Yes. You read it right. In this post, I will explain how to earn upto 9% interest on your idle savings account balance.

Option 1 – Choose High Interest Saving Account

Typically banks give 4% interest on savings accounts. However, after RBI de-regulated the savings account interest rates, few banks are offering higher rates.

| Bank / Rates | Balance upto 1 lakh | Balance above 1 Lakh |

| Yes bank | 6% | 7% |

| Kotak Bank | 5.50% | 6% |

| IndusInd Bank | 5.50% | 6% |

So, you can get maximum of 7% interest from your savings account.

Option 2 – Choose Sweep in / Out Facility on your Savig Account

But, let’s see how you can increase your returns upto 9% using “Sweep In/Out” facility.

A. What is this “Sweep in / out” facility?

This is like a combination of Savings account & Fixed Deposit account.

It combines benefits of both accounts –

- High Returns of Fixed Deposit &

- Quick encashment (Liquidity) of Savings Account.

B. How it works?

Most of the times, you have idle money sitting in savings account than you actually use it. But, you don’t invest it, because you think that you might need it, for e.g. in emergency.

So, in such cases, “Sweep in/out” facility comes handy.

Sweep facility allows you to transfer funds (automatic / manually) from your saving account to a “Virtual” Fixed deposit account and earn high interest rate.

And it automatically transfer money back from FD to savings account as and when required (cash withdrawal/ cheque etc).

1) An FD is made for the whole amount which earns higher interest rate.

2) When you withdraw money, an equivalent amount is reduced from your FD & auto transferred to saving account. You earn FD interest on that amount till the date of withdrawal. For the balance amount, you continue earning FD rate of interest.

C. Let’s understand through an example

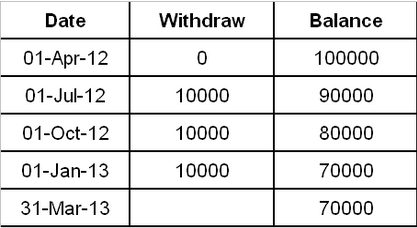

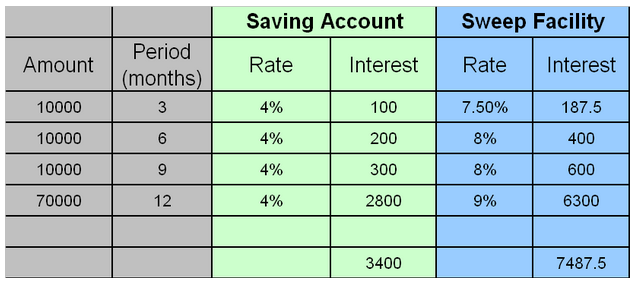

Suppose you have savings account balance as on 01-Apr & then withdraw money periodically as per schedule below:

In case of just normal saving account, you will earn interest of Rs 3400. However, if you avail sweep facility, your returns will increase to approx Rs 7487.

D. What will happen when I withdraw money / issue cheque / online purchase?

Suppose you want to withdraw / issue cheque of Rs 25000. Don’t worry; your cheque WILL NOT bounce.

The money will be swept-in from your FD account to your saving account automatically.

E. Points to note

- Some banks define the minimum saving bank limit above which the FD is made automatically while others allow you to choose minimum saving balance.

- Some banks allow the FD for defined tenure only while others allow you to choose FD tenure.

- Some banks sweep-in the FD into multiple of 5000 or 10000, while others do it in multiple of Rs 1.

- Some banks break the FD in First-in-First-Out basis while others do it on Last-in-First-out basis.

- When the FD is broken before the original term, you get bit less than original interest as the bank deduct penalty from the interest. e.g. lets say, the 1 year fd rate is 9% and 6 monmth FD rate is 8%, if you withdraw money after 6 month, you will get 8% – penalty = 7.% (for example) – which is still better than Saving Bank rate.

F. How to enable this Sweep in/out facility

Different banks have different names for such accounts like Supersaver facility, HDFC SavingMax Account, Kotak ActivMoney, ICICI Money maximiser etc

You have two options:

1) Auto Sweep-out facility & Sweep in : In this facility, Bank will automatically sweep-out/ transfer money from your saving account to Fixed deposit, once your saving balance is above threshold limit say Rs 50,000.

Visit your branch and ask your relationship manager to enable the “Auto Sweep / Sweep-in” facility on your account. Sometimes, they will enable this facility on your existing account or they can open a new savings account with this facility. To open a new saving account, you just need to sign the form as bank already have your documents.

Advantanges: FD is created automatically once the balance of saving account is above threshold limit.

Demerits: 1) You loose FD interest on amount defined as threshold limit (just savings interest on that amount)

2) Tenure of FD is standard set by bank. Normally 1 year. But sometimes you get higher interest if you make an FD for odd periods like 1 year 16 days etc.

2. Just Sweep-in facility: In this facility, you just have to create a normal FD online and then select this FD to enable sweep-in option. This is default feature in many banks.

Merits: You get FD interest on whole amount. Also, you can choose your tenure of FD based on higher interest rates.

Demerits: You have to create FD yourself through netbanking. It is not automatically done. So you need to remember to make FD when you get money in your saving account.

Read my other post – SBI Savings Plus Account with MOD High Interest Scheme – Details & Review

See my other post on – How to use Sweep-in facility in HDFC Bank via Net-banking (with screenshots)