Gitanjali Gems’s unit Nakshatra World is pan India jewellery company is coming with its IPO.

Issue Details of Nakshatra World Limited IPO:

- IPO Open:

- Issue Price band:

- Issue Size:

- Market lot:

- Minimum Investment:

- Book Running Lead Managers: IDBI capital, Elara

- Registrar:

- Listing: BSE / NSE

IPO Issue Allocation:

- Qualified institutional buyers (QIBs) – 50% of the offer.

- Non-institutional bidders – 15% of the offer.

- Retail individual bidders – 35% of the offer.

Background:

Nakshatra World Limited is an established pan-India player in the organized jewellery market, with a focus on manufacture and distribution of branded studded jewellery, gold jewellery and other jewellery products in India and overseas, under the brands Nakshatra, Gili, Asmi, Sangini, Diya, Parineeta and Rivaaz.

As of September 30, 2016, its distribution network spread across 290 cities and towns in India, with more than 1,644 POS, through its distributors, 329 SIS and 61 stores, which includes 49 franchisee operated stores and 12 stores which are owned and operated by the company. It also has 890 overseas POS located across China, Singapore, Thailand, Malaysia, Indonesia, United Arab Emirates, Saudi Arabia and Qatar.

In terms of its geographic spread across India, it has a strong presence in the eastern and western parts of India, with 39% of its POS being located in the eastern region (comprising cities and towns such as Kolkata, Patna, Ranchi, Cuttack, Guwahati, Gaya and Siliguri) while 35% of its POS are located in the western region (comprising cities and towns such as Mumbai, Aurangabad, Nagpur, Jaipur, Bikaner and Solapur).

The company has eight manufacturing units, two located in Mumbai, one in Jaipur, one in Surat and four in Hyderabad. The company has an in-house design team with a total design bank of 12,868 active stock keeping units (“SKUs”), of which approximately 4,000 new designs are churned every year. It provides quality certificates, issued by independent valuers, on all its jewellery.

The company acquired the brands ‘Gili’, ‘Nakshatra’, ‘Asmi’, ‘Sangini’, and ‘Parineeta’ in 2011, and ‘Diya’ in 2016. It is promoted by Mr. Mehul Choksi and GGL. GGL, the flagship company of the Gitanjali group, is a leading integrated jewellery manufacturing and retailing player that was established in 1986.

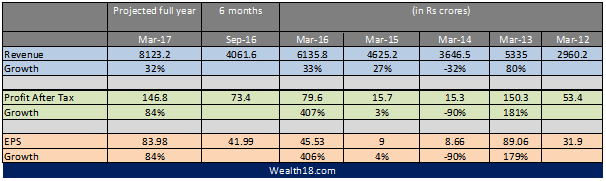

Its revenue from operations has increased at a CAGR of 28.28% from Fiscal 2014 to Fiscal 2016, and its net profit before minority interest has increased at a CAGR of 128.22% for the same period. For the six months ended September 30, 2016, its revenue from jewellery exported accounted for 62.07%, of its total revenue from operations.

Top Shareholdings:

The list of the top shareholders of the company and the number of equity shares held by them is as below:

- Gitanjali Gems Limited : 99.99%

- Mehul Choksi : Negligible

- Vipul Chitalia : Negligible

- Divyesh Timbadia : Negligible

- Milind Limaye : Negligible

- Aniyath Shivraman Nair : Negligible

- Jignesh Shah : Negligible

Objective of the issue:

The company proposes to utilize the funds which are being raised towards funding the following objects:

- Funding the working capital requirements of the company;

- Funding the working capital requirements of its subsidiaries, Nakshatra Brands and Gili India; and

- General corporate purposes.

In addition to the above, the company expects to receive the benefits of listing of its Equity Shares on the Stock Exchanges, including enhancing its brand name and creation of a public market for its Equity Shares in India.

Anchor Investors: Will be available one day before the IPO opens.

Financials:

Valuation as compared to its peers:

Nakshatra will join other listed jewellery retailers such as PC Jeweller, Tribhovandas Bhimji Zaveri, Tara Jewels, Titan Company, Rajesh Exports and Shree Ganesh Jewellery House.

| Company name | Revenue (in crores) | EPS (2016) | PE (offer document) |

| Nakshatra World Limited | 45.53 | – | |

| Peer Group | |||

| Titan Company Limited | 7.77 | 43.6 | |

| Tribhovandas Bhimji Zaveri Limited | -4.13 | – | |

| PC Jeweller Limited | 22.28 | 16.35 | |

| Renaissance Jewellery Limited | 24.87 | 5.04 |

Brokerage Recommendations: It will be updated once the IPO is announced.

Should you invest: The analysis will be completed once the price band is declared.

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.