Capacit’e Infraprojects, a construction company is coming up with its IPO soon.

Issue Details of Capacit’e Infraprojects Limited IPO:

- IPO Open: 13th Sep – 15th Sep 2017

- Issue Price band: Rs 245 – Rs 250

- Issue Size: Rs 400 crores

- Market lot: 60 shares (

- Minimum Investment: Rs 15000 , Max for Retail – 780 shares

- Book Running Lead Managers: Axis

- Registrar: Karvy

- Listing:BSE, NSE

IPO Issue Allocation:

- Qualified institutional buyers (QIBs) – 50% of the offer.

- Non-institutional bidders – 15% of the offer.

- Retail individual bidders – 35% of the offer.

Background:

Capacit’e Infraprojects Limited, is a fast growing construction company focussed on Residential, Commercial and Institutional buildings. It provides end-to-end construction services for residential buildings, multi level car parks, corporate office buildings and buildings for commercial purposes and buildings for educational, hospitality and healthcare purposes. Its capabilities include constructing concrete building structures as well as composite steel structures. It also provides mechanical, electrical and plumbing (MEP) and finishing works.

Based on the categorisation provided in the CRISIL Report, the buildings that the company constructs may be considered as (i) buildings with 40 or more floors as super high-rise buildings; and (ii) buildings with seven or more floors as high-rise buildings. The company considers (i) a single premise or land parcel containing at least four buildings, which may include High Rise Buildings or Super High Rise Buildings, as a gated community; (ii) duplex houses and row houses as villaments; and (iii) buildings other than Super High Rise Buildings, High Rise Buildings, Gated Community and Villaments as other buildings.

The company predominantly operates in the Mumbai metropolitan region (MMR), the National Capital Region (NCR) and Bengaluru. Its operations are geographically divided into MMR and Pune (West Zone), NCR and Patna (North Zone) and Bengaluru, Chennai, Hyderabad and Kochi (South Zone). As on January 31, 2017, projects in the West Zone, North Zone and South Zone constituted, approximately 60.78%, 15.69% and 23.53% of its total projects, respectively.

Capacit’e Infraprojects works for a number of reputed clients and are associated with some marquee construction projects in India. Some of its clients include Kalpataru, Oberoi Constructions Limited, The Wadhwa Group, Saifee Burhani Upliftment Trust, Lodha Group, Rustomjee, Godrej Properties Limited and Prestige Estates Projects Limited.

The company had an order book of Rs. 4,049.07 crores as at January 31 2017, comprising 51 ongoing projects. As of January 31, 2017, it had 1,688 employees and 10,678 contract labourers across all its projects.

The company has received an ISO 9001:2008, ISO 14001:2004 and an OHSAS 18001:2007 certification.

Top Shareholdings:

The list of the top shareholders of the company and the number of equity shares held by them is as below:

- Rohit R Katyal : 26.84%

- Katyal Merchandise Private Limited : 22.52%

- Rahul R Katyal : 15.20%

- Advance Housing Development Private Limited : 13.02%

- NewQuest : 8.90%

- Subir Malhotra : 6.27%

- Rohit R Katyal, Rahul R. Katyal and Sakshi Katyal (in their capacity of being partners of M/s. Asutosh Trade Links) : 2.95%

- Infina : 2.20%

- JT HUF : 1.10%

- Paragon : 1.00%

Objective of the issue:

The company proposes to utilise the Net Proceeds from the Fresh Issue towards the following objects:

- Funding working capital requirements;

- Funding purchase of capital assets (system formwork); and

- General corporate purposes.

In addition, the company expects to receive the benefits of listing of its Equity Shares on the Stock Exchanges, including enhancing its brand name and creation of a public market for its Equity Shares in India.

Anchor Investors: Will be available one day before the IPO opens.

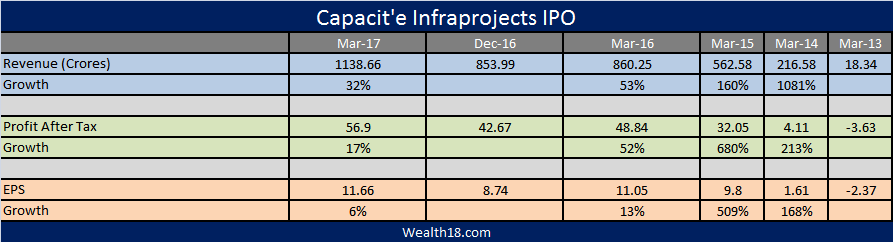

Financials:

Valuation as compared to its peers:

| Company name | Revenue from operations (in crores) | EPS (Basic) | PE (offer document) |

| Capacit’e Infraprojects Limited | 860.25 | 12.27 | – |

| Peer Group | |||

| Ahluwalia Contracts (India) Limited | 1263.16 | 12.6 | 26.31 |

| JMC Projects (India) Limited | 2648.2 | -24.9 | n/a |

| Simplex Infrastructures Limited | 5997.82 | 13.83 | 27.22 |

At the upper end of the price band of Rs. 250, the IPO is valued at 24x at FY17 EPS on post IPO basis. it has robust orderbook position of | 4603 crore (4x FY17 revenues), lean balance sheet (D/E: 0.2x post IPO)

Brokerage Recommendations:

| Ajcon GLobal | Subscribe |

| ICICI Direct | Subscribe |

| Motilal Oswal | Subscribe |

| ShareKhan | Subscribe |

| Mehta Investments | Subscribe |

Should you invest: The company has successfully delivered strong revenue / EBITDA / PAT growth of 75%/121%/169% in FY14-17. Valuation is also reasonable at 24.5x P/E on FY2017 earnings. Investors can consider to invest in this IPO for medium to long term basis.

[xyz-ihs snippet=”ad1″]

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investment