In Budget 2019, government has announced a Mega Pension Yojana, namely Pradhan Mantri Shram Yogi Mandhan (PM-SYM), to provide assured monthly pension of Rs 3000 per month for workers in the unorganised sector. Unorganised sector workers with income up to Rs 15,000 per month, will get pension after after 60 years of age for a contribution of Rs 100 per month.

In this post, I am providing more details about features of this pension yojana, its eligibility and application details:

Features – Pradhan Mantri Shram Yogi Mandhan (PMSYM) Pension Yojana

- Contribution: The applicant opting for this pension yojana, needs to contribute a certain amount (Rs 55 – Rs 200 depending ion your age) in the pension account every month.

- If you join the scheme at the age of 18 years, you will need to make monthly contributions of Rs. 55 till they attain the age of 60 years.

- If you join the scheme at 29 years of age or more, then you will need to deposit Rs. 100 every month.

- The government will contribute similar amount in the pension account

- Once the applicants reach the age of 60 years, the subscriber (pension scheme holder) will get a monthly pension Rs.3000.

Eligibility – Pradhan Mantri Shram Yogi Mandhan (PMSYM) Pension Yojana

- Any applicant from the unorganised sector or organised sector labour, This Scheme applies to the unorganised workers who are working or engaged as home- based workers, street vendors, mid-day meal workers, head loaders, brick kiln workers, cobblers, rag pickers, domestic workers, washer men, rickshaw pullers, landless labourers, own account workers, agricultural workers, construction workers, beedi workers, handloom workers, leather workers, audio- visual workers and similar other occupations.

- Minimum Age: 18 years, Maximum Age: 40 years

- The applicant will be deposit money in the scheme till 60 years.

- Income: Pradhan Mantri Shram Yogi Mandhan Yojana (PMSYM) is open for applicant with monthly income of less than or equal to Rs.15,000 per month. You must submit the Income proof for this scheme. You should not be an Income tax payer

- You need to submit ID proof, age proof and income proof. You should have Aadhar card and Savings Bank Account.

You will not be eligible for this scheme if you are already a member of other pension schemes. For e.g. if you are already under National Pension Scheme (NPS) where contribution is made by the Central Government or Employee State Insurance Corporation Scheme or Employee Provident Fund or if you are an income tax assessee.

Premium Table for Pradhan Mantri Shram Yogi Mandhan (PMSYM) Pension Yojana

When will you get the monthly pension

- Once you reach the age of 60 years, you will get a monthly pension Rs.3000.

What happens if the subscriber dies :

- If the eligible subscriber dies due to any cause (before 60 years of age) , then the spouse shall have an option to continue the scheme by making regular contribution or exit the scheme by receiving share of contribution paid by the subscriber along with accumulated interest or savings bank interest rate, whichever is higher.

- If the applicant (pension holder) dies (after 60 years), then your spouse is eligible to receive 50% of the pension received by the subscriber. Note that the children of the subscriber will not be allowed to receive any pension benefit after his/her death.

What if I want to leave the scheme early (before 60 years)

- If leave within 10 years: If a subsciber wants to leave the pension scheme within 10 years , then he can get back the total amount saved alongwith the interest

- If leave after 10 years but before reaching 60 years: If a subsciber wants to leave the pension scheme after 10 years but before 60 years of age,then he can get back the total amount saved alongwith the interest + some premium

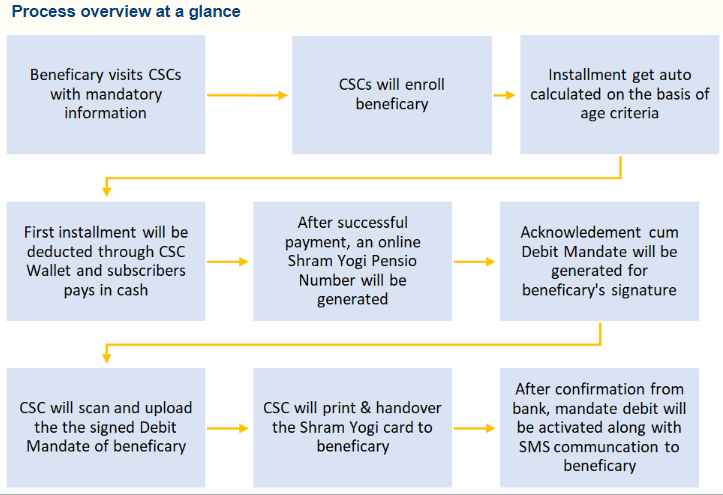

What is the process to apply and open the Pradhan Mantri Shram Yogi Mandhan account

- Interested eligible person shall visit neared CSC centre. Location of CSC centre can be checked here

- While going to CSC for enrolment, he shall carry with him the following :

a. Aadhar Card

b. Bank Account details along with IFS Code (Bank Passbook or Cheque Leave/book or copy of bank statement as evidence of bank account)

c. Mobile handset for OTP verification

d. Initial contribution amount for enrolment under the scheme - Village Level Entrepreneur ( VLE ) present at the CSC will key-in aadhar number, name of subscriber as printed on aadhar card and date of birth as given in aadhar card and the same will be verified with UDAI database through a process of demographic authorization.

- Further details like Bank Account details, Mobile Number, Email-id, if any, spouse and nominee details will be captured.

- Self-certification for eligibility conditions will be done.

- System will auto calculate monthly contribution payable according to age of the subscriber.

- Subscriber shall also pay the amount of initial contribution under the scheme to the VLE who will generate receipt to handed over to the subscriber. At the same time, a unique SYM number will be generated and SYM Card will be printed at CSC. Enrolment Form cum Auto Debit mandate will also be printed which will then be signed by the subscriber. VLE then shall scan the signed enrolment cum auto debit mandate and upload into the system.

- With completion of process, subscriber will be having with him SYM card and signed copy of enrolment form for his record.