CarTrade Tech IPO is opening on 9th Aug 2021. CarTrade Tech is a multi-channel auto platform (Online auto classifieds platform) with coverage and presence across vehicle types and value-added services through its brands — CarWale, CarTrade, Shriram Automall, BikeWale, CarTradeExchange, Adroit Auto and AutoBiz

Issue Details of CarTrade Tech IPO:

| IPO Opens on | 09 Aug 2021 |

| IPO Closes on | 11 Aug 2021 |

| Issue Price band | Rs 1585 – Rs 1618 |

| Any Discount | NA |

| Issue Size | Rs 2999 crore |

| Minimum Investment | 9 shares lot (min amount 14562) |

| Max Investment (Retail) | 13 lots / 117 shares (amount Rs 189306) |

| Registrar | Link Intime |

| Book Running Lead Managers | Axis Capital, Citigroup, Kotak Capital, Nomura |

| Listing | BSE/NSE |

| Download | Red Herring Prospectus |

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

CarTrade Tech IPO Grey market Premium :

As per market observers, CarTrade Tech IPO grey market premium (GMP) was at around

- Rs 690 – 7th Aug

- Rs 450 – 9th Aug

IPO Issue Allocation:

- QIB = Not More than 50% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 35% of the offer

Background:

CarTrade Tech is a multichannel auto platform and operate under several brands like CarWale, CarTrade, Shriram Automall, BikeWale, CarTradeExchange, Adroit Auto and AutoBiz. The company enables new and used automobile customers, vehicle dealerships, vehicle original equipment manufacturers (OEMs) and other businesses to buy and sell their vehicles. with coverage and presence across vehicle types and value-added services. CarTrade had picked up a 51% stake in Shriram Automall in January 2018 for around Rs157 crore. In 2015, it had acquired rival CarWale in a move to consolidate the online auto classifieds industry.

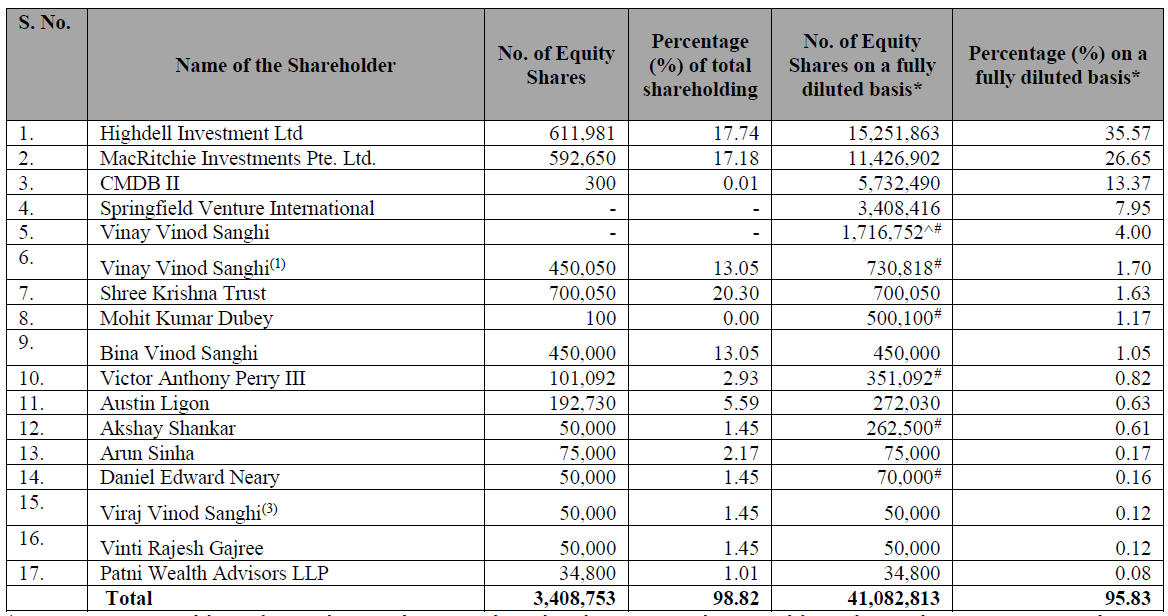

Top Shareholdings:

CarTrade is backed by American private equity giant Warburg Pincus, Singapore’s state investor Temasek, JPMorgan, and March Capital Partners

Objective of the issue:

- CMDB II will offload 22.64 lakh equity shares,

- Highdell Investment Ltd will sell 84.09 lakh equity shares,

- Macritchie Investments Pte Ltd will offer 50.76 lakh equity shares and

- Springfield Venture International will divest 17.65 lakh equity shares.

Anchor Investors:

CarTrade has mobilised Rs 900 crores from Anchor Investors. Nomura, HSBC Global, Goldman Sachs, Jupiter India Fund, Elara India Opportunities Fund, Aditya Birla Sun Life Insurance Company, Bajaj Allianz Life Insurance Company, Bharti Axa Life Insurance Company, Axis Mutual Fund (MF), HDFC MF, Kotak MF and Sundaram MF are among the anchor investors.

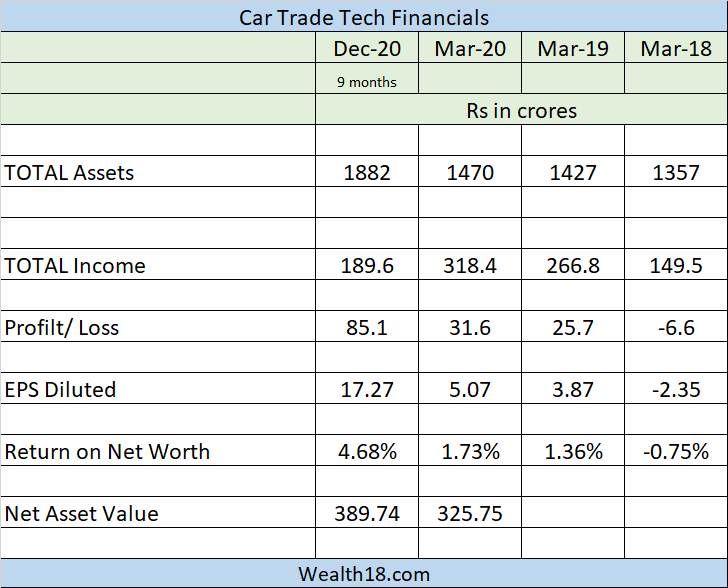

Financials:

The price/earnings ratio based on diluted EPS for FY21 for the company at the upper end of the price band is 84.31.

Valuation as compared to its peers:

There is no listed competitor. CarTrade tech is the only profitable online second-hand seller/car aggregator when compared to its peers Cars24, CarDekho, Mahindra First Choice and Droom.

For the June 2021 quarter, its consumer platforms, CarWale, CarTrade and BikeWale collectively had an average of 27.11 million unique visitors per month, with 88.14% being organic visitors.

Pros

- Profitable business model

- operate various brands CarWale, CarTrade, Shriram Automall, BikeWale, CarTrade Exchange, AutoBiz with 27.11 million unique visitors per month

Cons

- there may be general decline in individual car ownership due to trend towards ride hailing services

Brokerage Recommendations:

| Brokerage | Recommendations |

| ICICI Direct | Subscribe |

| Anand Rathi | Subscribe |

| Angel Broking | Subscribe |

| Nirmal Bang | Subscribe |

Should you invest:

Robust financials and profitable platform. I would consider to invest in this IPO.

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Disclaimer: This is not an investment advice and is only for educational purposes. Please consult your financial advisor before taking any financial decisions.

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | |

| Initiation of Refunds | |

| Credit of Equity Shares: | |

| Listing Date: |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | 0.01 | 0.59 | 35.45 | |

| NII | 0.03 | 0.27 | 41 | |

| Retail | 0.80 | 1.53 | 2.75 | |

| Employee | ||||

| TOTAL | 0.41 | 0.99 | 20.29 |

How to apply for XX IPO through Zerodha

Zerodha customers can apply online in CarTrade Tech IPO using UPI as a payment gateway. Zerodha customers can apply in CarTrade Tech IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘Devyani International IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.