IPO Allotment Status: To check IPO Allotment status, please check the link below. Select ICICI Prudential Life, Enter PAN number and you can check the allotment status :

https://kosmic.karvy.com:81/ipotrack/

Many members who applied for full amount, they have received an allotment of 251 shares.

Listing Date & Price : The listing is expected on 29th Sep 2016. Expected to list around Rs 360

[xyz-ihs snippet=”ad1″]

21st Sep – ICICI Pru Life IPO Over-subscribed 10.44 times – See details

ICICI Prudential Life Insurance IPO is opening on 19th Sep. This is the first Insurance company IPO and the the biggest IPO in 6 years after Coal India.

Issue Details of ICICI Prudential Life Insurance IPO:

- IPO Open : Sep 19 to Sep 21 2016

- Issue Price band: Rs 300 – 334

- Issue Size: Rs 5000 crore

- Market lot : 44 shares

- Minimum Investment:

- Book Running Lead Managers : Bank of America Merrill Lynch, ICICI Securities, CLSA, Deutsche, Edelweiss, HSBC, IIFL, JM Financial and SBI Capital Markets.

- Registrar –

- Listing: BSE/NSE

ICICI Prudential Life Insurance IPO Issue Allocation

- Qualified institutional buyers (QIBs) – 50 % of the total issue size.

- Non-institutional investors (NIIs) – 15 % of the issue size.

- The retail quota limit in the issue = 35 % of the issue size.

Background:

ICICI Prudential Life Insurance Company is the Joint venture between ICICI Bank and Prudential Corporation. The company is the largest private sector life insurer in India. The company’s market share among all insurance companies in India (public and private sector) is 11.3%, The company’s market share among 23 private insurance companies is 22%,

Among the 23 private sector life insurance companies in India, the company had a market share on a retail weighted received premium basis

The company has a diversified multi-channel distribution and sales network. As of March 31, 2016, it had 121,016 individual agents and it’s bank partners had over 4,500 branches.

The company’s claims settlement ratio for retail death claims of 96.2% % was higher than most private sector life insurance companies, as compared to the private sector average of 89.4%.

Industry

The size of the Indian life insurance sector (excluding Sahara Life Insurance Company Limited) was Rs 3.7 trillion on a total premium basis in fiscal 2016, making it the 10th largest life insurance market in the world and the 5th largest in Asia.

The total premium in the Indian life insurance sector grew at a CAGR of approximately 17% between fiscal 2001 and fiscal 2016. Despite this, India continues to be an underpenetrated insurance market with a life insurance penetration of 2.7% in fiscal 2015, as compared to 3.7% in Thailand, 7.3% in South Korea and a global average of 3.5% in 2015.

In 2015, Government of India increased the maximum permissible shareholding of foreign investors from 26% of paid-up equity capital to 49%. This led to an inflow in foreign investments of US$1.13 billion in fiscal 2016, an approximate increase of 170% over fiscal 2015.

The Indian life insurance sector was opened for private companies in 2000, which witnessed the commencement of operations by four private companies in the first year itself and 22 companies between 2000 and 2010 (Source: IRDAI). As of March 31, 2016, there are a total of 24 companies in the Indian life insurance sector with life Insurance Corporation (LIC) being the only public sector life insurer. The private sector has grown significantly since 2000 and it accounted for 52% of the life insurance sector, in fiscal 2016. In fiscal 2016, bancassurance contributed to 52.6% of the new business premiums for private sector companies.

According to CRISIL Research, Life insurance industry report, July 2016, the new business premium for Indian life insurance companies is expected to grow at a CAGR of 11-13% over the next five years. Improving economic growth, low insurance penetration, increased financial savings, and a low sum assured to GDP ratio are expected be the key catalysts for this growth.

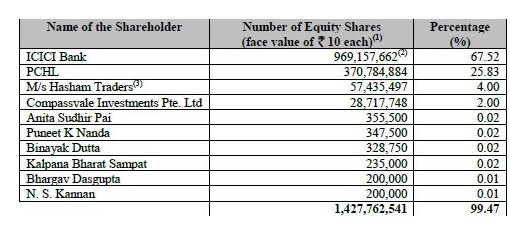

Promoters holdings: At the end of March 2016

ICICI Prudential Life Insurance is a joint venture between ICICI Bank Limited, India’s largest private sector bank in terms of total assets with an asset base of Rs 7.2 trillion at March 31, 2016, and Prudential Corporation Holdings Limited (PCHL), a part of the Prudential Group, an international financial services group with GBP 509 billion of assets under management at December 31, 2015.

ICICI Bank and PCHL have been identified as promoters in previous filings with IRDAI. Further, ICICI Prudential Life Insurance is an “Indian owned and controlled” company under the Insurance Act and applicable regulations. ICICI Bank currently holds 969,157,662 Equity Shares and PCHL holds 370,784,884 Equity Shares, equivalent to 67.62% and 25.87% of the pre-Offer issued, subscribed and paid-up Equity Share capital of Company, respectively.

Objective of the issue:

The company will not receive any proceeds from the Offer.

The objects of the Offer are to achieve the benefits of listing the Equity Shares of the company on the Stock Exchanges and to carry out the sale of up to 181,341,058 Equity Shares (10%) by the selling shareholder. The listing of the Equity Shares will enhance the “ICICI Prudential” brand name and provide liquidity to the existing shareholders. The listing will also provide a public market for the Equity Shares in India.

Last November, ICICI Bank sold nearly 6 percent stake in ICICI Prudential to Temasek and PremjiInvest.. Prudential will not dilute its stake in the IPO of ICICI Prudential Life Insurance Company while ICICI Bank will be selling its 12.65 per cent stake in the insurer.

Financials:

In fiscal 2016, the company’s gross premium income was Rs 19100 crores, which comprised Rs 4900 crores of retail new business regular premium, Rs 400 crore of retail new business single premium, Rs 12000 crore of retail renewal premium and Rs 1800 crore.

Its 13th month persistency ratio in fiscal 2016 was 82.4%, which was one of the highest in the sector.

At March 31, 2016, the company had Rs 1 lakh crores of assets under management, making it one of the largest fund managers in India. Of these, 72.4% were in linked assets. Funds representing 92.9% of its linked assets with identified benchmarks at March 31, 2016 had performed better than their respective benchmarks since inception. The company’s expense ratio of 14.6% for fiscal 2016 was also one of the lowest among the private sector life insurance companies in India.

The company has an established track record of delivering annual returns to shareholders. Its profit after tax was Rs 1650 crores in fiscal 2016 and the return on equity has exceeded 30% for each year since fiscal 2012. It has a strong capital position with a solvency ratio of 320.0% at March 31, 2016 compared to the IRDAI prescribed control level of 150.0%. Its business has not received a shareholder capital injection since fiscal 2009 and the company has paid annual dividends since fiscal 2012. It has paid cumulative dividends (exclusive of dividend distribution tax) of Rs 4032 crores since fiscal 2012.

With over 90% of its debt portfolio at March 31, 2016 invested in domestic AAA-rated instruments, including sovereign instruments and AAA equivalent rated instruments, the company believes to have a low exposure to credit risk. The company also have a low exposure to guarantees which is reflected in the low time-value of financial options and guarantees of `385 million at March 31, 2016.

- Gross premium income in FY16 rose by 25% to Rs 19,164.4 crore YoY and 23.16 % in FY15 to Rs 15,306.6 crore. It was Rs 3,560 crore in Q1FY17, up 14.4 % over Q1FY16.

- New business premium in FY16 was up by 23 % to Rs 6,563 crore compared with FY15.

- Profit grew only by 0.75 % to Rs 1,652.7 crore in FY16 and 5 % to Rs 1,640.35 crore in FY15 on YoY basis.

- Profit in quarter ended June 2016 was at Rs 405 crore (up 2 % over Q1FY16).

Anchor Investors: Ahead of its mega IPO worth up to Rs 6,057 crore, ICICI Prudential Life Insurance is believed to have allotted shares worth Rs 1,635 crore to a clutch of marquee investors from India and abroad, including Singapore Government, Nomura and a pension trust for Boeing employees.

The anchor investors are believed to have included Government Of Singapore, Nomura, Monetary Authority Of Singapore, National Pension Service Managed By Oaktree Capital Management LP, The Boeing Company Employee Retirement Plans Master Trust, Russell Emerging Markets Funds, Oaktree Emerging Markets, Pggm World Equity Ii BV and National Westminster Bank Plc as trustee of the Jupiter India Fund. The investors also included Goldman Sachs, Morgan Stanley, Copthall Mauritius Investment Limited, Integrated Core Strategies Asia Pte Ltd, as also DSP Blackrock, Chennai 2007, GMO Funds, HDFC Standard Life Insurance, Rochdale Emerging Markets, Legg Mason Western Asset Asian Enterprise Trust, Wasatch Global Opportunities Fund, as also various mutual fund schemes of Tata MF, Reliance MF, UTI MF, SBI MF, Birla Sunlife, L&T MF, IDFC MF, Kotak Mahindra MF, Sundaram Mutual Fund and Edelweiss Mutual Fund.

Risks:

Valuation as compared to its peers:

Within the life insurance sector, there were 24 public and private sector life insurance companies operating in India at March 31, 2016. The company compete principally with other large life insurance companies in India, such as Life Insurance Corporation of India (LIC), HDFC Life, SBI Life Insurance Company Limited (SBI Life), Max Life and Kotak Mahindra Old Mutual Life Insurance Limited. It also faces competition from smaller insurance companies, including health insurers, which have been seeking to expand their market shares in recent years and may develop strong positions in certain customer segments.

In June 2016, HDFC Life and Max Life announced that they will enter into an agreement to evaluate a potential combination through a merger of Max Life and Max Financial Services Limited into HDFC Life.

There are no listed life insurance companies in India. MFS, which is a holding company for Max Life Insurance, is the only listed company in this sector. However, MFS underwent a restructuring during the fiscal 2016 and hence comparative financial information corresponding to the latest fiscal year for MFS is unavailable as of date.

| Centrum Wealth Geojit BNP Parbas |

Subscribe |

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.