There is a famous saying in financial world that you will become rich by “Investing” not only “Saving”.

Well, Isn’t Investing & Saving is the same thing?

Actually No, when you save money, you put it in extremely safe, liquid option like Bank Account, Fixed deposit etc. Saving is mainly to keep pace with Inflation or short term goals or for emergency.

When you want to invest, you look around for various available options which can grow your wealth. Based on the goal horizon & risk appetite, you can invest your money in options like Shares, Mutual Funds, Property etc

A. Fixed Income

- Savings Bank Account

- Sweep-in FD Account

- Fixed Deposits

- Recurring Deposit

- Public Provident Fund (PPF)

- PO National Savings Certificate – NSC

- RBI Tax free Bonds

- Corporate Non-Convertible debentures (NCD)

- Tax free Infrastructure Bonds

- National Pension Scheme – NPS

- Mutual Funds – Balanced, Debt, Liquid, Gilt etc

B. Equity

- Shares

- Equity Mutual Funds – Large Cap, Mid Cap, Small Cap, Diversified, Sector, Thematic, International, Arbitrage, Balanced etc

- RGESS – Rajiv Gandhi Equity Savings Scheme

- National Pension Scheme – NPS

- Derivatives – Futures, Options (Index / Stocks)

C. Commodities

- Gold – Physical, Jewellery, Gold ETF, Gold Savings Fund, e-Gold

- Silver – Physical , e-Silver

- Commodity Futures – Bullion, Metals, Oil, Pulses, Energy, Spices etc

D. Real Estate

- Residential (Pre-launch, Launch., Resale etc)

- Commercial – Office, Showroom, Retail etc

E. Insurance Products

- Money Back Life Insurance Policies

- ULIP – Unit Linked Insurance Plans

- Single Premium Policies

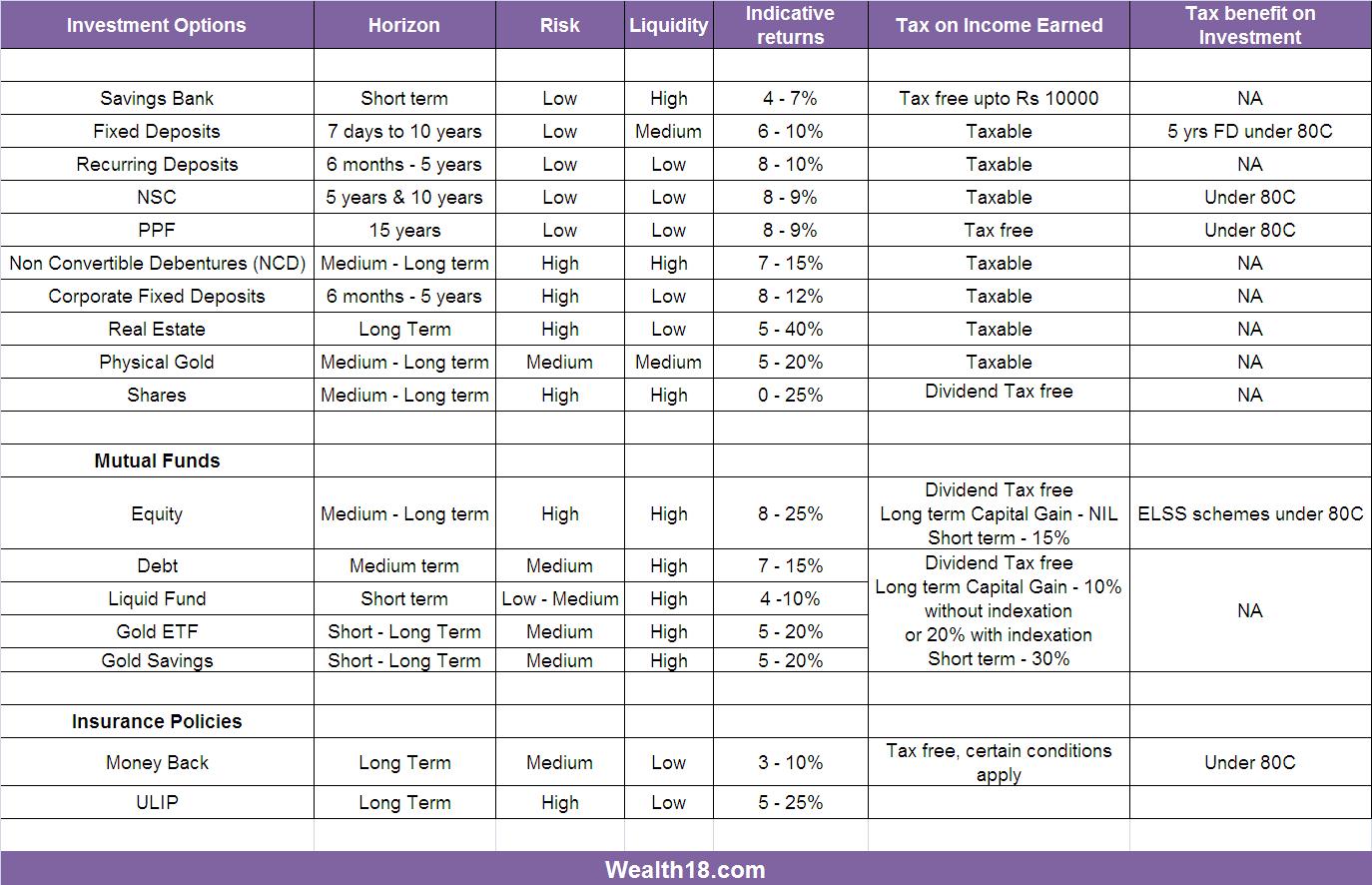

Simple Comparison of various available options:

Author’s Tip

- Keep 3-5 months of your monthly expenses in Savings Account. Alternatively you can put this money in Sweep-in FD account (Read my Article on – How to Earn 9% on your Savings Balance)

- Open a PPF Account (Read my Article on – Why should you invest in PPF)

- Start a SIP in diversified Equity mutual fund from as little as Rs 1000 per month (Read my article on – Basics of Mutual Funds)

- Based on your long term & shot term goals, allocate your money in various investment options – Equity, debt, commodities, real estate etc.