As you know the last date for filing income tax returns for AY 2015-2016 (FY 2014-2015) is 31st Aug 2015.

For many Individual salaried taxpayers, the TDS is deducted by employer. Bank also deduct TDS on interest payment.You can check how much TDS is deducted by them by checking your Form 26AS online.

However, at the time of filing IT returns, when you add all your incomes and you may realise that there is a tax due which needs to be paid. In that case, you should NOT submit the return before filing the tax.

If there is any tax due showing, then pay the tax first , then enter the tax paid details in ITR, and then submit the ITR. Ideally when you finally submit your ITR, your TAX should either be “ZERO” or there is a refund.

Important Posts

How to file Income Tax Return online

[How to] View your Form 26AS online – Check Tax Credit Statement

See the steps below regarding how to pay any balance tax online (without visiting to bank branch):

1) Visit the NSDL Tax payment website

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

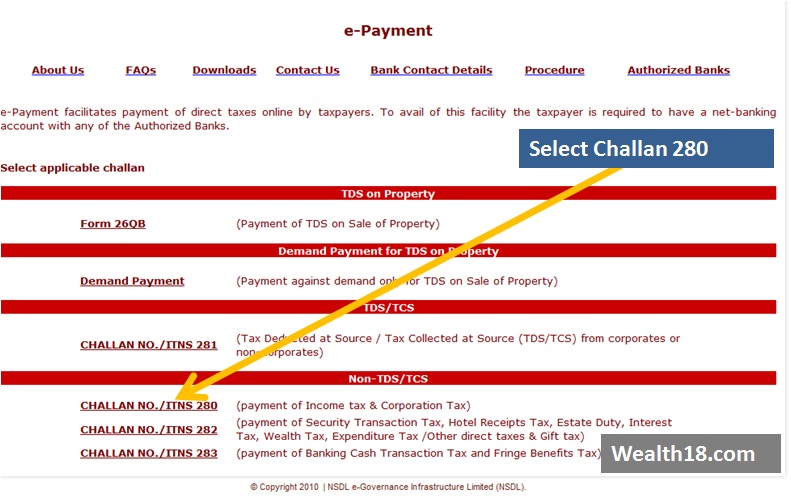

2) To pay taxes online the taxpayer will select the relevant challan i.e. ITNS 280, ITNS 281, ITNS 282 or ITNS 283, as applicable.

For payment of Income tax for Individuals – you need to select Challan 280

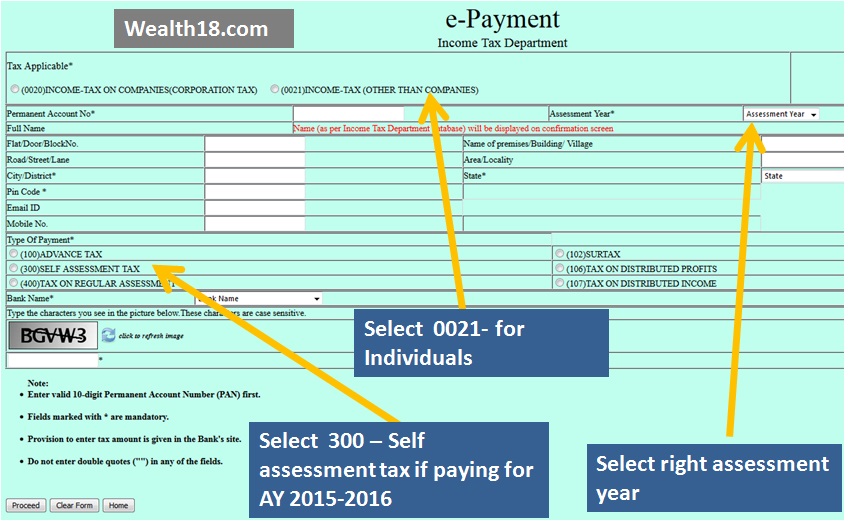

3) Enter PAN details and select appropriate assessment year.

4) Select Type of Payment as “Self assessment tax” if you are paying the balance tax payment for AY 2015-2016

5) When you submit the data, you will get a confirmation screen which shows the entered data for confirmation. It will be directed to the net-banking site of the bank.

6) The taxpayer will login to the net-banking site with the user id/ password provided by the bank for net-banking purpose and

enter payment details at the bank site.

7) On successful payment a challan counterfoil will be displayed containing CIN, payment details and bank name through which e-payment has been made. This counterfoil is proof of payment being made.

8) You need to enter these details in your income tax return in “Taxed Paid” section.

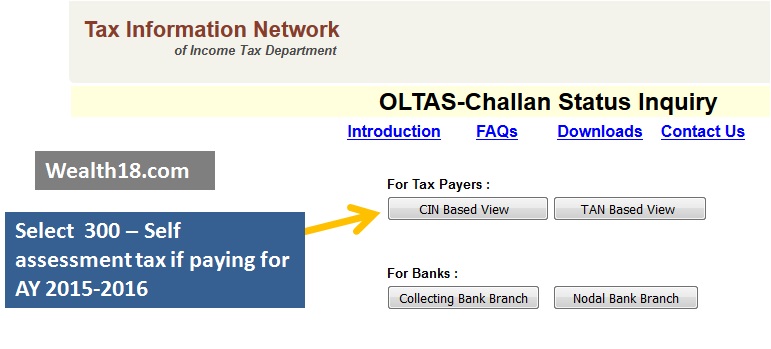

9) You can also check if your payment has reached the Income Tax Department at https://tin.tin.nsdl.com/oltas/servlet/QueryTaxpayer

Paying taxes at Bank branches

You can also pay tax by visiting the authorised bank branches. See the link below to check your nearest branch.

https://www.tin-nsdl.com/oltas/oltas-bank-branches.php

Important Links – Must Read

How to File Income Tax return (ITR) online – Step by Step Guide for eFiling

How to quick e-file ITR1 & ITR 4S online for FREE – Step by Step Guide

[How to] get Electronic Verification Code (EVC) to e-Verify Income tax return for AY 2015-2016

[How to] View your Form 26AS online – Check Tax Credit Statement