Check Allotment Status for L&T Infotech IPO

You can check the allotment status for L&T Infotech IPO at the registrar website (LinkIntime) below. As per the site, the allotment can be checked after 9 pm on 19th July .

https://www.linkintime.co.in/PublicIssues/

Update 13th July – Day 3 – L&T IPO is oversubscribed 11.67 times on its last day.

- QIB – 19.90 times oversubscribed

- HNI – 10.75 times oversubscribed

- Retail: 7.3 times oversubscribed

L&T Infotech has attracted 10.58 lakh applications, the largest number of applications in IPOs since 2011.

Grey Market Premium (GMP) for L&T Infotech is going @ Rs 75-77 (estimated).

Expected Listing Price is Rs 770 – 800

Update 11th July – Day 1 – L&T IPO is oversubscribed 1.23 times on Monday.

Larsen & Toubro Infotech (L&T Infotech), the subsidiary of engineering and construction major L&T, has announced its IPO which will open on July 11. They are also offering Rs 10 discount to retail investors on issue price.

Issue Details of L&T Infotech IPO:

- IPO Open : July 11 to July 13 2016

- Issue Price band: Rs 705 – 710 per share (Rs 10 discount to retail investors)

- Issue Size: Rs 1200 crore ( 17,50,000 Shares)

- Market lot : 18 shares

- Minimum Investment: Rs 12600 (Upper band – retail discount)

- Book Running Lead Managers : Citigroup Global Markets India Private Limited, Kotak Mahindra Capital Company and ICICI Securities.

- Registrar – Link Intime India

- Listing: BSE/NSE

[xyz-ihs snippet=”ad1″]

L&T Infotech IPO Issue Allocation

- Qualified institutional buyers (QIBs) – 50% of the total issue size.

- Non-institutional investors (NIIs) – 15% of the issue size.

- The retail quota limit in the issue = 35% of the issue size.

Other Recent IPOs:

- Quess Corp IPO is oversubsribed 144 times , See allotment status & dates. Link

- Mahanagar Gas limited (MGL) was oversubscribed 66 times, with retail portion oversubscribed 6 times. Link

Background:

L&T Infotech is one of the largest IT services company and subsidiary of L&T.

- Ranked 6th largest Indian IT services company in terms of export revenues.

- Amongst the top-20 IT service providers globally in 2015.

- 22 delivery centres and 44 sales offices globally (As of December 31, 2015)

- Works with 258 clients, including 49 Fortune 500 companies.

- Employee strength of 21,073. (approx, 52.5% are working onsite while 47.5% have offsite assignments)

L&T Infotech offers a suite of business solutions which includes technology consulting, enterprise solutions, systems integration, custom application development, application maintenance and production support, infrastructure management, independent testing and validation, Cloud ecosystem integration and among others. The company has been changing with times and is working closely with clients in developing capabilities in emerging technologies under digital solutions.

- Digital Solutions accounts for 11.2% of the revenue in the nine months ended period December 31, 2015.

- Application development, maintenance and outsourcing accounts for 41.9% of the company’s revenue,

- Enterprise solutions contribute 24.2%, testing at 10% and Infrastructure Management Services at 8.8%.

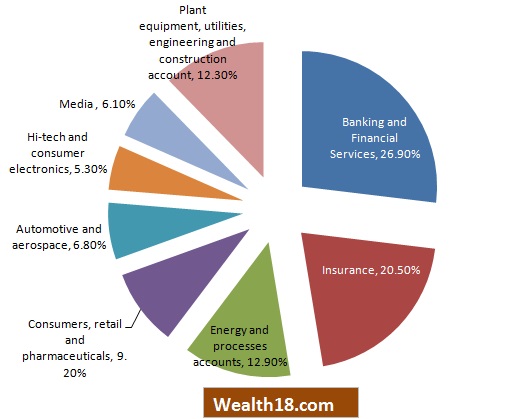

Revenue (segment wise)

Promoters holdings:

- 94.96% of the shareholding is owned by Larsen & Tubro (L&T)

Objective of the issue:

It is an offer for sale for 10.3% by promoter L&T. Hence, the company will not receive any proceeds from the offer. The listing of the equity shares will enhance the brand name and provide liquidity to the existing shareholders

Financials:

| (in INR crores | ||||||

| 2015-16 | 2014-15 | 2013-14 | 2012-13 | 2011-12 | ||

| Total Income | 6143 | 5069 | 4837 | 3873 | 3192 | |

| Growth | 21% | 5% | 25% | 21% | ||

| Net profit before extraordinary item as restated | 922 | 761 | 688 | 573 | 433 | |

| Growth | 21% | 11% | 20% | 32% | ||

| Net profit after tax as restated | 922 | 769 | 928 | 573 | 433 | |

| Growth | 20% | -17% | 62% | 32% |

In terms of geographies covered, L&T Infotech derives the largest chunk of its revenue from

- North America at 69.4%

- Europe at 17.2%.

- Asia Pacific accounts for 2.2%

- 6.2% : rest of the world.

Looking at their client contribution,

- 20 clients generated above $10 million in revenue,

- 8 clients generated above $20 million in revenue and

- 3 clients who generated above $50 million in revenue.

Though the company does not have any clients contributing $100 million in revenue its retention rates are impressive.

In 2015, around 97.9% of its business was generate from existing clients across various verticals. The company has been engaged with over 100 clients for more than three years and had been doing business with two of its largest clients for over ten years.

Top five clients account for 37.7% of the revenue, while its top client alone accounts for 15.5% of the revenue in 2015.

Anchor Investors: Will be available one day before the IPO opens

Risks:

- Like other IT companies, the business is dependent on key clients across the world

- Revenue concentration in one region ( North America)

- Largest client alone contributed 15% of firm’s revenue in FY16.

- Like other major IT players, L&T Infotech is exposed significantly to segments such as banking and financial services, insurance and energy. Some of these segments are not performing well of late

Valuation as compared to its peers:

| Basic EPS | Diluted EPS | Weight | |

| Mar 31 2015 | 47.21 | 45.17 | 3 |

| Mar 31 2014 | 42.7 | 40.86 | 2 |

| Mar 31 2013 | 35.58 | 34.04 | 1 |

| Weighted Average | 43.77 | 41.88 |

For the nine months period ended December 31, 2015 the Basic EPS was ₹ 42.44 and the Diluted EPS was ₹ 42.15 on a consolidated basis (not annualized).

Should you invest:

1) Revenues are growing @20% CAGR for last 5 years

2) Attractively prices as compared to peers. PE ratio is around 12.5 times while other peers have PE ratio between 20 to 13.7

| Reliance Securities | Subscribe |

| IIFL | Subscribe |

| Hem Securities | Subscribe |

| Ajcon Global | Subscribe |

| Angel Broking | Subscribe |

| GEPL Capital | Subscribe |

| Arihant Capital | Subscribe |

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.