28th Oct Update: IPO is oversubscribed 4.8 times on Day 1

PFSN E-Commerce Ventures Ltd, the parent company of online beauty e-commerce platform Nykaa, will launch its initial public offering (IPO) on Thursday, October 28, 2021.

| IPO Opens on | 28 Oct 2021 |

| IPO Closes on | 01 Nov 2021 |

| Issue Price band | Rs 1085 – Rs 1125 |

| Any Discount | NA |

| Issue Size | Rs 5375 crore |

| Minimum Investment | 12 shares lot (min amount 13500) |

| Max Investment (Retail) | 14 lots / 168 shares (amount Rs 189000) |

| Registrar | Link Intime |

| Book Running Lead Managers | ICICI Securities, JM Financial |

| Listing | BSE/NSE |

| Download | Red Herring Prospectus |

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

FSN E-Commerce Ventures (Nykaa) IPO Grey market Premium :

As per market observers, Nykaa IPO grey market premium (GMP) was at around Rs 610 – Rs 670

IPO Issue Allocation:

- QIB = Not More than 75% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 10% of the offer

Background:

- FSN E-Commerce Fashion or “Nykaa“ is a multi-brand beauty, personal care and fashion platform. Nykaa is founded and promoted by Falguni Nair, a former managing director at Kotak Mahindra Capital Company

- The company has a diverse portfolio of beauty, personal care and fashion products, including their own brand of products manufactured by them. Nykaa operates under 2 major business verticals namely Nykaa (beauty and personal care products) and Nykaa Fashion (apparel and accessories). It has offered approximately 3.1 million SKUs (stock-keeping units) from 4,078 national and international brands to its consumers across two business verticals.

- Incorporated in 2012, Nykaa is a digitally native consumer technology platform, delivering a content-led, life style retail experience to consumers. Leading specialty Beauty and Personal Care (BPC) platform in India: Nykaa is the largest Specialty BPC Platform in India and enjoys the highest Average Order Value (AOV) among its peers. It has the largest luxury BPC platform. It is one of the fastest growing fashion platforms in India based on GMV (Gross Merchandise Value) growth. Fashion started in 2018 and now contributes ~16% to GMV, up from 10% in FY20.

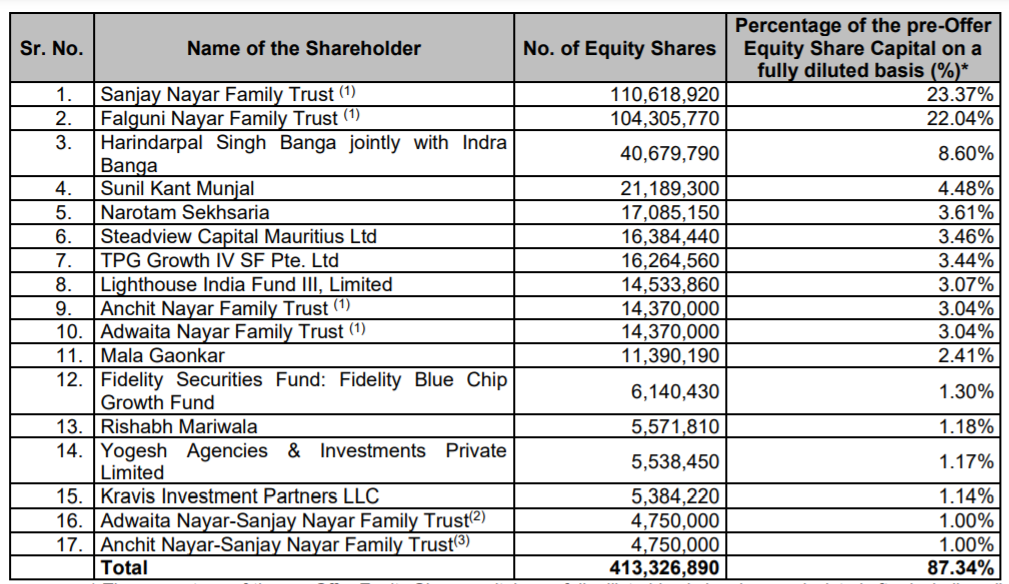

Top Shareholdings:

Objective of the issue:

Anchor Investors:

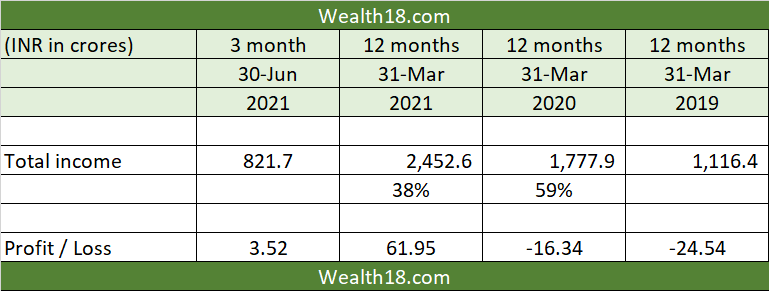

Financials:

- Nykaa can sustain a CAGR of ~35% in sales, 50% in EBIDTA over coming few years with double digit margins

- Although the brokerages expect lower margins in FY22 (lower ad spend in FY21), we expect steady margin expansion led by scale economies as it has already expanded margins from 1.8% to 6.6% over FY19-21 making it one of the few Ecom players to turn profitable

- IPO is at 12.6xEV/GMV on FY21 sales and ~4.7xEV/GMV on FY24 sales

Valuation as compared to its peers:

.The issue is valued at 16.1x FY22 EV/Sales on a post issue and annualized basis, which seems to be similar to other Indian unicorns.

Brokerage Recommendations:

| Brokerage | Recommendations |

| Prabhudas Liladhar | Subscribe |

| Motilal Oswal | Subscribe |

| KR Choksey | Subscribe |

| Subscribe |

Should you invest:

Nykaa has strong technology led platform, strong relationship with global brands, diverse portfolio of own brands. It also has planned expansion in Middle East and Europe, growth in Tier II & III cities.

Nykaa’s GMV/revenue/EBITDA has grown at a 57%/48%/ 181% CAGR over FY19-21, while it turned PAT positive in FY21. EBITDA margins too improved to 6.6% in FY21 with FCF turning positive.

Considering the prevailing opportunities, investors can consider investing in Nykaa’s IPO for listing gains as well as long term opportunity it presents.

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Disclaimer: This is not an investment advice and is only for educational purposes. Please consult your financial advisor before taking any financial decisions.

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | 8 Nov 2021 |

| Initiation of Refunds | 9 Nov 2021 |

| Credit of Equity Shares: | 10 Nov 2021 |

| Listing Date: | 11 Nov 2021 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Day-1 | Day-2 | Day-3 |

|---|---|---|---|

| QIB | 4.72 | ||

| NII | 4.17 | ||

| Retail | 6.32 | ||

| Employee | 1.18 | ||

| TOTAL | 4.82 |

How to apply for IPO through Zerodha

Zerodha customers can apply online in this IPO using UPI as a payment gateway. Zerodha customers can apply in this IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘FSN E-Commerce Ventures’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.