Edelweiss Housing Finance Limited (EHFL) is opening its first public issue of NCDs on 8th July 2016 & it closes on 27th July 2016. This NCD issue is offering yield upto 10% and have 7 different investment options.

In this post, I am trying to put details around how good Edelweiss Housing Finance NCD is ? What are the postive and negative factors of Edelweiss Housing Finance NCD? Who should invest in Edelweiss Housing Finance NCD?

Key Features of Edelweiss Housing Finance NCD

- NCD Issue Open: 8th July 2016

- NCD Issue Closing date: 22nd July 2016

- Type of Instrument: Secured redeemable non-convertible debentures (NCD)

- Size of Issue: Rs. 250 crores with a green-shoe option of another Rs 250 crores

- Minimum & Maximum Investment: minimum 10 NCD of Rs 1000 each = Rs 10000.

- Listing: Proposed to be listed on NSE & BSE (within 12 working days of closing the issue)

- NRI– Non Resident Indian (NRI) cannot invest in this issue

- Credit Rating– These NCDs are rated as BWR AA+, ICRA AA, CARE AA

- Issue Allocation or Allotment method: First come first served basis

- Issue Breakup

| Category | Allocation | Issue Size (in Crores) | |

| Base Issue | Limit | ||

| Individual | 60% | 150 | 300 |

| Institutional | 20% | 50 | 100 |

| Non-institutional (corporate) | 20% | 50 | 100 |

| TOTAL | 100% | 250 | 500 |

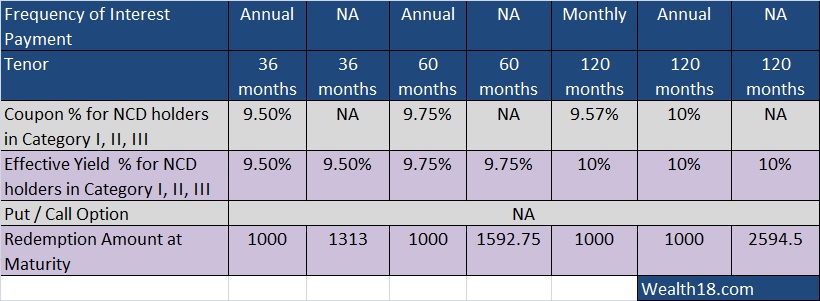

Interest rate options for Edelweiss Housing Finance NCD

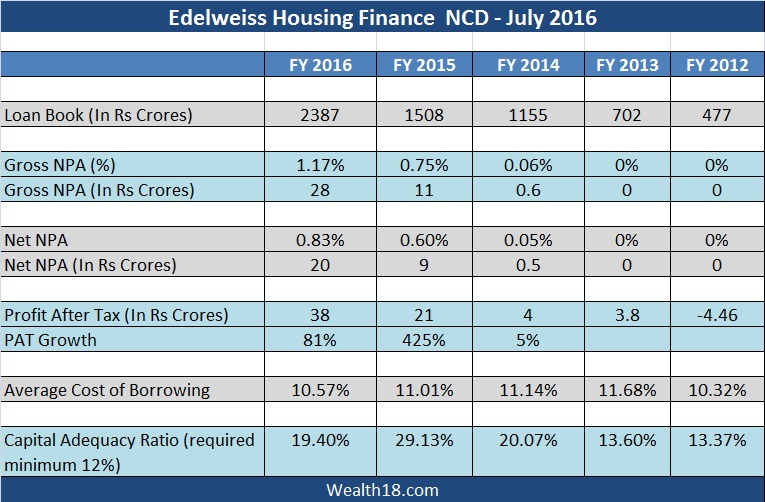

About Company

Edelweiss Housing Finance is part of the Edelweiss Group. Edelweiss Housing Finance Limited is a non deposit taking Housing Finance Company focused on majorly offering secured loan products to suit the needs of the individuals and corporate. The Company also offer small ticket unsecured loans to the customers mainly in rural areas. Their products include:

| Segment | Details | Loan Book | Amount |

| Home Loans | secured loans to salaried individuals, self-employed individuals and others for urchase/construction/renovation of residential properties, against mortgage of the same property, | 37% of Loan Book | Rs 894 crores |

| Loan Against property | loans for business purposes or for the purchase of commercial property or for investment in asset, against mortgage of the same property |

26% of Loan Book | Rs 616 crores |

| Construction Finance | loans to reputed developers for construction of residential projects, against mortgage of the same property and/or other collateral |

20% of Loan Book | Rs 488 crores |

| Rural finance | unsecured loans to customers (primarily in rural areas) for a tenure of upto 2 years | 16% of Loan Book | Rs 389 crores |

| TOTAL | 100% | Rs 2387 crores |

Taxation Aspect

NCDs taken in the DMAT form will NOT attract any TDS on the interest income. However, if NCD are taken in physical form, TDS will be applicable if the interest amount exceeds Rs. 5,000.

| Internest earned on NCD | Taxable as per tax slab of Investor |

| If sold on exchange (before 12 months) | Short term capital gain / loss Taxable as per tax slab of Investor |

| If sold on exchange (after 12 months) | Long term capital gain / loss Taxable @ 10.30% without indexation |

In case of an individual or HUF, being a resident, where the total income as reduced by such long-term capital gains is below the maximum amount which is not chargeable to income-tax, then, such long-term capital gains shall be reduced by the amount by which the total income as so reduced falls short of the maximum amount which is not chargeable to income-tax and the tax on the balance of such long-term capital gains shall be computed at the rate mentioned above.

Under Section 54EC of the I.T. Act, long term capital gains arising to the debenture holders on transfer of their debentures in the company shall not be chargeable to tax to the extent such capital gains are invested in certain notified bonds within six months after the date of transfer.

As per the provisions of Section 54F of the I.T. Act, any long-term capital gains on transfer of a long term capital asset (not being residential house) arising to a Debenture Holder who is an individual or Hindu Undivided Family, is exempt from tax if the entire net sales consideration is utilized, within a period of one year before, or two years after the date of transfer, in purchase of a new residential house, or for construction of residential house within three years from the date of transfer.

Positive factors

- Attractive Interest rates of 10% as compare to Banks FD rates (approx 8%)

- Secured NCD

Negative factors

- NCDs are not very liquid. Though they are listed on exchanges but trading volumes are low to get right price.

- For an investor in the highest tax bracket, it doesn’t make sense to invest in these as the net returns are comparable with that of the tax-free bonds.

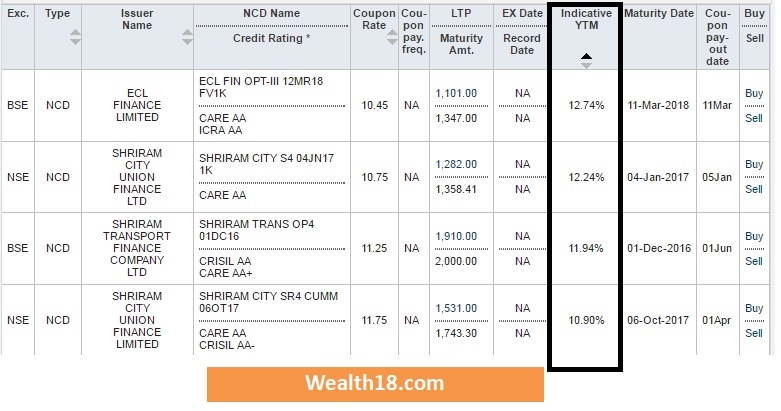

Comparison

There are other NCDs available in the secondary market that are giving better yield (YTM). However, these NCDs have lower balance duration and the purchase will incur small brokerage cost.

There are other NCD issues in the pipeline – Dewan Housing Finance plans to issue NCD for Rs 4,000 crore and Srei Infrastructure Finance plans to raise up to Rs 300 crores. I will review these NCDs very soon.

How to Apply

- Physical Form – You can download the Form and submit to designated bank branches alongwith cheque. (Link to download Edelweiss Housing Finance NCD 2016 Form)

- Online – You can invest online in DMAT form through your online share trading account or through your broker.

Summary

- Attractive Interest: Investors who are looking for steady income can go for this NCD as the Interest rate is attractive and rating is AA.

- Capital Gain: If the interest rates fall (most likely), these bonds are most likely be traded at premium, thereby having chance of capital gain as well (in addition to the coupon interest).

Note: There are other NCD issues in the pipeline – Dewan Housing Finance plans to issue NCD for Rs 4,000 crore and Srei Infrastructure Finance plans to raise up to Rs 300 crores. I will review these NCDs very soon.