Update: In case you are looking for the new EPFO notification about threshold increment from Rs 6500 to Rs 15000, please go to the post below :

June 2014 – EPF threshold raised from Rs 6500 to Rs 15000 – New EPFO Notification

https://wealth18.com/epf-threshold-raised-from-rs-6500-to-rs-15000/

—————————————————————————————————————————-

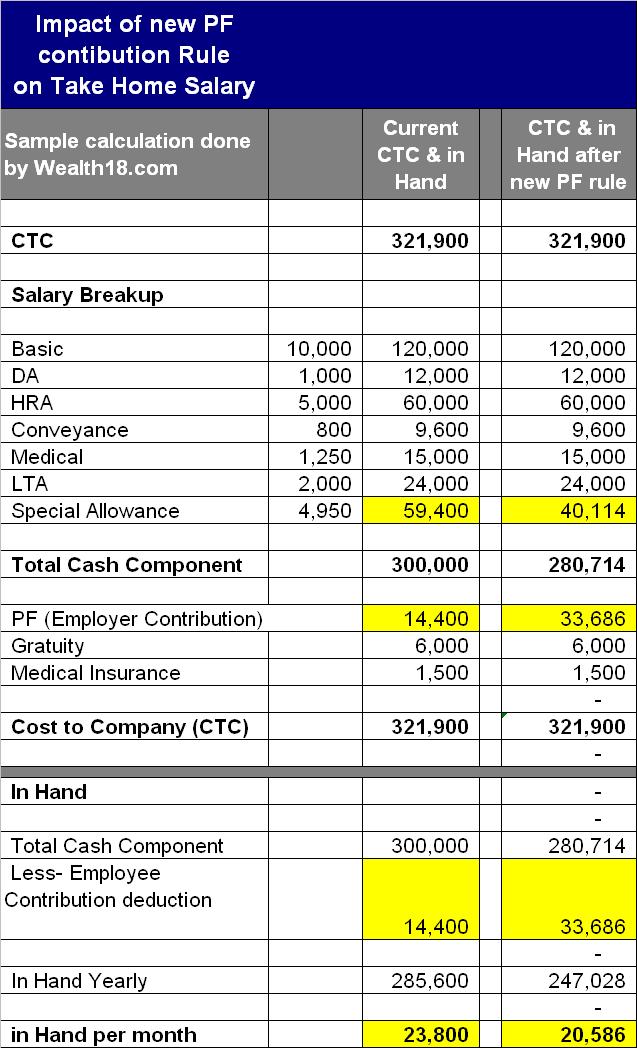

This post if related to impact on take-home salary if the PF dept decides to include allowances under the ambit of PF deduction.

Did you know that the latest drive of the Provident fund authorities may reduce your take home salary?

Employees Provident Fund Organization (EPFO) is all set to re-notify a new definition of “compensation” that will include all your allowances (not just Basic & DA) and PF contributions needs to be done on total compensation.

Currently, employers & employees contribute only 12% of Basic Salary & DA only. Employees get other allowances (fixed or specific purposes like conveyance allowance, special allowance, food allowance etc) on which no PF is contributed / deducted.

How it will impact employees??

1) Your Take home salary may be lower:

a) Your PF contribution deduction will be higher and your take home salary may be reduced.

b) Most of the companies hire employees on CTC basis and if employer’s increased contribution is also factored in your current CTC; the take home salary will be reduced further.

2) Your employer may give you option to opt-out: As PF contribution is mandatory only for employees whose salary is 6500 per month or less (Rs 78000 per year. So your employer may give you an option to opt out of EPF scheme and re-structure your salary.

From the above comparison, you will note that the Employer PF Contribution will increase from 14400 to 33686 (difference of Rs 19286) , which he will adjust by reducing your allowances ( to keep the total CTC same)

At the same time, employee PF contribution deduction will increase from 4400 to 33686 (difference of Rs 19286).

So your take home salary will reduce by 19286+19286 = Rs 38572 ( a monthly reduction of Rs 3214).

Will it be anyhow beneficial to employees?

May be as PF is important retirement benefit for salaried employees and it also offer tax benefits & tax free interest. So you will have higher savings in PF for your retirement, but it will put some constraints on your current obligations.

Why this issue has come up now??

In 2010-2011, there have been two relevant High court rulings:

Cases of Montage Enterprises Pvt. Ltd. (Madhya Pradesh High Court) and Reynolds Pens India Pvt. Ltd. (Madras High Court), wherein it has been interestingly held that :

“ various allowances paid by the employer to his employees under different heads (such as Conveyance, Educational, Food Concession, Medical, Special Holidays, Night Shift Incentives, City Compensatory allowances, etc) qualified as Basic wages under section 2(b) of the PF Act and hence, the same also needs to be included while calculating PF contribution.”

These rulings are based on the hypothesis that generally, fixed monthly amounts (eg Conveyance allowance) payable to all employees of an organisation or paid without any specific criteria to determine the quantum (eg Special allowance) are nothing but part of salary paid for work done which are labelled as various types of allowances, and therefore, need to be included to compute PF contributions.

From when it will be implemented ?

EPFO notified the changes last year but had to withdraw the circular in the wake of protests from employers and the perception that take-home salaries would come down.

Now, EPFO is expected to go ahead with the plan as a panel set up by the labour ministry to vet the proposal has endorsed it.

The report is currently pending with the labour ministry but sources said the government will go ahead and notify the norms. To ensure that the proposal goes through without facing legal glitches, the EPFO board may also discuss and ratify it.

Industry chambers have, however, not given up the fight against the move.

As per an article published in ET –

The introduction of a triple test- ‘Ordinarily, Necessarily and Uniformly’- for the purposes of defining basic wages by notification no. 7 (1)2012/RCs Review Meeting/345 dated 30th November, 2012 will arm the field staff of the EPFO with full powers to brand any component of salary, other than those exempted, as part of the wages for deducting EPF contribution, imposing thereby a huge financial liability on the establishments

———————

Also read other posts

August 2014 – EPFO re-initate process to club allowances with basic pay, ordered inspection

https://wealth18.com/epfo-re-initate-process-to-club-allowances-with-basic-pay-ordered-inspection/

June 2014 – EPF threshold raised from Rs 6500 to Rs 15000 – New EPFO Notification

https://wealth18.com/epf-threshold-raised-from-rs-6500-to-rs-15000/

May 27 2014 – Employer can cap PF contribution limit to Rs 6500 Basic Salary – New EPFO Notification & Supreme court ruling

Nov 2012 – New PF contribution rule may reduce your take home salary

https://wealth18.com/new-pf-contribution-rule-may-reduce-your-take-home-salary/