PSP Projects, a construction company is coming up with its IPO on 17-May-2017

Issue Details of PSP Projects IPO:

- IPO Open : 17 May – 19 May 2017

- Issue Price band: Rs 205 – 210 per share

- Issue Size: Rs 206 crores ( XX Shares)

- Market lot : 70 shares (application per share Rs 210)

- Minimum Investment: Rs 14700 (Upper band)

- Book Running Lead Managers : Karvy

- Registrar – Karvy

- Listing: BSE/NSE

IPO Issue Allocation

- Qualified institutional buyers (QIBs) – 50% of the total issue size.

- Non-institutional investors (NIIs) – 15% of the issue size.

- The retail quota limit in the issue = 35% of the issue size.

Background

It is a multidisciplinary construction company offering a diversified range of construction and allied services across industrial, institutional, government, government residential and residential projects in India. We provide our services across the construction value chain, ranging from planning and design to construction and post construction activities to private and public sector enterprises. Historically, the company has focused on projects in the Gujarat region. The company has completed and continue to undertake construction projects in this region. More recently, it has geographically diversified the portfolio of services and undertaking or have bid for projects pan India.

Since the incorporation in August 2008, the company has executed over 71 projects as of November 30, 2016. Some of the key projects, the company has completed are:

- Industrial – manufacturing and processing facilities for customers such as Torrent Pharmaceuticals Limited, Nirma Limited, Intas Pharmaceuticals Limited, Cadila Healthcare Limited, Claris Injectables Limited, KHS Machinery Private Limited and Inductotherm (India) Private Limited.

- Institutional – construction of Zydus Hospital, GCS Medical College, Hospital and Research Centre (managed by the Gujarat Cancer Society), and the CIMS Hospital.

- Government: Swarnim Sankul 01 and 02 at Gandhinagar,interior work for the ICEM Building at Ahmedabad. affordable high-rise residential buildings cum commercial units in Gujarat under the “Mukhya Mantri GRUH Yojana” for a major Gujarat-based public sector customer.

Promoters holdings:

- Prahaladbhai Shivrambhai Patel: 55%

- Shilpaben Patel: 20%

- Sagar Patel: 15%

- Pooja Patel: 9.99%

- The Offer for Sale : Company will not receive any proceeds from the Offer for Sale.

- The Fresh Issue: The Net Proceeds from the Fresh Issue will be utilised towards the following objects:

- 1. Funding working capital requirements of our Company;

- 2. Funding capital expenditure requirements of our Company; and

- 3. General corporate purposes

Anchor Investors: Will be available one day before the IPO opens

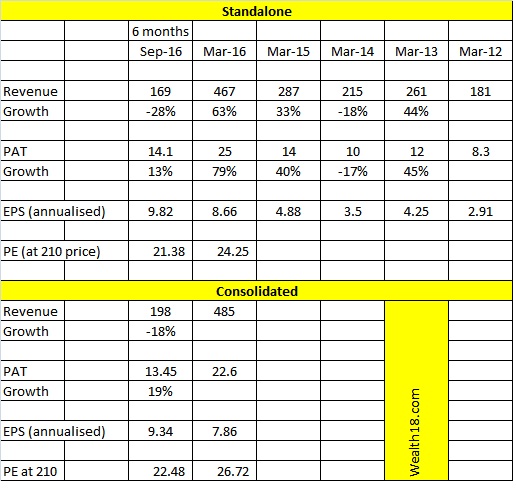

Financials:

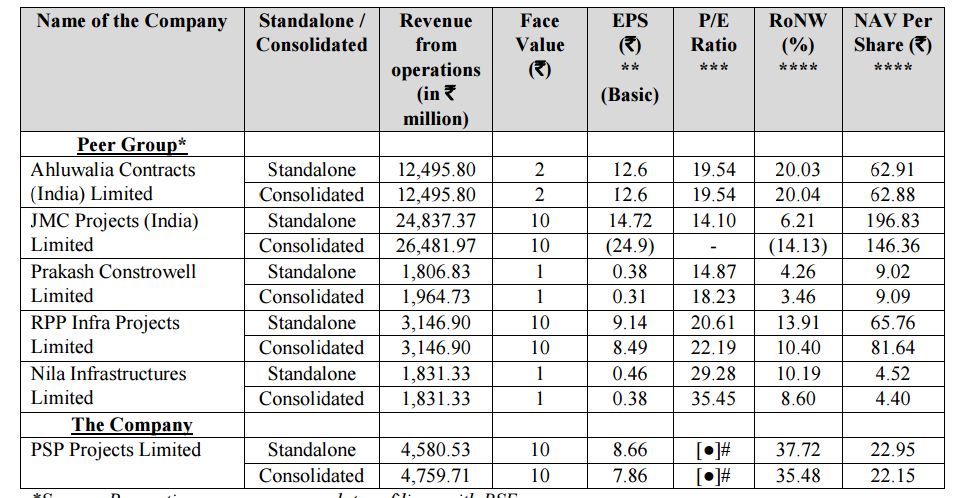

Valuation as compared to its peers:

PSP IPO is valued at 26 times FY 2016 consolidated earnings which is high as compared to its peers.

Brokerage Recommendations:

Should you invest: You should consider avoiding this IPO as i) the issue seems expensive as compared to its peers ii) the sales for 2016-2017 seems to be declining based on 6 months figures.

[xyz-ihs snippet=”ad1″]

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.