Update : On day 3 (last day), AETL IPO Oversubscribed 115 times.

- Financial institutions – oversubsrcibe 94 times

- HNI – subsrcibe 393 times

- Retail- oversubsrcibe 10.48 times

As the retail portion is oversubscribed, the allocation will be by draw. Not every applicant will get the allotment.

Update : On day 2, AETL IPO Oversubscribed approx 5 times.

- Financial institutions – oversubsrcibe 5.9 times

- HNI – subsrcibe 0.89 times

- Retail- oversubsrcibe 4.89 times

Advanced Enzyme Technologies IPO in opening from 20th – 22nd July. The company is the largest domestic enzyme company, engaged in research, development, manufacture and marketing of over 400 proprietary products developed from 60 indigenous enzymes. It ranks among the top 15 global companies in terms of enzyme sales and has the second highest market share domestically, next only to the world’s largest enzyme company Novozymes.

Earlier in 2013, the company had approached Sebi to launch its IPO and had also obtained its approval. However, the company did not go ahead with its plan.

Issue Details of Advanced Enzyme Technologies IPO:

- IPO Open : 20th – 22nd July 2016

- Issue Price band: Rs 880 – 896

- Issue Size: 412 crore – (Rs 362 crore of the issue is offer for sale (OFS) from existing investors, while Rs 50 crore is fresh-capital raising).

- Market lot : 16 shares

- Minimum Investment: Rs 14336

- Book Running Lead Managers : ICICI Securities and Axis Capital

- Registrar –

- Listing: BSE/NSE

[xyz-ihs snippet=”ad1″]

Advanced Enzyme Technologies IPO Issue Allocation

- Qualified institutional buyers (QIBs) – 65% of the total issue size.

- Non-institutional investors (NIIs) – 15% of the issue size.

- The retail quota limit in the issue = 35 % of the issue size.

Background:

The company is the largest domestic enzyme company, engaged in research, development, manufacture and marketing of over 400 proprietary products developed from 60 indigenous enzymes.

It ranks among the top 15 global companies in terms of enzyme sales and has the second highest market share domestically, next only to the world’s largest enzyme company Novozymes

It operates in two primary business verticals namely healthcare and nutrition (human and animal) and bio-processing (food and non-food). Company has over 20 years of fermentation experience in the production of enzymes.

It offers products to its global clientele of over 700 customers spanning across 50 countries, Rathi said.

Global growth is estimated to be led by speciality enzymes while industrial enzymes are expected to see moderate growth.

North America dominates the global enzyme market. The domestic enzyme market is expected to grow from USD 105 million in 2015 to USD 279 million in 2020 ( Rs 600 crore to 1500 crore) . The company aims to replace traditionally used chemicals with eco-friendly enzymatic solutions.

The company has 13 patents registered in its name and applications for registration of 4 patents are pending.

The Company has 6 manufacturing units – Nashik (2), Indore (1) , Thane (1), California USA (2)

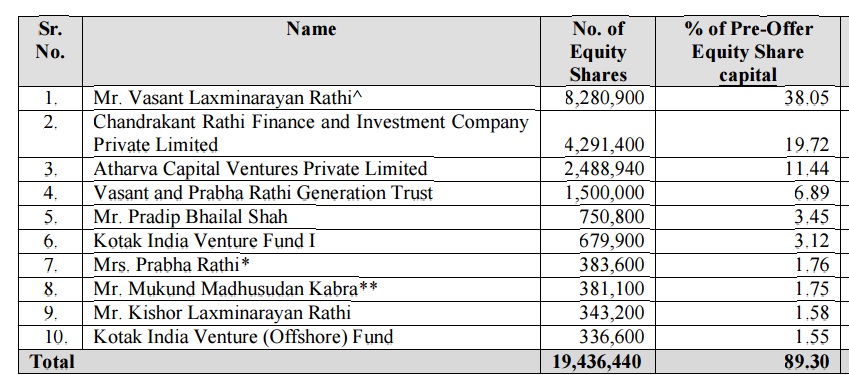

Promoters holdings: At the end of March 2016

Objective of the issue: The Offer consists of a Fresh Issue by the company and an Offer for Sale by the Selling Shareholders.

1. Offer for Sale : Company will not receive any proceeds from the Offer for Sale. Through the OFS, promoter group will sell 2.68 million shares while 517,200 shares will be offered by various Kotak private equity (PE) entities. Kotak PE owns nearly 4.75% equity stake in the company while promoters hold 63.11%.

2. The Fresh Issue : The proceeds of the fresh issue will be utilised towards investment in the company’s wholly-owned firm Advanced Enzymes USA, repayment of certain loans and for other general corporate purposes.

Financials:

| Particulars | For the year/period ended (in Rs. Million) | ||||

| 31-Mar-16 | 31-Mar-15 | 31-Mar-14 | 31-Mar-13 | 31-Mar-12 | |

| Total Assets | 4,182.20 | 4,082.76 | 3,963.46 | 3,490.11 | |

| Total Revenue | 2940 | 2,241.13 | 2,404.81 | 2,239.85 | 1,748.78 |

| Profit After Tax (PAT) | 784 | 501.06 | 201.37 | 491.28 | 330.85 |

| Consolidated EPS | 23.02 | 9.25 | 23.05 | ||

Anchor Investors:

Advanced Enzyme on Tuesday raised Rs 123 crore from 15 anchor investors by selling shares at a price of Rs 896 per equity share

DB International (Asia) Ltd, Kuwait Investment Authority Fund, DSP Blackrock Equity Fund, SBI Life Insurance Company Ltd, L&T Mutual Fund Trustee Ltd and Tata AIA Life Insurance Co Ltd are among the anchor investors.

Risks:

- Significantly dependent on foreign Subsidiaries incorporated in North America.

- Sales from top five product groups accounted for 40% of total revenues

- Advanced Vital Enzymes Private Limited, one of Group Companies has objects similar to that of Company’s business and is engaged in the same and/ or similar line of business / industry in which Company operates

- A significant portion of the proceeds of the Fresh Issue will be utilized for investment in wholly owned subsidiary Advanced Enzymes USA, which shall in turn utilize these funds for repayment / pre-payment of certain loans availed by it from Promoter, Mr. Vasant Laxminarayan Rathi and Group Company Rathi Property LLC.

- The proceeds will be used to repay promoter and group company loans.

Reasons to Invest:

- Net Profit Margin increasing over last few years

- On the upper price band of 896 and EPS of 33 (FY16) , PE ratio is 24.4

- On the upper price band of 896 and EPS of 27.22 (last 3 years) , PE ratio is 33

- There is no listed peer in India, but Global leader Novozymes is listed on Copenhagen Stock Exchange while ADRs are also traded actively in the US. The Denmark-based enzymes giant trades at a trailing 12-months PE ratio of 35.5.

Valuation as compared to its peers:

- There is no listed peer in India, but Global leader Novozymes is listed on Copenhagen Stock Exchange while ADRs are also traded actively in the US. The Denmark-based enzymes giant trades at a trailing 12-months PE ratio of 35.5.

- On the upper price band of 896 and EPS of 33 (FY16) , PE ratio is 24.4

- Net Profit Margin increasing over last few years

- First IPO in Enzymes segment

- Valuation attractive as compared to Global peer

- Kotak PE Fund is not exiting completely and will have some shareholding.

| GEPL Capital | Subscribe |

| Way2Wealth | Subscribe |

| ABM Equity | Subscribe |

| Hem Securities | Subscribe |

| Anand Rathi | Subscribe |

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.