Ujjivan Financial Services is a microfinance company with small finance bank license, and is ready to hit the market with its initial public offering (IPO) on 28th April 2016.

Issue Details

- IPO Open : 28th April 2016 to 2nd May 2016

- Issue Price band: Rs 207 – 210 per share

- Issue Size – Rs 875 – 882 crore

- Market lot : 70 shares and in multiples of 70 shares

Background:

Ujjivan Financial Services, which will become the second micro-lender to go public, has already received in-principle approval to set up a small finance bank.

- Ujjivan is fourth largest among the country’s micro finance institutions (MFIs) in terms of assets under management (AUM). Its market share was 7% as on March 2015, Equitas being close at 5%, shows data from CRISIL Research. It commenced its operation in 2005 as NBFC.

- As on December 31, 2015, its gross AUM was Rs 4,600 crore spread across 470 branches, serving 2.77 million clients. Founder Samit Ghosh is close to retirement and the company is strengthening its second line of leaders.

- The MFI has over 2.77 million active customers through 470 branches and 7,862 employees in 24 states and 209 districts through the country, making the company the largest MFI in terms of geographical spread. Of its 469 branches, 27 per cent are in east India, 19 per cent in North India and 10 per cent in Central India. The company has 38 per cent semi-urban base, 34 per cent urban and 28 per cent rural base.

Promoters holdings:

The public issue of Ujjivan Financial Services, comprises fresh issuance of shares worth Rs 358.16 crore and an offer for sale of up to 24,968,332 shares by the existing shareholders. Three foreign investors – Mauritius Unitus Corporation (2.49 per cent), WCP Holdings III (3.06 per cent) and Women’s World Banking Capital Partners (5.34 per cent) – will be completely exiting the company through the IPO.

“Out of the Rs 885-crore IPO, the company will garner Rs 358 crore in fresh capital and the balance is a secondary transaction through an OFS by the existing foreign shareholders who will be exiting their investment.

Objective of the issue: The proceeds from issue of new shares will be used to augment the capital base. Among the key reasons for their IPOs is to reduce foreign shareholding to the Reserve Bank’s mandate of not exceeding 49 per cent for an SFB. This means that as with Equitas, foreign investors will not be participating in Ujjivan’s IPO.

Financials:

- Financials From FY11 to FY15, income has grown at 40% CAGR and net profit at 60%. Its income and net profit for the first nine months of FY16 were Rs 729.6 crore and Rs 122.3 crore. Its net interest margins have been in the range of 11.3% and 13.8% over the past few years and return on assets in the range of 2.5- 3.6%.

- During 2011 and 2015, Ujjivan has been able to clock 35 per cent CAGR in net interest income (NII) and the NIM (net interest margins) came down from 17 per cent in 2011 to more stable levels of 12-13 per cent off late. The management has shown operational improvement with a decline in operational costs as a percentage of AUM from 17.5 per cent in 2011 to 8.5 per cent in FY15. This resulted in strong PAT growth from Rs 12 crore in 2011 to Rs 76 crore in 2015.

- Its ROE has increased to 19.1% in the first nine months of FY16. The debt to equity in the period was 4.3% and its gross NPA was 0.15% which is very low. The NIMs and return ratios may be under pressure once Ujjivan commissions its small bank business. They may remain under pressure for the next 3 years, but the

Industry growth:

Ujjivan has a market share of 11.2%. The microfinance industry is likely to grow at 30% from FY15 to FY18, and given Ujjivan’s strong presence, its microfinance business will continue to grow at a fast pace. Its assets under management have grown at 51% CAGR from FY11 to FY15.

Anchor Investors: The company raised Rs 144 crore by allotting 3.22 million shares to anchor investors that included DSP Blackrock, HDFC MF and Birla Sunlife MF. The shares were allotted at Rs 446 apiece.

Risks:

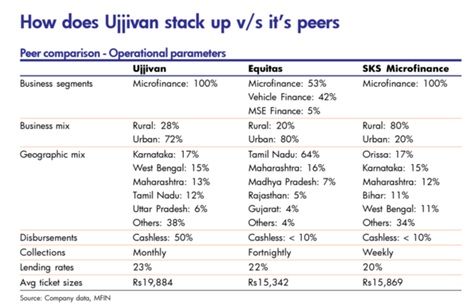

- Brokerages pointed out that Karnataka, West Bengal, Maharashtra and Tamil Nadu contribute over half of the company’s total AUM.

- Post conversion into small bank the company will have to comply with CRR, SLR and higher priority sector lending requirements, which may negatively impact its operating performance in the next 18-24 months, according to Reliance Securities. Further, key to the successful transition will be the build up of CASA base, which will be challenging for any new entrant.

Valuation as compared to its peers:

The IPO is attractively priced at 1.66 times, post IPO price-to-book. Equitas had priced its IPO at 1.8 times and witnessed strong listing gains of over 30%.

At the upper end of the price band at Rs 210, the issue is priced at P/B of 1.6 times post issue BV and appears to be attractive compared with listed players such as Equitas Holdings (2.44 times), SKS Microfinance (6.2 times 9MFY16) and Cholamandalam Investment and Finance (3.17 times 9MFY16).

Should you invest:

- Angel Broking – Subscribe

- Antique Stock Broking – Subscribe

- GEPL Capital – Subscribe

- ICICIDIrect – Not rated

- Choice Broking – Subscribe

- Prabhudas Lilladher – Subscribe

- Aditya Birla Money Equity Research – Subscribe

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.