Allotment Status & Date : Quess Corp IPO allotment is done now today 8th July & listing is expected on 9th July 2016.

Allotment for Quess Corp IPO can be checked on its Registrar’s website Link InTime – https://eipo.linkintime.co.in/PublicIssues/default.aspx

https://eipo.linkintime.co.in/ipo/

As the retail portion is oversubscribed 32 times, they will get very limited shares. I have checked with two of my friends. they applied for minimum lot and have not got any allotment. So don’t be very hopeful of getting allotment.

Also Read: L&T Infotech IPO opening on July 11. See Details & Review.

01-July-2016 (Day 3) – Quess Corp IPO Oversubscribed 147 times on Day 3 closing date.

- Qualified institutional buyers (QIBs) is oversubscribed 2.8 times and

- Retail investors’ portion is oversubscribed 32 times.

- Non-institutional investors portion is not yet fully subscribed at is currently at 32 % subscription.

30-June-2016 (Day 2) – Quess Corp IPO Oversubscribed 3.4 times on Day 2

- Qualified institutional buyers (QIBs) is oversubscribed 2.8 times and

- Retail investors’ portion is oversubscribed 9.81 times.

- Non-institutional investors portion is not yet fully subscribed at is currently at 32 % subscription.

If you intend to apply in retail category, you may consider applying for just 1 lot as chances are the investors will get just 1 lot (on lottery basis)

You may consider applying in HNI category( above Rs 2 lakh) as it is not yet fully subscribed.

———–

Quess Corp (Promoted by Thomas Cook) is the largest IT staff augmentation provider in India based on number of employees, and is ready to hit the market with its initial public offering (IPO). The company was formerly known as IKYA Human Capital Solutions Limited. The IPO is open from June 29 to July 1 2016.

Issue Details of Quess Corp:

- IPO Open : June 29 – July 1 2016

- Issue Price band: Rs 310-317 per share

- Issue Size: Rs 400 crore

- Market lot : 45 shares

Quess Corp IPO Issue Allocation

- Qualified institutional buyers (QIBs) – 75% of the total issue size.

- Non-institutional investors (NIIs) – 15% of the issue size.

- The retail quota limit in the issue = 10% of the issue size.

Background:

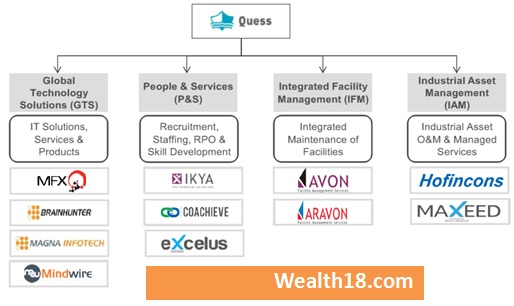

Quess Corp Limited is one of India’s leading integrated business services providers focused on emerging as the preferred partner for handling end-to-end business functions of its clients. It offers comprehensive solutions including recruitment, temporary staffing, technology staffing, IT products and solutions, skill development, payroll, compliance management, integrated facility management and industrial asset management services. Its service and product offerings include four broad operational segments: Global Technology Solutions(“GTS”), People and Services (“P&S”), Integrated Facility Management (“IFM”) and Industrial Asset Management (“IAM”), which are offered under various brands as indicated below:

Headquartered in Bengaluru, Quess Corp has a pan-India presence with 43 offices across 24 cities, as well as operations in North America, the Middle East and South East Asia. As of November 30, 2015, it employed more than 118,000 employees and over 115,000 Associate Employees, i.e. employees placed with our clients.

On October 14, 2015, Quess Corp has entered into an agreement to acquire the entire shareholding in Randstad Lanka, a company that offers staffing and human resource solutions in Sri Lanka, to further expand its operations in a new geography. Later in 2015 Quess Corp also acquired the entire beneficial interest in the profits and net assets of Styracorp and IME Consultancy from MS Vishwanathan, who had acquired these two entities from its individual promoter, Ajit Isaac. In February 2016, it also entered into an agreement with CPI Engineering Services SDN BHD to set up a joint venture entity in Malaysia to expand its IAM business. It proposes to have a 49.0% shareholding in such entity. The joint venture agreement contemplates certain exclusivity arrangements with respect to the IAM business in Malaysia.

Quess Corp Limited has also increased its shareholding in MFX from 49.00% to 100.00% with effect from January 1, 2016.

On December 22, 2015, Quess Corp Limited issued 2,560,000 Equity Shares pursuant to a rights issue in the ratio of 0.099 Equity Shares for every one Equity Share and on January 5, 2016, it issued 85,001,292 Equity Shares through a bonus issue in the ratio of three Equity Shares for every one Equity Share.

The company is the industry leaders in each of key business services:

- The largest IT staff augmentation provider in India based on number of employees (Source: F&S Report 2016);

- The third largest general staffing company in India based on number of employees (Source: F&S Report 2016);

- Among the leading industrial asset management service providers in India (Source: F&S Report 2016);

- Among the largest integrated facility management service providers in India (Source: F&S Report 2016); and

- Among the largest training and skill development partner for the Ministry of Rural Development based on approved project cost (Source: F&S Report 2016).

Promoters holdings:

| Current Shareholding | |

| Thomas Cook (India) – TCIL | 69.50% |

| Ajit Isac | 16.40% |

| Net Resources | 13.56% |

| Others | 0.54% |

| Total | 100% |

Currently Thomas Cook holds around 70 % equity stake in Quess. Post issue, its shareholding will be reduced to 62.7-62.8 percent. Thomas Cook acquired 74% stake in the HR solutions provider for Rs 256 crore in February 2013 when the company was valued at Rs 346 crore.

Objective of the issue:

The objects of the Issue are:

- Repayment of debt availed;

- Funding capital expenditure requirements of Quess Corp Limited and its subsidiary, MFX US;

- Funding incremental working capital requirement;

- Acquisitions and other strategic initiatives; and

- General corporate purposes

Industry growth:

The global staffing market was estimated at `20,530.00 billion in 2012. India accounted for 2.1% of the global market in 2012. India is among the least penetrated flexi staffing markets in the world.

In India, there are 1.3 million (13 lakh) temporary workers presently in the organized sector and demand for temporary workers is estimated to swell to 9.0 million (90 lakh) in the next 10 years. Growth of temporary staffing segment will be spurred by growth in retail, telecom, BFSI, healthcare and BPO industries. By 2050, India is expected to have a working age population of 1,098 million and would account for 19%of the world’s working age population. With increasing competition, margin pressures and shortage of skilled manpower, more temporary jobs are expected to be created. The need to build in workforce flexibility as part of the business model and ready availability of a large employable workforce are expected to be key drivers for the temporary staffing market in India.

Financials:

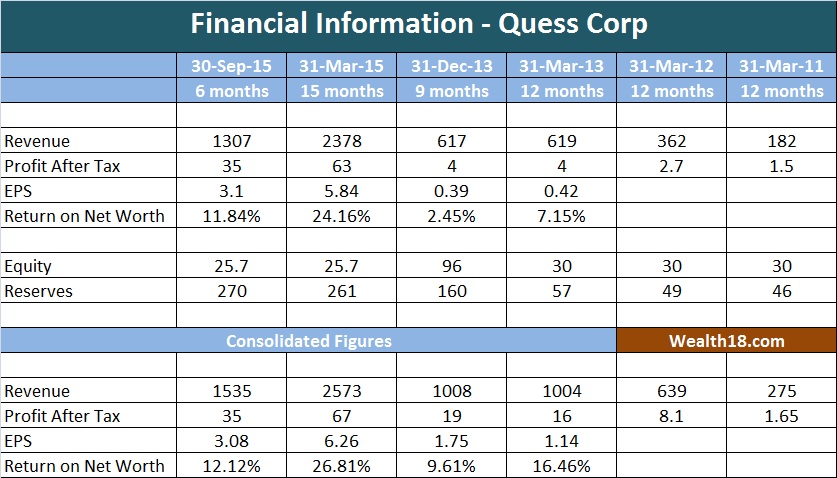

- The company has weighted average EPS of 6.37 (standalone) and 7 (consolidated).

- At the upper band of Rs 317, the PE Ratio will be 49.76 (standalone) & 45.28 (Consolidated)

- Weighted average Return on Networth is 21.57% & 24.13% (Consolidated)

| Quess | TeamLease | |

| Revenue (in crores) | 3442 | 2510 |

| EPS | 7.82 | 15.92 |

| RoNW | 25.62% | 7.96% |

| NAV | 30.52 | 182.24 |

| Upper Price Band | 317 | |

| Current Market price | 920 | |

| P/E Ratio | 40.54 | 57.79 |

Team Lease IPO was in Feb 2016 with price of Rs 850. The Issue was oversubscribed 66 times, with retail portion oversubscribed 10 times.

Anchor Investors: The company on Tuesday raised Rs 180 crore from 15 anchor investors @ Rs 317 per share. Anchor investors are – Kuwait Investment Authority, Fidelity Investments, ICICI Prudential MF, HDFC MF, Nomura, Harvard Management Co, DSP BlackRock, Wasatch, Pictet and Grandeur Peak were among the anchor investors.

Risks:

- Acquisitions may not yield intended benefits which could negatively affect its financial performance

- Company is running on PAT of around 2% from the last 5 years. PAT in FY 2011 was just 1% which is now increased to 2.50% in FY 2016.

Valuation as compared to its peers:

The closest listed peer of Quess is Teamlease services. Based on the data analysis above, the Quess IPO seems to be priced attractively with P/E of 40 as compared to Team Lease P/E of 57.

Should you invest: Attractively priced as compared to its listed peer.

| Hem Securities | Subscribe |

| Ajcon Global | Subscribe |

| SPA Research | Subscribe |

| Motilal Oswal | Subscribe |

| GEPL Capital | Subscribe |

| Angel Broking | Subscribe |

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.