ICICI Securities recommend investors to start accumulating quality midcap stocks to ride the next leg of a major up move (around 30 percent from hereon).

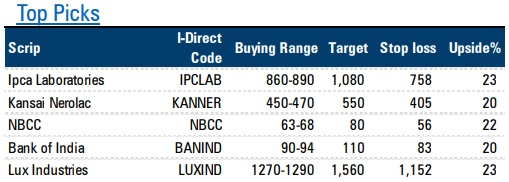

Ipca Laboratories | Target: Rs 1,080 | Stop loss: Rs 758

> Breakout from a five-year consolidation signals a structural turnaround

> A faster retracement as 14 quarters decline (Rs 906-400) is completely retraced in just six quarters

> We expect the stock to continue its current up move and test levels of Rs 1,090 as it is the 138.6 percent external retracement of the entire previous decline (Rs 907 to Rs 400)

Kansai Nerolac Paints | Target: Rs 550 | Stop loss: Rs 405

> At the cusp of a falling channel breakout containing entire decline since high of Dec’17 (Rs 614)

> A slower retracement as the stock has already taken 14 months to retrace just 80 percent of the previous 12 months’ up move from Rs 319 to Rs 614

> The favourable risk-reward set-up offers a fresh entry opportunity for upside toward Rs 560 as it is 80 percent retracement of the entire decline (Rs 614 to Rs 343)

NBCC India | Target: Rs 80 | Stop loss: Rs 56

> Double bottom breakout aided stock to resolve out of long-term falling trendline to longest pullback since November 2017 along with a faster retracement as six weeks decline (Rs 63-47) has been completely retraced in four weeks

> We expect the stock to resolve higher towards August 2018 high Rs 80 as it is the 61.8 percent retracement of the last decline (Rs 109 to Rs 47)

Bank of India | Target: Rs 110 | Stop loss: Rs 83

> The stock has been forming a base at key support zone of Rs 80 as on multiple occasions it respected May 2005 lows (Rs 80)

> Monthly RSI recorded a bullish crossover after witnessing a positive divergence

> We expect the stock to continue its current up move and test Rs 110 as it the high of January 2019 and 80 percent retirement of the previous major decline (Rs 119 to Rs 73)

Lux Industries | Target: Rs 1,560 | Stop loss: Rs 1,152

> Breakout from a major falling channel contains the entire corrective decline

> The stock in March rebounded from the major support area of Rs 1,100 as it is the major trendline support joining the lows of CY2016 (Rs 576) and CY2017 (Rs 650)

> The current improvement in price structure signals resumption of up move and open upside towards Rs 1,570 as it is 50 percent retracement of the entire decline (Rs 2,094-1,055).