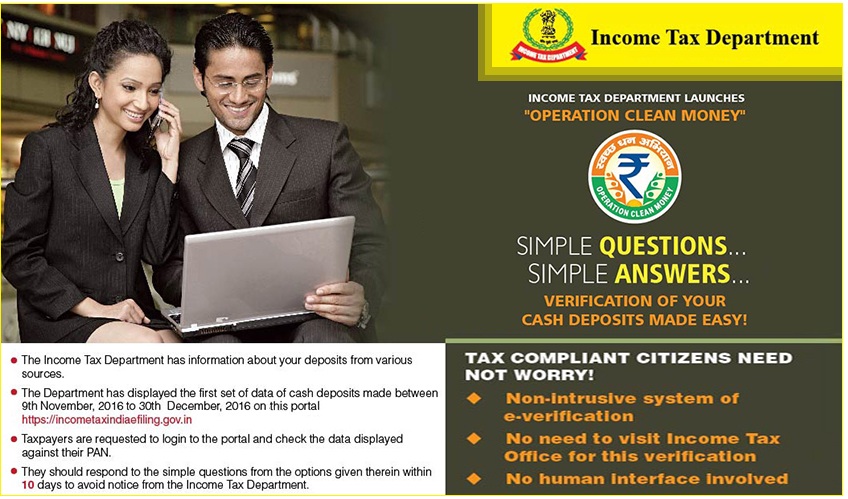

Income Tax department has launched “Operation Clean Money / Swachh Dhan Abhiyan initiative., to investigate the large cash deposits made after demonitization. They are sending notices to more than 18 lakh people.

If you have deposited large cash after demonitoization, the chances are that you will or may already have got a notice from Income Tax.

You need to respond within 10 days of getting the message.

If you have made large deposit, but have not received any message yet, please check your e-filing account to see if there is any notice for you.

You can get notice:

- if your high-value transactions are not in line with your income profile.

- or may be because of technical error when a cash deposit was wrongly connected to your PAN.

So it is important that you login to your efiling account and check if there is any message from the tax department.

Must Check

Income Tax Department has issued 19 page User Guide – Online Verification of Cash Deposits during 9th Nov to 30th Dec 2016 – Download CashTransactions_UserGuide

[xyz-ihs snippet=”ad1″]

How to check for Notice

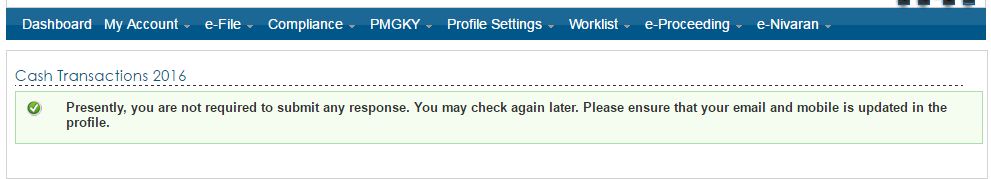

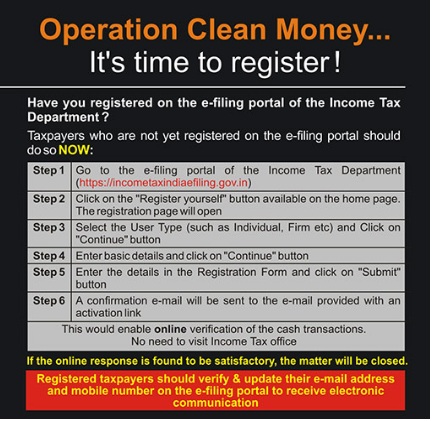

1. Login to you efiling account – https://incometaxindiaefiling.gov.in

2. Click the “Cash Transactions, 2016” option from the drop down list under “Compliance” section.

If there is no cash deposit-related compliance against your profile, it will show the message: “Presently, you are not required to submit any response. You may check again later. Please ensure that your email and mobile is updated in the profile.”

However, if you did make deposits that are out of tune with your past returns, it will reflect the details of transactions related to cash deposits between 9 November and 30 December 2016. In such a case, you will be further required to submit responses, which can be done online.

[xyz-ihs snippet=”ad-full”]

How to Submit response to the Income Tax Notice

The response can be submitted in two steps.

1. The first step is to acknowledge whether the transaction information belongs to you or not. For each transaction, you can choose: “The account relates to this PAN” or “The account does not relate to this PAN”. There are possibilities that cash deposit transactions were wrongly credited against your PAN.

2. If the transaction belong to your PAN, then you need to confirm that the amount mentioned in the transaction or deposit is correct. If there is a mismatch in what you deposited and the amount against which the department is seeking your response, you can mention the correct amount you had deposited in the bank account

3.Explanation of deposit: Once you confirm the amount of money deposited by you in the bank account, the next step is to give details about the deposited amount.

Based on the information provided by the individual, the department will take further necessary action. If the deposited amount in the bank is from more than one categories (or out of cash in hand), the details of each source and amount from it needs to be mentioned.

If you claim that the deposited cash was out of earlier income or savings, you may need to provide additional information, which will be matched with your income tax returns filed earlier. If this is not in line with the taxpayer’s profile or other available information, the case may be selected for verification based on the risk criteria.

If cash is claimed to be out of receipts exempt from tax, such as agricultural income, gift, and donation, further details need to be provided such as name and PAN of the person who gifted or donated. In the other three options you can mention that the cash deposited is received from another person. Here you have to give a break-up of the: “Cash received from identifiable persons (with PAN)”, “Cash received from identifiable persons (without PAN)”, and “Cash received from un-identifiable persons”. But if someone mentions the source of the cash as received from another person—whether identifiable or not—it may attract trouble. This is because the income tax department has warned people against depositing others’ money in their own account

Besides that, you can also mention that the deposited money is disclosed or is to be disclosed under Pradhan Mantri Garib Kalyan Yojana.

Summary – Even if you have not received any such email or message, you should proactively login to the e-filing account and check if there is any compliance intimation to be addressed. Check your e-filing even if you have not made large deposits.