Bank Fixed deposit is an all-time favourite investment in India as it provides a decent fixed return for the fixed period and relatively safer as compared to other forms of investment products.

Specially, in current interest rate scenario, the fixed deposit rates are quite lucrative (8.5 – 10%). However, it is likely that rates will go down further, so it is advisable to lock-in your interest rates if you want to invest in FD for longer term.

Banks are required to deduct Tax (TDS) @ 10 % if the interest earned on FD exceeds Rs 10,000 in a financial year. This could have a significant impact on the amount received at maturity.

I am sure that everyone wants to save tax and to avoid any deduction from their hard earned money. Most common queries, I received from friends are:

- My Bank is deducting TDS on FD, can’t I avoid it?

- Do I really need to pay tax on Bank FD Interest?

- My total income in under taxable limit, how should I get the refund back?

Let me try to explain answer to above queries in addition to few ways to avoid TDS on Interest on fixed deposits.

1. Interest earned on Bank FD is Taxable

First of all, you should know that any interest earned on bank FD is taxable & should be included in your taxable income.

Even if the TDS has not been deducted by bank, you need to include the income from fixed deposits in your tax returns and pay the tax as per your tax slab.

If the TDS has been deducted by bank @ 10 %, you still need to include the income from fixed deposits in your tax returns and claim the TDS amount in appropriate column. For e.g if you are already in 30% tax slab, any interest earned on FD will also be attract 30% tax (even if tax is deducted by banks @10%).

2. Tax Deducted by Banks (TDS)

Banks are required to deduct TDS at 10%, if the total interest earned on your fixed deposits in a bank branch exceeds Rs 10,000 in a financial year.

Make sure than your PAN is updated with the Bank otherwise TDS will be deducted @ 20%.

TDS is also applicable on the interest accrued. At the end of fiscal year (31-Mar), tax is deducted on the interest accrued on the fixed deposit(s), even if this interest has not been paid / credited. Check your 26AS to ensure that tax is deducted and paid by bank before you file your return.

Read my post- How to check Form 26AS

3. So, is there any way to avoid TDS?

Yes. An investor can save TDS by following ways:

a. By submitting Form 15G/15H

If the investor’s estimated total income is below exemption limit, he can submit Form 15G, then the bank would not deduct any TDS from the interest earned. For senior citizens, the requisite form is 15H to avoid TDS.

You need to fill this form at the beginning of each financial year providing details of fixed deposits and submit to your bank.

Read my post – Who can submit Form 15G / Form 15H to avoid TDS on Bank FD Interest.

b. By splitting FD across Banks & branches

Another easy way adopted by many investors to avoid TDS, is to split their FD across banks so that the interest earned does not exceed the Rs 10,000 limits.

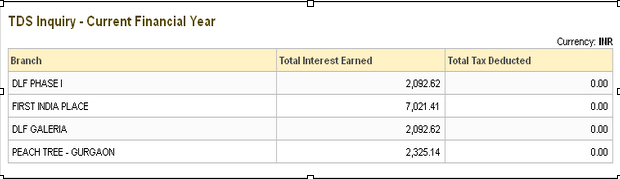

You can also spread FD across various branches so that the interest earned in a particular branch is below Rs 10,000 in a financial year.

Update Budget 2015 – As per new tax rules, TDS will be deducted in respect of FD with ALL the branches taken together in case the bank has core banking solution. Read More at my post here.

However, please note that this will just avoid TDS. You will still need to include this while filing your income tax returns for the year. So, if your income is taxable, then you will need to pay taxes according to your income tax slab.

Suppose you want to invest Rs 1.5 lacs in FD giving 10% interest. If you open FD in one bank / branch, the interest earned per annum will be Rs 15000 and TDS will be deducted. However, you split your investment across 2 banks – Rs 75000 each, then the interest earned on each FD will be Rs 7500 only which will be below TDS limit and no TDS will be deducted by Banks.

See in the screenshot above, just by booking FD in different branches, the TDS is not deducted even total interest in more than 10000 (but less than 10000 per branch). Update Budget 2015 – As per new tax rules, TDS will be deducted in respect of FD with ALL the branches taken together in case the bank has core banking solution. Read More at my post here.

c. by Timing the FD

You can also avoid TDS by timing your FD so that the interest earned in one financial year does not exceed Rs 10000.

Suppose you want to invest Rs 1.5 lacs in FD giving 10% interest. If you start this FD for 1 year on 01-April-2013, then the interest earned in one financial year (April 13 – March 14) will be Rs 15000 and TDS will be deducted.

However, if you open this FD in Oct 13, then the interest will be split in 2 financial years (Oct13-Mar14 & Apr14-Sep15) and no TDS will be deducted.

4. How to get TDS refund.

If your bank has deducted tax on the interest earned and your tax liability is NIL , then you can claim refund by filing your income tax return. Check your form 26AS to ensure that tax is deducted and paid by bank before you file your return.