Last date for linking PAN and Aadhaar has been extended

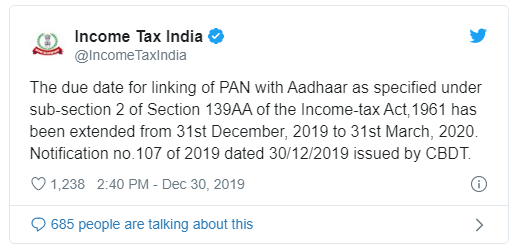

Relief for people who have not yet linked their PAN with Aadhaar. The due date for linking PAN with Aadhaar has now been extended to 31st March 2020.

This is the 9th time when CBDT has extended the deadline for individuals to link their PAN and Aadhaar.

See below the twitter update from Income Tax India:

How to Link your PAN with AAdhaar?

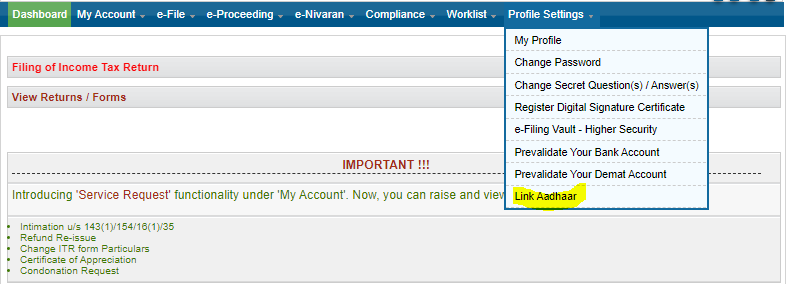

- If you are registered on Income Tax efiling website

Login to eFiling Website –> Go to “Profile Setting” –> Link Aadhaar

https://www.incometaxindiaefiling.gov.in/home

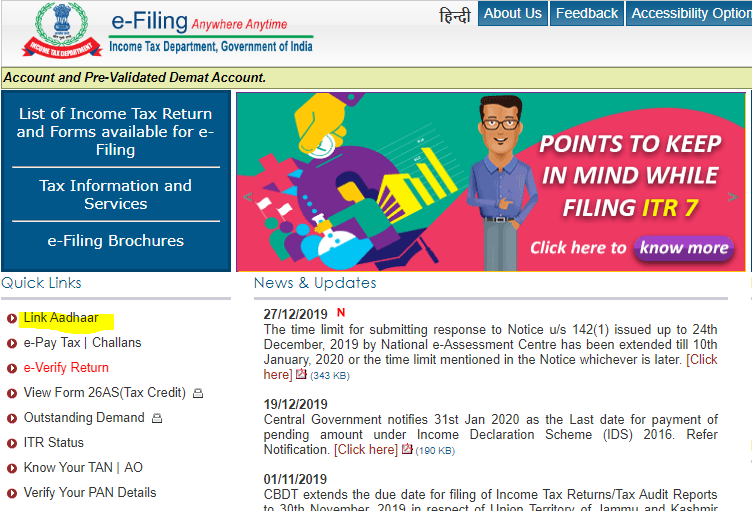

2. If you are not registered on Income Tax efiling website:

Fine the “Link Aadhar” link on the home page of Income Tax efiling website (left side column)

If your name on PAN and Aadhar doesnot match but date of birth and gender matches, an Aadhaar OTP will be generated and sent to the mobile number registered/linked to the Aadhaar. You will have to enter that OTP online to continue and complete the linking process.

3. By sending an SMS to PAN service providers

You can also link your PAN and Aadhar by sending SMS in specific format (Mobile charges may apply)

SMS Format: UIDPAN<SPACE><12 digit Aadhaar><SPACE><10 digit PAN>

Send this SMS to 567678 or 56161

4. Manual Form Option (in case of mismatch)

If you are not able to register online / SMS due to mismatch in PAN and Aadhaar data, then you need to:

- visit a service centre of PAN service provider, NSDL or UTIITSL.

- fill in the form ‘Annexure-I’ along with the supporting documents i.e. copy of PAN card and Aadhaar card.

- need to pay fee for correction (PAN card correction – Rs 110 / Aadhaar card correction: Rs 25)