HDFC Life is one of the leading life insurer in India, offering a range of individual and group insurance solutions. Its portfolio comprises various insurance and investment products such as Protection, Pension, Savings, Income and Health.

Issue Details of HDFC Life Insurance IPO:

- IPO Open: 7th Nov – 9th Nov 2017

- Issue Price band: Rs 275 – Rs 290

- Issue Size: Rs 8700 crore

- Market lot: shares

- Minimum Investment: (Rs per share)

- Max Investment for Retail Investor – xx shares

- Book Running Lead Managers: Edelweiss

- Registrar: Karvy

- Listing: BSE/NSE

- Download – HDFC Life Insurance IPO Red Herring Prospectus

HDFC Life Insurance IPO Grey market Premium :

- 22.10.2017 GMP Rs per equity share

IPO Issue Allocation:

- Qualified institutional buyers (QIBs) – 50% of the offer.

- Non-institutional bidders – 15% of the offer.

- Retail individual bidders – 35% of the offer.

Background:

HDFC Life is one of the top 3 private life insurers in India and one of the most profitable as well. The company is a joint venture of joint venture between HDFC (one of India’s leading housing finance institutions) and Standard Life Aberdeen plc (one of the world’s largest investment companies), initially through its wholly owned subsidiary The Standard Life Assurance Company and now through its wholly owned subsidiary, Standard Life Mauritius.

The company has broad, diversified product portfolio covering five principal segments across the individual and group categories, namely participating, non-participating protection term, non-participating protection health, other nonparticipating

and unit-linked insurance products

| New Business Premium (in crores) | |

| 2017 | 8696 |

| 2016 | 6487 |

| 2015 | 5492 |

Industry Overview:

Top Shareholdings: Top Shareholders:

- HDFC: 61.21%

- Standard Life: 34.75%

- Aziz Premji Trust: 0.94%

Objective of the issue: The company will not receive any proceeds from the Offer. The objects of the Offer are to achieve the benefits of listing the Equity Shares on the Stock Exchanges and to carry out the sale of Offered Shares by the Promoter Selling Shareholders.

Anchor Investors: One day before the issue.

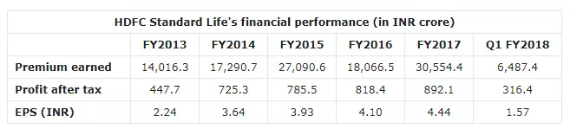

Financials:

| in crores | Total Income

(in crores) |

PAT

(in crores) |

||

| 2017 | 1013 | 892 | ||

| 2016 | 897 | 818 | ||

| 2015 | 872 | 785 | ||

| 2014 | 879 | 725 | ||

| 2013 | 461 | 448 | ||

EPS for the last 3 years is 4.5 (2017), 4.1 (2016) and 3.9 (2015). At the issue price of Rs 290 , the PE ratio of 65 times (EPS 4.44).

Valuation as compared to its peers:

| Similar Companies | CMP | Market Cap | PE Ratio |

| ICICI Prudential | 395 | 56751 | 33 |

| SBI Life | 662 | 66170 | 69 |

- SBI Life IPO has issue price of 700, and the current market price is below that.

- ICICI Prudential IPO has issue price of 334 (Sep 2016) and CMP is 18% returns.

The price range implies a multiple of 3-3.15 its 2019 embedded value, a ratio that measures the present value of future profits.

Last year, ICICI Prudential was priced at 3.44 times its embedded value and this year SBI Life close to 4 times.

Brokerage Recommendations:

| Brokerage | Subscribe |

Should you invest: Based on the embedded value, it seems that the pricing is reasonable as compared to ICICI Pru Life & SBI Life. But based on the PE ratio, it seems expensive as compared to ICICI Life.

However, you should not expect major gains from the listing, as the Life insurance is long term play. Investors may consider to apply in this IPO with a long term view and reasonable returns.