See below the Brokerage recommendations on Best Stocks to buy in India for profits in 2020

2019 has been a year of large caps and experts believe that we can see a good rally in midcap and small cap quality stocks in 2020.

In Dec, various brokerage houses has provided their recommendations for stock picking for 2020. I have tried to consolidate the recommendations for your benefit:

Jan 2 2020 – 15 Stocks where brokerages initiated coverage (link)

| Brokerage | Stock | Target | CMP | Upside |

| Anand Rathi | Dixon Technologies | 5822 | 3913 | 49% |

| KR Choksey | Bandhan Bank: | 667 | 499 | 34% |

| Haitong Securities | Finolex Industries | 700 | 550 | 27% |

| Reliance Securities | V-Mart Retail | 2060 | 1664 | 24% |

| Jefferies | IndiaMart | 2500 | 2047 | 22% |

| Anand Rathi | Varun Beverages | 862 | 707 | 22% |

| Spark Capital | Polycab India | 1173 | 977 | 20% |

| Anand Rathi | Relaxo | 744 | 622 | 20% |

| ICICI Securities | Spandana Sphoorty | 1400 | 1181 | 19% |

| Axis Securities | KEC International: | 367 | 310 | 18% |

| Ambit | Motherson Sumi Sytstems | 176 | 149 | 18% |

| Axis Securities | Embassy Office Parks REIT | 495 | 422 | 17% |

| ICICI Securities | DB Corp | 155 | 135 | 15% |

| ICICI Securities | Entertainment Network | 300 | 265 | 13% |

| IDBI Capital | Jubilant Foodworks | 1836 | 1687 | 9% |

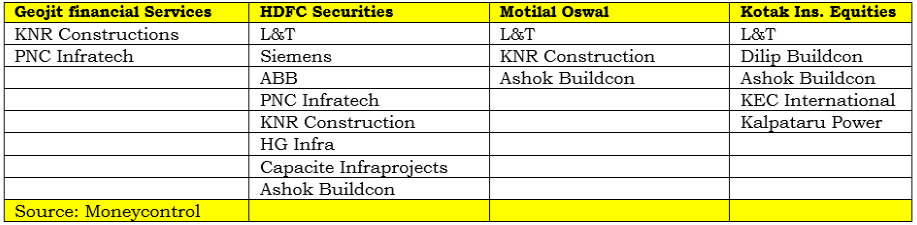

Jan 2 2020 – 10 Stocks ion focus – may benefit from Govt’s ambitious infra spend of Rs 100 lakh crores (link)

Jan 2, 2020 – Hemang Jani, Head– Advisory, Sharekhan – 6 stocks that can give 50% return in 2020 (link)

- Vinati Organics,

- Varun Beverages,

- Trent,

- Aarti Industries,

- Bajaj Holdings and

- V-Guard Industries.

Jan 2, 2020 – 17 quality stocks that can give 10-38% return in 2020 (link)

| Brokerage | Stock | Target | CMP | Upside |

| Nirmal Bang | Ashok Leyland | 92 | 84 | 10% |

| Eicher Motors | 24843 | 21600 | 15% | |

| Solar Industries | 1315 | 1115 | 18% | |

| Gujarat State Petronet | 303 | 232 | 31% | |

| Petronet LNG | 336 | 269 | 25% | |

| HUL | 2490 | 1941 | 28% | |

| Marico | 425 | 337 | 26% | |

| Inox Liesure | 450 | 379 | 19% | |

| V Mart retail | 2283 | 1664 | 37% | |

| Natco pharma | 747 | 620 | 20% | |

| Sun Pharma | 517 | 435 | 19% | |

| Motilal Oswal | Ultratech Cement | 5050 | 4244 | 19% |

| Globe Capital | Bharat Dynamics | 340 | 306 | 11% |

| DCB Bank | 210 | 183 | 15% | |

| HCL Technologies | 725 | 574 | 26% | |

| L&T | 1595 | 1345 | 19% | |

| Mahindra & Mahindra | 750 | 540 | 39% |

Jan 1, 2020 – Experts list 20 stocks for 2020 that could generate wealth (link)

| Brokerage | Stock |

| CapitalVia | Dabur India |

| Manappuram Finance | |

| ICICI Securities | |

| Affle India | |

| Adani Enterprises | |

| KIFS Trade | Bharat Electronics |

| Wipro | |

| SBI | |

| Jubilant Foodworks | |

| HDFC Bank | |

| SMC Investments | ICICI Bank |

| Gujarat Gas | |

| JB Chemicals & Pharmaceuticals | |

| Inox Leisure | |

| KEC International | |

| Geojit Financial | SBI Life |

| Religare | L&T |

| Britannia Industries | |

| Reliance Nippon Life AMC |

Stocks for 2020 (CNBC Experts on 30-Dec)

- Axis Bank

- Godrej Consumer Products

- HDFC life

- IRCTC

Moneycontrol’s “GOOD NEWS” stocks where you can expect good news in 2020 and are worth considering for investments:

- PVR

- RK Forging

- TATA STEEL

- SIS SECURITIES

- TIMKEN INDIA

Moneycontrol’s “SANTA” stocks where you can expect good triggers in 2020 and are worth considering for investments: (

- IRCTC

- L&T

- BPCL

7 stocks that have potential to rally

| Brokerage | Stocks | Upside |

| Axis Sec | L&T | 37% |

| SMC Global | KEC International | 33% |

| Religare Broking | Gujarat Gas | 22% |

| Nirmal Bang | HUL | 28% |

| SMC Global | ICICI Bank | 21% |

| Nirmal Bang | Gujarat State Petronet | 41% |

| Motial Oswal | UltraTech Cement | 24% |

JM Financial is bullish on Pharma for 2020

- Alembic, Torrent, Cipla, Natco and Sanofi are the top buys.

Motilal Oswal’s preferred sectors for 2020:

- Banking (ICICI Bank, Axis Bank, State Bank of India);

- fast-moving consumer goods (Hindustan Unilever and Colgate Palmolive);

- Cement and Capital goods (Larsen & Toubro, ABB, Siemens, Ultratech and JK Cement);

- Insurance (HDFC Life and ICICI Prudential Life) and

- hospitality (Indian Hotels)

Geojit Financial is bullish on:

- HDFC Bank, SBI Life Insurance, Aarti Industries

IndiaNivesh likes following stocks:

| Target | CMP | Upside | |

| ITC | 310 | 238 | 30% |

| Hindalco | 250 | 218 | 15% |

| Dr Reddys | 3370 | 2883 | 17% |

| Escorts | 810 | 631 | 28% |

CitiBank Top Picks for 2020

- The brokerage is ‘overweight’ on financials, healthcare, and industrials, and ‘underweight’ on consumer staples and auto space.

- Top large-cap picks of Citi include HCL Tech, HDFC Bank, ICICI Bank, IndusInd Bank, L&T, Maruti, Petronet LNG, SBI Life, and UltraTech Cement.

- Among midcaps, it prefers, ACC, Apollo Hospitals, Biocon, Indraprastha Gas, JSW Energy, JustDial, L&T Infotech, L&T Finance Holdings, Phoenix Mills, Polycab India, and SRF.

UBS Top Picks for 2020

- ‘overweight’ on financials, property, oil & gas, power utilities, life insurance, and telecom.

- ‘neutral’ on consumer staples, consumer discretionary, metals, pharma, cement, and industrials.

- ‘underweight’ on auto, IT services, and small and midcaps space.

Morgan Stanley’s focus list for 2020

- includes Bajaj Auto, M&M, Maruti Suzuki, Motherson Sumi, Indian Hotels, Jubilant FoodWorks, ITC, United Spirits, RIL, DLF, HDFC, HDFC Bank, ICICI Bank, M&M Financial, MCX, Shriram Transport, Ashok Leyland, InterGlobe Aviation, L&T, and Gujarat Gas.

- It has increased weightage in consumer discretionary, industrials, and financials and reduced weight on technology, healthcare, and materials.

Credit Suisse Top picks for 2020

- ‘overweight’ on financials like SBI, ICICI Bank, ICICI Life.

- In telecom, it likes Bharti Airtel,

- in utilities PowerGrid, and Tata Steel among metal stocks.

- minor ‘overweight’ on pharma (Dr. Reddy’s, Lupin) and IT (Tech Mahindra), and

- ‘underweight’ on discretionary, cement, and industrials.

Escorts Securities, Research Head-Aasif Iqbal: Top 20 Stocks to buy at CMP:

| Target | CMP | Upside | |

| Larsen & Toubro (L&T) | 1700 | 1302 | 31% |

| Reliance Industries | 2100 | 1544 | 36% |

| Biocon | 400 | 292 | 37% |

| Satia Industries | 140 | 82 | 71% |

| Syngene International | 410 | 322 | 27% |

| Info Edge | 3100 | 2543 | 22% |

| Affle (India) Limited | 1800 | 1614 | 12% |

| Lal Path Lab | 2100 | 1488 | 41% |

| ACC | 1750 | 1452 | 21% |

| Kansai Nerolac Paints | 650 | 508 | 28% |

| NIIT Tech | 1700 | 1584 | 7% |

| HDFC Life Insurance | 750 | 636 | 18% |

| Bharti Airtel | 610 | 460 | 33% |

| RITES Ltd | 370 | 290 | 28% |

| IRCTC | 1100 | 927 | 19% |

| Reliance Nippon Life | 450 | 363 | 24% |

| Apollo Hospitals | 1800 | 1419 | 27% |

| United Breweries | 1500 | 1280 | 17% |

| United spirits Limited | 730 | 592 | 23% |

| Sun Pharma | 550 | 430 | 28% |

HDFC Securities – Top Picks for 2020:

| Target | CMP | Upside | |

| Axis bank | 1100 | 756 | 46% |

| ICICI Bank | 800 | 544 | 47% |

| APL Apollo Tubes | 2700 | 1840 | 47% |

HDFC Securities’ 2020 outlook for major sectors and stock ideas (link)

- Financials: Axis bank and SBI

- Technology: Inforsys, Mphasis, L&T Infotech and Sonata Software

- Automobile: Bajaj Auto, Hero Moto

- Consumer: Voltas, Symphony, Jubilant Foods

- Oil & Gas: Gujarat Gas

- Cement: Ultratech Cement, Dalmia Bharat, Birla Corp, JK Cement

- Healthcare: Torrent Pharma, Cipla

- Industrials: L&T, KNR Constructions, PNC Infratech, KEC International

Axis Securities – 7 Stock Ideas for 2020 (link)

| Target | CMP | Upside | |

| Reliance Industries | 1711 | 1563 | 9% |

| L&T | 1736 | 1264 | 37% |

| Cholamandalam Inv & Fin | 387 | 303 | 28% |

| Minda Industries | 410 | 341 | 20% |

| KEC International | 367 | 277 | 32% |

| SIS India | 1100 | 909 | 21% |

| Mold Tek Pachaging | 351 | 272 | 29% |

Nirmal Bang Picks for 2020

| Target | CMP | Upside | |

| Ashok Leyland | 92 | 82 | 12% |

| Eicher Motors | 24843 | 22829 | 9% |

| City Union Bank | 250 | 235 | 6% |

| ICICI Bank | 584 | 544 | 7% |

| Hindustan Lever | 2490 | 1937 | 29% |

| Marico | 425 | 343 | 24% |

| Natco Pharma | 747 | 585 | 28% |

| Sun Pharma | 517 | 430 | 20% |

| Phoenix Mills | 900 | 835 | 8% |

Religare Broking top picks for 2020

| Target | CMP | Upside | |

| Bajaj Auto | 3723 | 3258 | 14% |

| Britannia | 3632 | 3047 | 19% |

| Coromandel International | 624 | 525 | 19% |

| Crompton Greaves Consumer | 299 | 241 | 24% |

| Gujarat Gas | 273 | 229 | 19% |

| INOX Liesure | 464 | 384 | 21% |

| L&T | 1618 | 1302 | 24% |

| Reliance Nippon Life | 419 | 363 | 15% |

| Tech Mahindra | 939 | 782 | 20% |

| The RAMCO cement | 902 | 759 | 19% |

Antique Research like “MNC” stocks for 2020 (link)

| Stocks | Target | CMP | 2 year Upside |

| Hindutan Lever | 1937 | 14-37% | |

| Nestle India | 14867 | 30-44% | |

| Siemens | 1518 | 32-46% | |

| Colgate Pamolive | 1466 | 16-32% | |

| Procter and Gamble | 11507 | 35-37% | |

| ABB India | 1300 | 44-68% | |

| Whirlpool | 2386 | 21-44% | |

| GlaxoSmithKline Pharma | 1611 | 35-44% | |

| Abbott India | 13196 | 18-44% | |

| Honeywell Automation | 27186 | 56-70% |

ShareKhan’s Top Value Picks (link)

| Target | CMP | Upside | |

| Aarti Industries | 976 | 771 | 27% |

| Bharat Electronics | 140 | 100 | 40% |

| Exide Industries | 241 | 186 | 30% |

| IPCA Lab | 1220 | 1133 | 8% |

| Kalpataru Power | 590 | 422 | 40% |

| KNR Constructions | 293 | 246 | 19% |

| L&T Finance Holdings | 120 | 116 | 3% |

ShareKhan’s Top Earning Compounders (link)

| Target | CMP | Upside | |

| Astral Poly | 1358 | 1168 | 16% |

| Biocon | 290 | 293 | -1% |

| Mahanagar Gas | 1155 | 1045 | 11% |

| Relaxo | 650 | 610 | 7% |

| Spandana Sphoorty | 1340 | 1192 | 12% |

| Trent | 650 | 505 | 29% |

| Varun Beverages | 872 | 700 | 25% |

| V-Guard Industries | 285 | 218 | 31% |

| Vinati Organics | 2361 | 1960 | 20% |

For previous recommendations, please see the previous pages below