Gold is shining again! Over the past one year, Gold funds have delivered returns of almost 50%. Gold has always been viewed as a safe asset class and are chased by investors in times of uncertainty or market turmoil.

As the gold prices are all time high, should you still consider investment in Gold through Gold ETF / Gold Funds? In this post, I will explain some of the options and best performing Gold Funds or Gold ETF in India that you can consider for investment.

Difference between Gold ETF and Gold Mutual Funds:

- Gold ETF: Gold ETF is open ended fund that is traded on Stock exchanges. Gold ETFs invests in gold of 99.5 per cent purity (by RBI approved banks). You need a demat account to buy/sell Gold ETF

- Gold Mutual funds: Gold Mutual Funds is a variant of Gold ETFs. Gold mutual funds mainly invest in Gold ETFs. While they do not invest directly in physical gold, they invest in ETF and ETF in turn invest in Physical gold. Gold Funds can be bought/sold as other mutual funds and you do not need a DMAT account for investing in it.

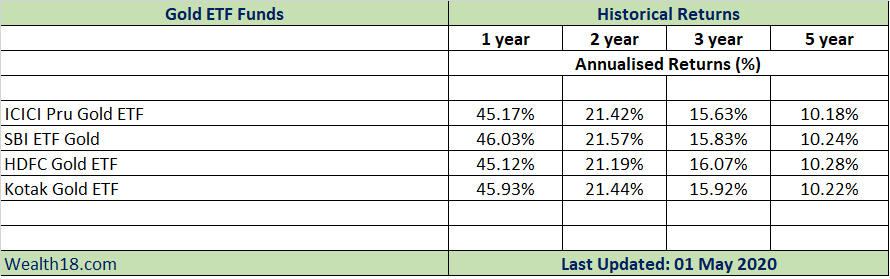

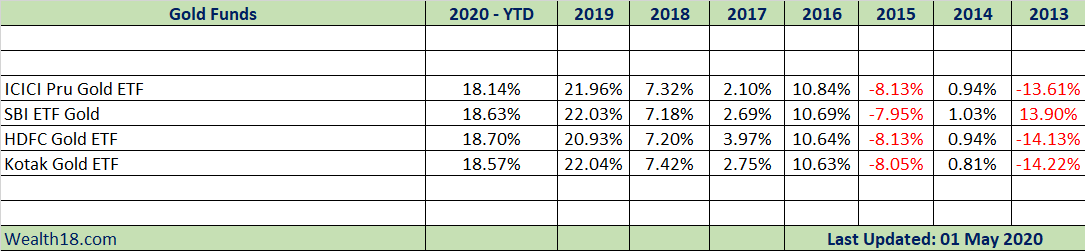

Best and Top Performing Gold ETF

As Gold is the underlying investment in the Gold ETF and it tracks Gold Index, the returns for all the Gold ETF are almost the same.

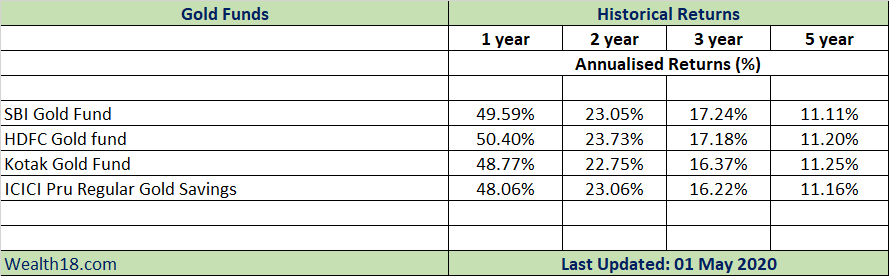

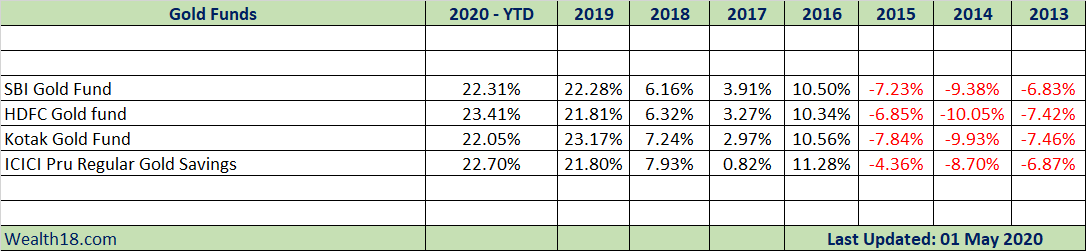

Best and Top Performing Gold Mutual Funds

Gold Funds invest in Gold ETF, so the returns for all the Gold Mutual Funds are almost the same.

Summary

Gold has been shining since 2019 and have delivered almost 50% over past 1 year. You may be tempted to invest int it, but ensure that you are appropriately allocating your funds.

Gold is a good hedge when markets are not doing well. You should only allocate 10-15% of your portfolio in Gold. You can see from above historical returns that Gold’s performance was not well in 2013 -2018 period.