Subscription: On last day, the IPo subscribed 1.53 times – QIBs – 1.48 times, HNI – 2.85 times and retail investors 0.94 times

GTPL Hathway Limited is a leading regional Multi Service Operator (MSO) in India, offering cable television and broadband services.

Issue Details of GTPL Hathway IPO:

- IPO Open: 21 June to 23 June 2017

- Issue Price band: Rs 167 – Rs 170

- Issue Size:

- Market lot: 88 shares

- Minimum Investment:

- Book Running Lead Managers: JM, BNP, Motilal, Yes

- Registrar: Link Intimes

- Listing: BSE, NSE

IPO Issue Allocation:

- Qualified institutional buyers (QIBs) – 50% of the offer.

- Non-institutional bidders – 15% of the offer.

- Retail individual bidders – 35% of the offer.

Background:

GTPL Hathway Limited is a leading regional Multi Service Operator (MSO) in India, offering cable television and broadband services. It is number 1 MSO in Gujarat with a market share of 67% of cable television subscribers in 2015, accounting for approximately 3.7 million of 5.6 million cable television households; and is number 2 MSO in Kolkata and Howrah in West Bengal with a market share of 24% of cable television subscribers in 2015, accounting for approximately 0.7 million of 3.0 million cable television households.

The company accounted for 14% share of the total cable carriage and placement fee market in India in Fiscal 2016. As of September 30, 2016, its digital cable television services reached 169 towns across India, including towns in Gujarat, West Bengal, Maharashtra, Bihar, Assam, Jharkhand, Madhya Pradesh, Telangana, Rajasthan and Andhra Pradesh. As of September 30, 2016, it had seeded approximately 6.19 million Set-Top Boxes (STBs) and had approximately 5.41 million active digital cable subscribers. As of August 31, 2016 it had approximately 2.02 million analog cable subscribers, for which it has received requisitions for digital STBs from Local Cable Operators (LCOs).

As of September 30, 2016, the company had 217,823 broadband subscribers. It provides broadband services primarily in the state of Gujarat and has established a home pass of approximately 1.0 million households. India’s internet subscriber base is expected to increase from 411.2 million subscribers in 2016 to 825.2 million subscribers in 2020 led by growth in wireless subscribers. (Source: The KPMG – FICCI Report)

GTPL Hathway offers cable TV and broadband services in several cities including Pune, Ahmedabad and Kolkata.

Promoters & Promoter Group holdings:

Mr. Aniruddhasinhji Jadeja, Mr. Kanaksinh Rana, Gujarat Digi Com Private Limited and Hathway Cable and Datacom Limited are the Promoters of the company.

Objective of the issue:

The Issue comprises of a Fresh Issue by the company and an Offer for Sale by the selling shareholders.

- The Offer for Sale : The company will not receive any proceeds from the Offer for Sale.

- The Fresh Issue: The net proceeds from the fresh issue will be utilised towards the following objects:

-

- Repayment/pre-payment, in full or part, of certain borrowings; and

- General corporate purposes.

Anchor Investors: Will be available one day before the IPO opens.

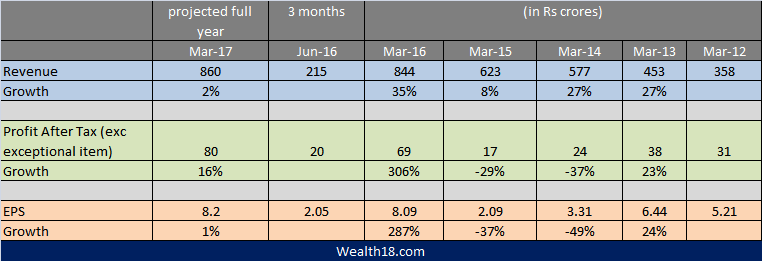

Financials:

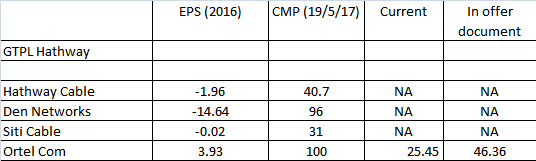

Valuation as compared to its peers:

Risks:

- The holding company, Hathway provides cable television and cable broadband services, and therefore is in a similar line of business as our Company and the target subscribers may be the same for our Company and Hathway.

- The cable television distribution industry is highly competitive, which affects our ability to attract and retain subscribers.

- Competitors providing DTH satellite television services include Tata Sky Limited, Dish TV India Limited, Videocon D2h Limited and Bharti Airtel Limited

- Competitors providing broadband services include BSNL, Airtel, Rcom

Brokerage Recommendations:

| Centrum | Avoid | |

| Angel Broking | Neutral | |

| IIFL | Not upbeat | |

Should you invest: The market is quite competitive with big competitors. You should consider AVOIDING this IPO as the company is not in new OTT/ DTH business which is the future.

[xyz-ihs snippet=”ad1″]

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.