Four Seasons Residency, a hotel company is coming up with its IPO on XXXX.

Issue Details of Four Seasons Residency IPO:

- IPO Open :

- Issue Price band:

- Issue Size:

- Market lot :

- Minimum Investment:

- Book Running Lead Managers :

- Registrar –

- Listing: BSE/NSE

IPO Issue Allocation

- Qualified institutional buyers (QIBs) – 75% of the offer.

- Non-institutional bidders – 15% of the offer.

- Retail individual bidders – 10% of the offer.

Background

Four Seasons Residency Limited (FSRL) was incorporated as “Four Seasons Residency Private Limited” in April 2009. Thereafter a fresh certificate of incorporation consequent upon change of name on conversion of the company to public limited company in the name of the “Four Seasons Residency Limited” was granted in Sep 2011.

At present there is no business activity in the company.

FSRL owns a land in Gandhinagar, Gujarat where it intends to build a hotel to be known as “The Westin Gandhinagar Ahmedabad Road” upon completion. FSRL has entered into an operating services agreement with Starwood Hotels & Resorts India Private Limited (“Starwood”) and its affiliates relating to the supervision, direction and control of the operation of the hotel on a sole and exclusive basis during the operating term in return for a stipulated fee.

Upon completion of the construction, the hotel will have the following facilities:

- Minimum 230 Guest Rooms, with a minimum room size of 42 square meters (net carpet area of the room including vestibule and bathroom area);

- 2,500 square meters of meeting space;

- Adequate parking spaces dedicated to the exclusive use of the hotel;

- 3 food and beverage facilities including one lobby lounge, one three-meal restaurant, and one specialty restaurant;

- Recreational facilities including gym/work-out facility and swimming pool; and

- 500 square meter spa.

The hotel is estimated to open on April 1, 2020. Under the License Agreement, FSRL has been granted the non-exclusive right for the hotel to be operated under the Westin® brand in return for a monthly fee. Further, under the Centralized Services Agreement, the hotel has access to certain programs and services that are available to substantially all of the operating hotels under the Westin® brand including access to Starwood’s reservation system, sales and marketing and the Starwood Preferred Guest Program.

Promoters holdings:

The list of the top shareholders of the company and the number of equity shares held by them is as below:

- Sampati Securities Limited : 75.48%

- Bharati A Dhanak : 14.42%

- Riddhi Securities Limited : 5.79%

- Viral M Shah : 3.07%

- General Capital and Holding Company Limited : 0.98%

- Zankarsinh K Solanki : 0.06%

- Mona V Shah : 0.06%

- Dhara Z Solanki : 0.06%

- Rupen M Modi : 0.06%

- Gyscoal Enterprise Private Limited : Negligible

Objective of the issue:

The company proposes to utilize the funds which are being raised towards funding the following objects:

- Capital expenditure for setting up a hotel;

- General corporate purposes; and

- To meet the Issue expenses.

The company believes that listing will enhance its brand equity and provide liquidity to its shareholders.

Anchor Investors: Will be available one day before the IPO opens

Risks:

- In recent past,

Financials: NIL as the company is not yet operational.

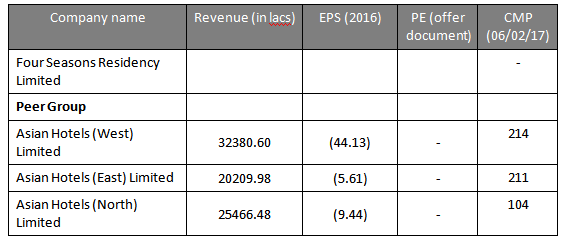

Valuation as compared to its peers:

Brokerage Recommendations:

Should you invest:

[xyz-ihs snippet=”ad1″]

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.