and enter the following

- Personal details

- filing status

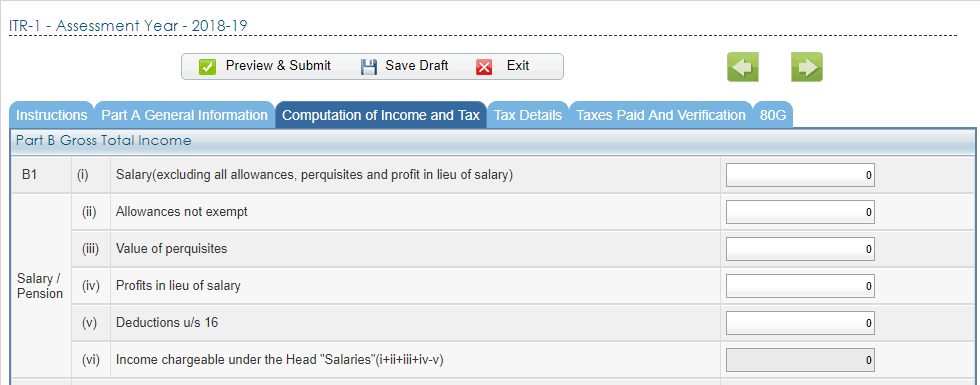

6) then Click on tab “Income Details” and enter your Income from Salaries, House property, Other Income etc

Also enter the amount of 80C dedcuction claimed.

- Salary income as per Form 16 to be entered in B1

- Other income like Interest to be entered in B3.

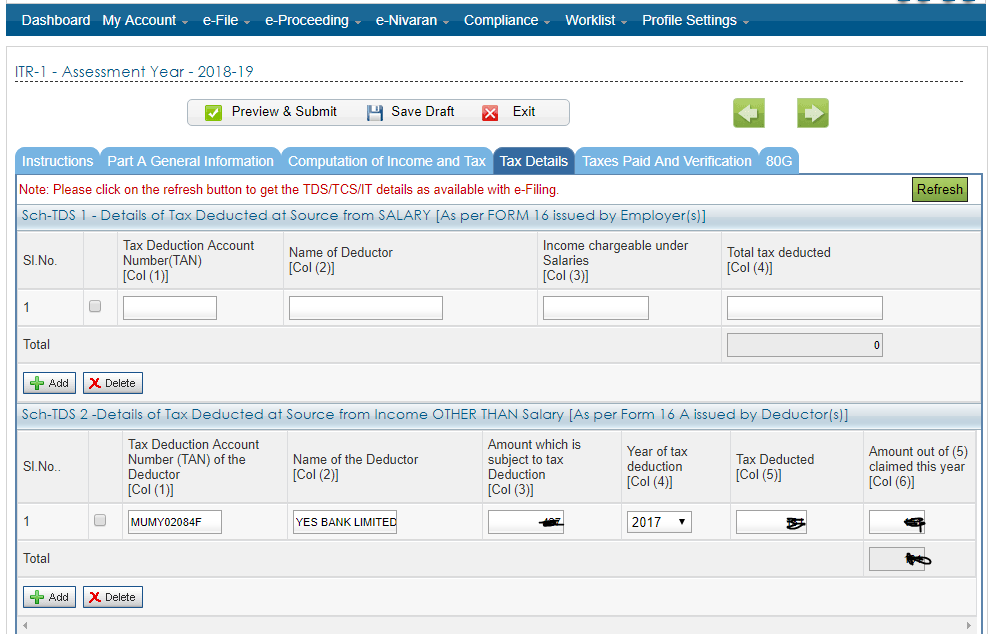

7) Click in “Tax Details” tab. In this tab you need to show the TDS deducted as well as Self assessment tax paid.

Normally, The TDs deducted by Banks are automatically shown here. If not, you need to enter the details from Form 16/16A etc. Or you can get the TDS detaisl from Form 26AS.

Note that any self assessment tax paid, need to be shown under SCH-IT section above.

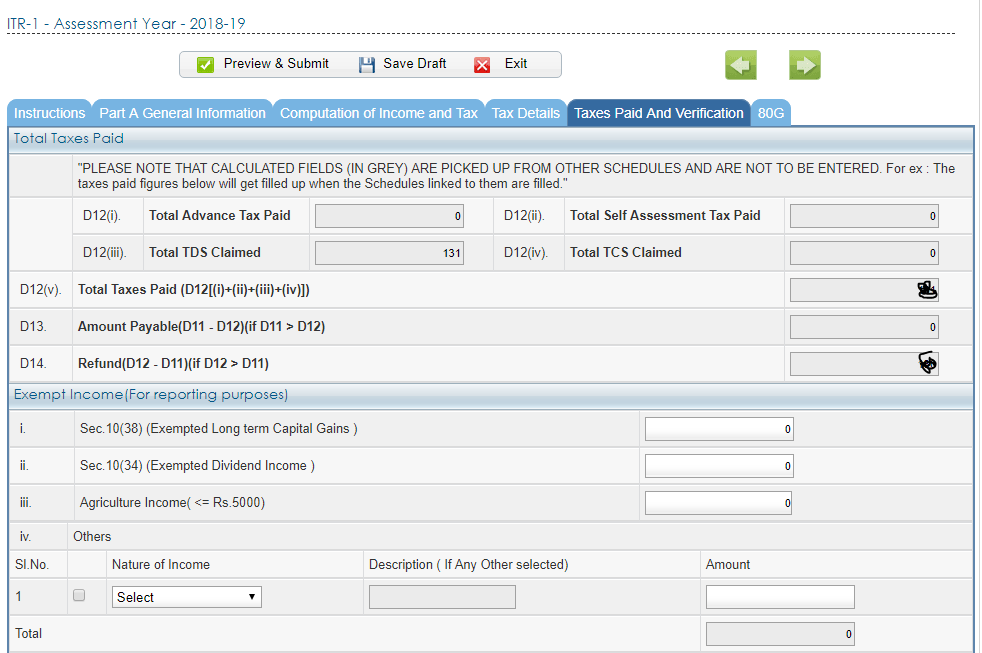

8) Click on “Taxes paid and Validation” Tab. In this section you will see the balance of tax to be paid / refund

If there is an amount in D17, which mean that you need to pay more tax. In that case, DONOT submit the return now.

- First pay that amount using the Self assessment challan – How to pay balance Income Tax online

- Then enter the self assessment tax in Tab – Tax Details (See screenshot in point 7 above)

- then D17 should show 0.

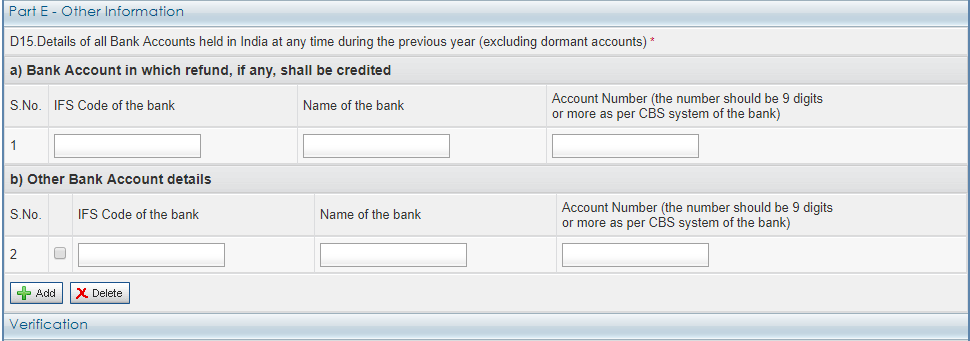

Enter Bank details in D15, (whether there is refund due or not) – This is new requirement in the form.

You need to proivide details of all your bank accounts.

9) Once you enter all these details, click on “Submit” to file the return.

10) You can now either e-verify the return (in that case, no need to send physical copy)- Read my other post on how to e-verify the ITR

Or you can send physical signed ITR V acknowledgement to CPC Bangalore.

——-

Important Links – Must Read

How to File Income Tax return (ITR) online – Step by Step Guide for eFiling

How to quick e-file ITR1 & ITR 4S online for FREE – Step by Step Guide

[How to] get Electronic Verification Code (EVC) to e-Verify Income tax return for AY 2015-2016

[How to] View your Form 26AS online – Check Tax Credit Statement