Have you ever wondered how you could invest in Global companies like Facebook, Amazon, Google? You don’t have to open foreign bank accounts or foreign brokerage account. You can invest in these companies via the International Funds provided by Indian Mutual Fund Companies.

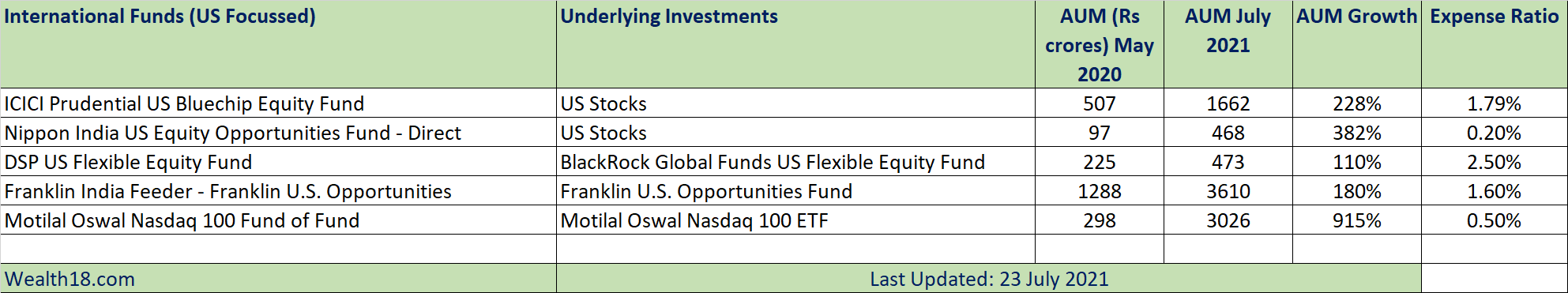

Indian Mutual Fund houses offer “International Funds” through which they either invest directly in US Markets / Stocks or they Invest in their Global Funds that invests in International Markets. Ultimately through these funds, you can take exposure in global well known US companies. In the post below, I am sharing top funds, their performance and portfolio companies.

The performance of these funds over past few years has been very good as compared to India focussed funds. Also, the returns have been less volatile. So you should definitely consider these funds for your portfolio. The investment in such funds involves additional risk as compared to domestic Equity funds as they also carry Currency Risk. However, sophisticated investors can consider investing through these funds as part of global diversification.

These funds also give you opportunities to invest in Global Companies like Amazon, Facebook, Google Apple etc. Some of the best performing International Funds (US) are:

-

-

- ICICI Prudential US Bluechip Equity Fund

- Nippon India US Equity Opportunities Fund

- DSP US Flexible Equity Fund

- Franklin India Feeder – Franklin U.S. Opportunities

- Motilal Oswal Nasdaq 100 Fund of Fund

-

As you can see from above AUM growth, investors are putting lot more money in US markets and getting diverse exposure.

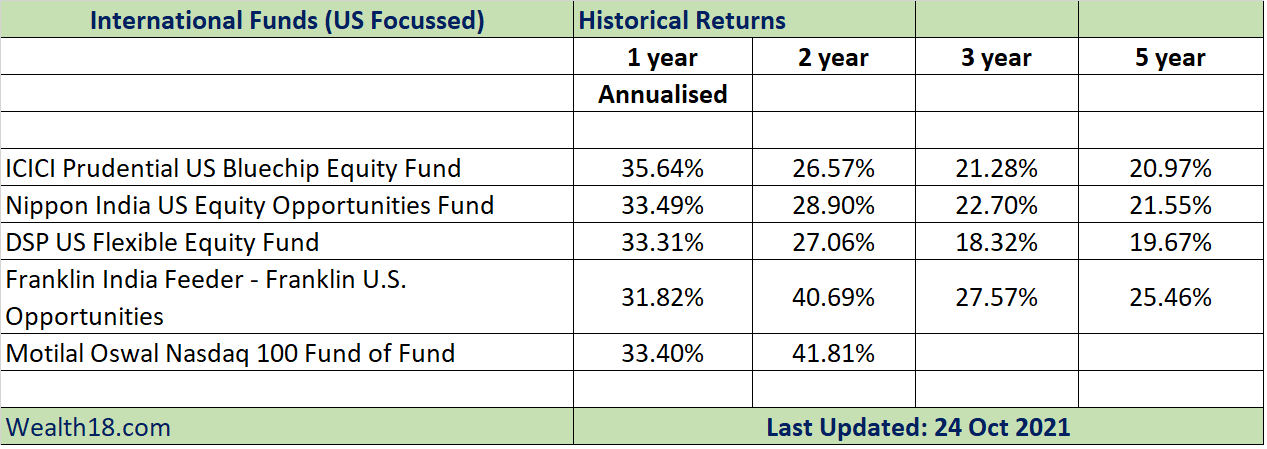

Best Performing International Equity Funds (US Focused)

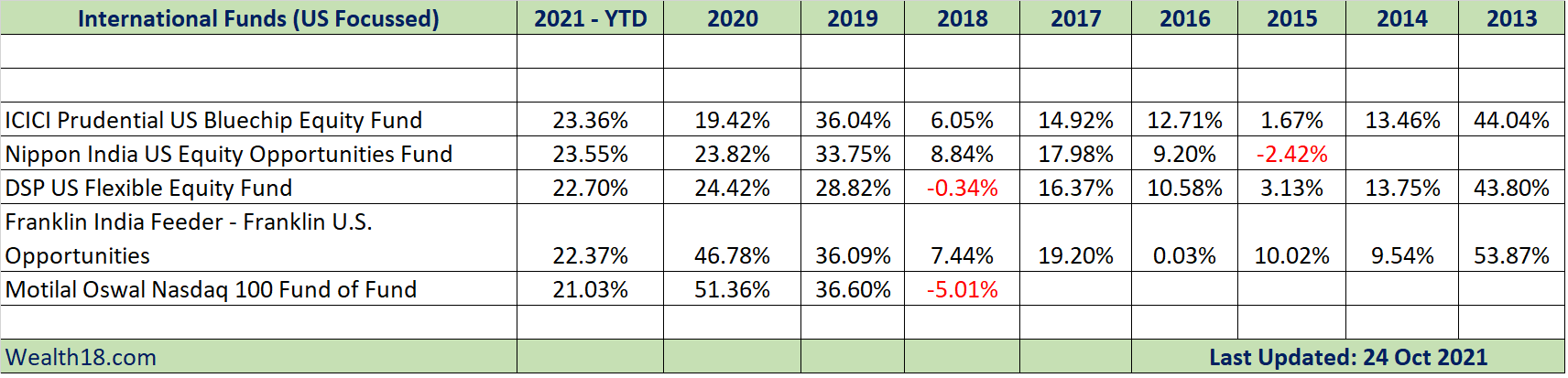

Please see below the year-on-year return for the US focused International Funds. It is good for geographical hedge and hedge against currency risk. Also, if you see below the funds have given positive returns in most of the years.

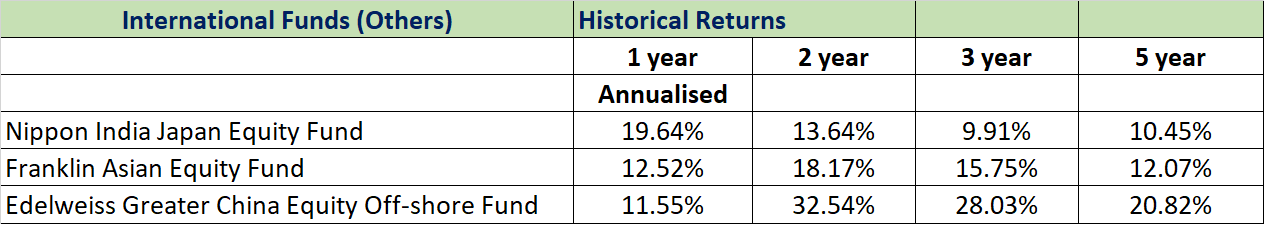

Other International Funds

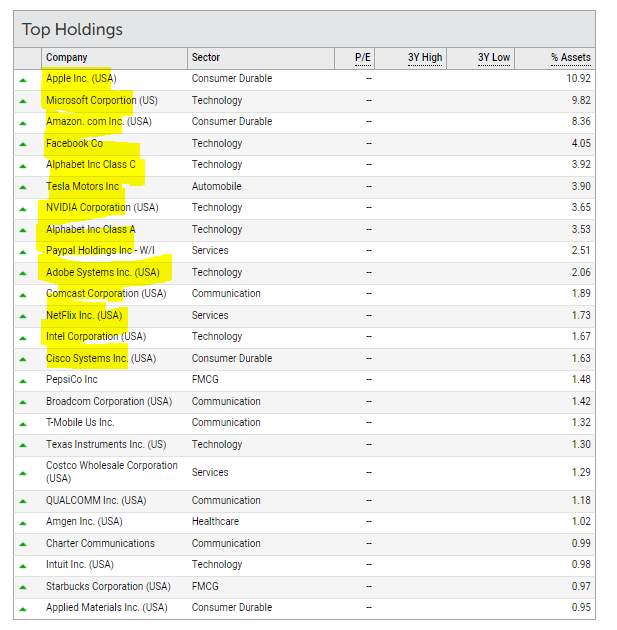

Investments under these funds

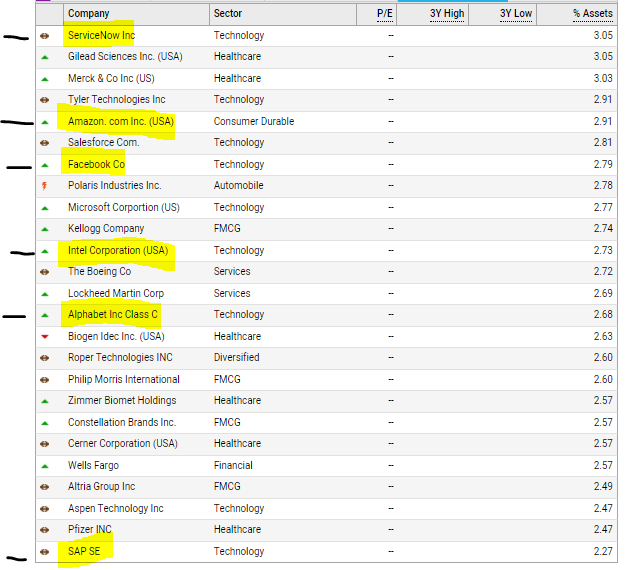

Top Holdings under ICICI Prudential US Bluechip Equity Fund

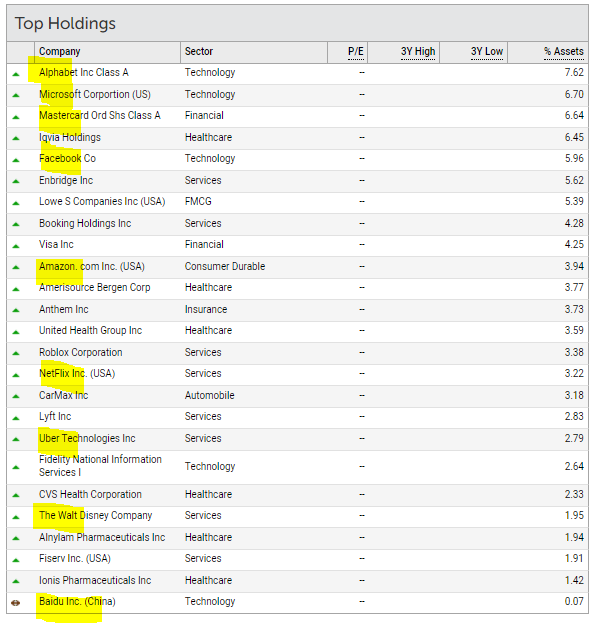

Top Holdings under Nippon India US Equity Opportunities Fund – Direct

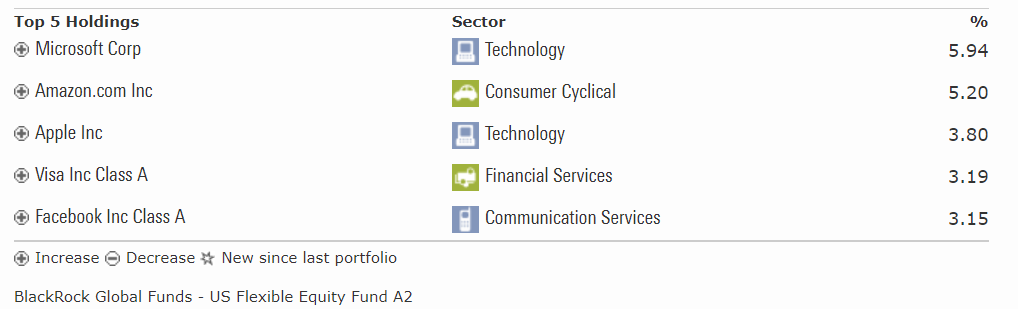

Top Holdings under BlackRock Global Funds US Flexible Equity Fund

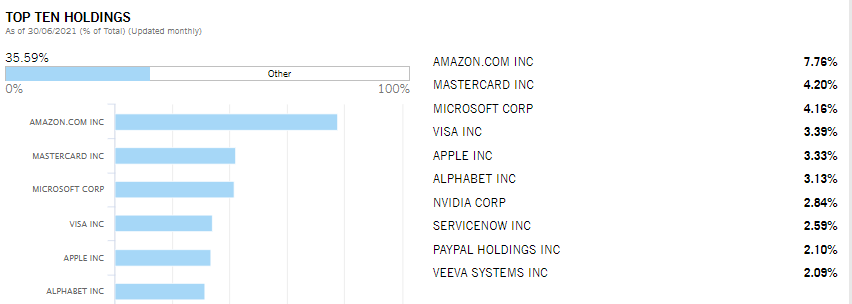

Top Holdings under Franklin U.S. Opportunities Fund

Top Holdings under Motilal Oswal Nasdaq 100 ETF

So, if you are looking to invest in Global Companies, you should consider investing in US Focussed International Equity Funds.

Summary

- As the International Funds carry additional risks, you should only consider if you have a large investible surplus. You should consider allocating 5-15% of your portfolio for diversification.

- Looking at the cumulative performance and year-on-year performance, it make sense to consider this as part of overall portfolio.

- These funds will help with geographical hedge and hedge against currency risk.

Please see my other posts on

- Best Performing Equity funds – Large Cap, Midcap, Small Cap, Multicap

- Best Performing ELSS funds (Tax Savings Funds)

- Best Performing International Funds – Invest in Google, Facebook, Amazon, Apple

- Best Performing Sector Funds -Pharma, Banking, Technology, Consumer

- Best Performing Arbitrage funds ( almost risk free and can be used as alternative to Fixed Deposits)

Please comment below if you have any queries related to sector funds. Have you invested in such funds?