SIS India is a leading provider of private security and facility management services in India.

Issue Details for SIS India IPO – not yet announced

- IPO Open : 31st July – 2nd Aug 2017

- Issue Price band: Rs 805 – Rs 815

- Issue Size: Rs 780 crores

- Market lot: minimum 18 shares and in lot of 18 shares

- Min / Max Shares for Retail:

- Listing:

- Book Running , Lead Managers: Axis Capital, ICICI Securities, IIFL Holdings, Kotak Mahindra

IPO Issue Allocation

- Qualified institutional buyers (QIBs) – 50% per cent of the total issue size.

- Non-institutional investors (NIIs) – 15% per cent of the issue size.

- The retail quota limit in the issue = 35%

Objective of the issue:

The initial public offer (IPO) comprises fresh issue of shares worth Rs 362.25 crore and an offer for sale of up to 51,20,619 shares by the existing shareholders. The objects for which SIS India intends to use the Net Proceeds from this IPO are as follows:

- Repayment and pre-payment of a portion of certain outstanding indebtedness availed by our Company;

- Funding working capital requirements of our Company; and

- General corporate purposes

Background:

Security and Intelligence Services SIS India is a leading provider of private security and facility management services in India. They have strategic relationship in India with several multinational companies. As of August 1, 2016, cvompany has a widespread branch network consisting of 229 branches in 118 cities and towns in India, which cover 605 districts. It employs 133,551 personnel in India and rendered security and facility management services at 10,224 customer premises across India.

- second largest security services provider in India

- second largest cash logistics service provider in India

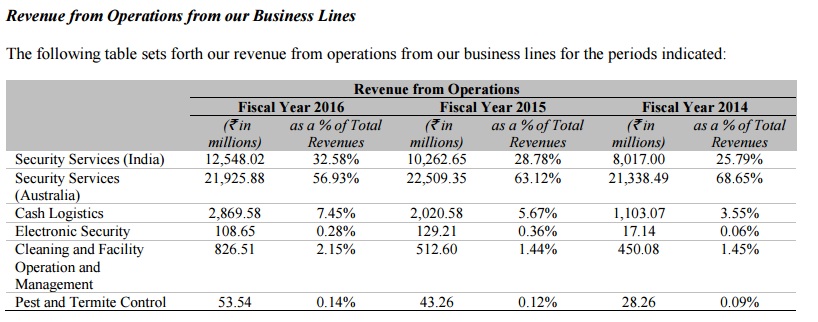

The company operate in the following business lines: private security services, comprising of: o security services; o cash logistics services; o electronic security; and o home alarm monitoring and response services; as well as facility management services, comprising of: o cleaning and facility operation and management services; and o pest and termite control.

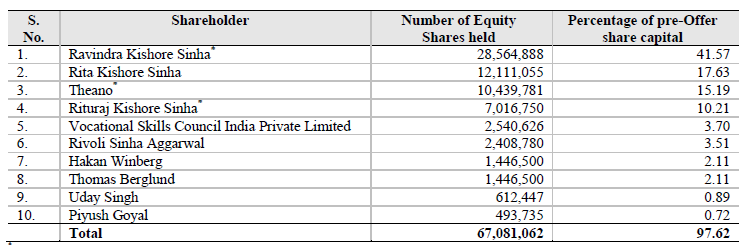

Promoters : Shareholders

Competitors : Nearest competitor – Quess Corp

Anchor Investors: This will be one day before the issue opens.

Financials:

Standalone

| (in crores) | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Income | 1619.9 | 1287.32 | 1056.29 | 824.49 | 582.67 | 464.88 | |

| Income Growth | 26% | 22% | 28% | 42% | 25% | ||

| Net Profit | 26.55 | 33.91 | 24.64 | 33.21 | 29.9 | 11.05 | |

| Profit Growth | -22% | 38% | -26% | 11% | 171% | ||

| Net Profit Margin | 1.64% | 2.63% | 2.33% | 4.03% | 5.13% | 2.38% | |

| EPS | 4.97 | 3.62 | 4.88 |

| (in crores) | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Income | 4577.12 | 3851.68 | 3566.08 | 3108.4 | 2658.79 | 2416.11 | |

| Income Growth | 19% | 8% | 15% | 17% | 10% | ||

| Net Profit | 91.28 | 65.07 | 48.51 | 65.56 | 54.36 | 86.08 | |

| Profit Growth | 40% | 34% | -26% | 21% | -37% | ||

| Net Profit Margin | 1.99% | 1.69% | 1.36% | 2.11% | 2.04% | 3.56% | |

| EPS | 13.29 | 11.16 | 9.21 | 10.11 |

Brokerage Recommendations:

Should you consider investing: While the revenue has grown in last 5 years, the net profit margin is very thin (2-3%).

Given that the revenues have growth consistently and reasonable valuation, investors can consider investing in this IPO.

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.