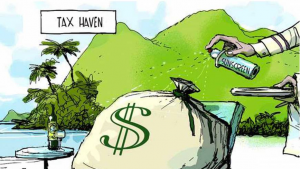

You may have heard in news about tax havens around the world. Companies set up offices in Mauritius, Cayman Islands etc. and pay no/ minimal tax in India.

But you will be surprised to know that we have a tax haven within India. There is no income tax for people of one of the states. Amazed? It is in State of Sikkim.

As per Section 10 (26AAA), following income of a Sikkimese individual is exempt from tax:

- from any income source in the State of Sikkim; or

- Income by way of dividend or interest on securities (generated in Sikkim or any other place). This exemption is not available to a Sikkimese woman who, on or after April 1, 2008 marries a non- Sikkimese individual.

Explanation.—For the purposes of this clause, “Sikkimese” shall mean—

- an individual, whose name is recorded in the register maintained under the Sikkim Subjects Regulation, 1961 read with the Sikkim Subject Rules, 1961 (hereinafter referred to as the “Register of Sikkim Subjects”), immediately before the 26th day of April, 1975; or

- an individual, whose name is included in the Register of Sikkim Subjects by virtue of the Government of India Order No. 26030/36/90-I.C.I., dated the 7th August, 1990 and Order of even number dated the 8th April, 1991; or

- any other individual, whose name does not appear in the Register of Sikkim Subjects, but it is established beyond doubt that the name oaf such individual’s father or husband or paternal grand-father or brother from the same father has been recorded in that register;

Please comment if you did not know this before!