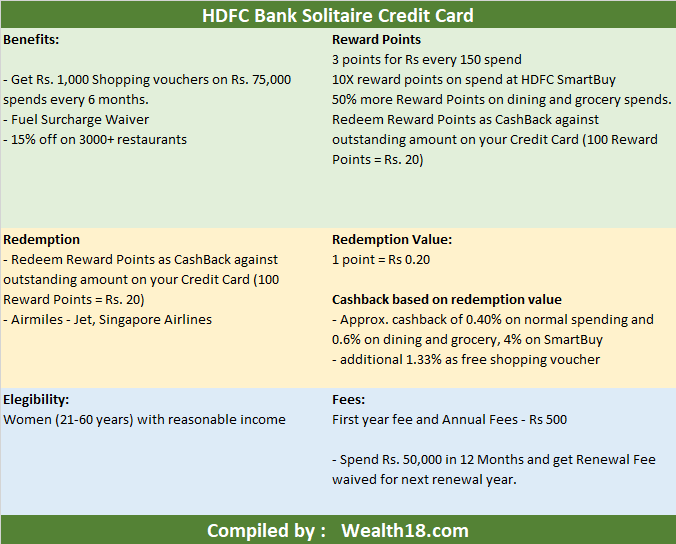

HDFC Solitaire Credit Card is an exclusive premium Credit Card for women with rewarding spends – Shoppers Stop gift vouchers.

Features

- Get Rs. 1,000 Shopping vouchers on Rs. 75,000 spends every 6 months.

- Fuel Surcharge Waiver capped at Rs. 250 every billing cycle

- 15% off on 3000+ restaurants

Reward Points Collection

- 3 Reward Points on Rs. 150 spent.

- 50% more Reward Points on dining and grocery spends.

- 10X reward points on HDFC SmartBuy Site

Reward Points Redemption

- Redeem Reward Points as CashBack against outstanding amount on your Credit Card (100 Reward Points = Rs. 20)

- Reward Points against air miles of Jet Airways (Jet Privilege Miles) and Singapore Airlines (KrisFlyer Miles).

- Get Rs. 1,000 Shopping vouchers on Rs. 75,000 spends every 6 months. (i.e. voucher of Rs 2000 per annum)

Points Value / Cashback equivalent based on redemption

1 point = Rs 0.20

- Approx. cashback of 0.40% on normal spending and

- Approx. cashback of 0.60% on dining and grocery,

- Approx. cashback of of 40% on SmartBuy spending

Additional 1.33% cashback equivalent as free shopping voucher (making a total cashback between 1.73% to 5.33%)

Fees

- First year fee and Annual Fees – Rs 500

- First year fee waived off if you spend Rs 10000 in first 90 days

- Spend Rs. 50,000 in 12 Months and get Renewal Fee waived for next renewal year.

Summary

This is an exclusive credit card for women and offer shopping benefits. The key highlight is getting Rs 1000 shopping voucher on spending on Rs 75000 in 6 months (equivalent to 1.33% cashback).

There are many credit cards offered by HDFC bank with different features including discount on movies, groceries, dining as well as air travel and hotels, free international and domestic lounge access. Some of the cards offers redemption rewards equivalent to 13%-33% cashback, that’s pretty amazing. See list of all credit cards offered by HDFC Bank and check which one you should go for.