Indiabulls Housing Finance is looking to raise up to Rs 1,000 crore through secured / unsecured redeemable non-convertible debentures (NCD) offering interest of 8.75% – 9.75% for different maturities. Indiabulls Housing Finance is one of India’s largest housing finance companies and has assets under management (AUM) of ₹79,213 crore with more than one million customers as of 30 June 2021.

Key Features for Indiabulls Housing Finance NCD

| Issue Open Date | Sep 6 2021 |

| Issue Closing Date | Sep 20 2021 |

| Type of Instrument | Secured redeemable NCDs

Unsecured, subordinated, redeemable NCD |

| Size of issue | Rs 1000 crores (Base size: Rs 200 crores) |

| Minimum Investment | 10 NCD (Rs 1000 per NCD) |

| Max Investment | N/A |

| Listing | BSE, NSE |

| Credit Rating | CRISIL AA / Stable by CRISIL Ratings and BWR AA + Negative by Brickworks Ratings |

| Interest | Monthly and Annual, Cumulative |

| Allocation method | First Come First Serve Basis |

| NRI allowed? | Not eligible |

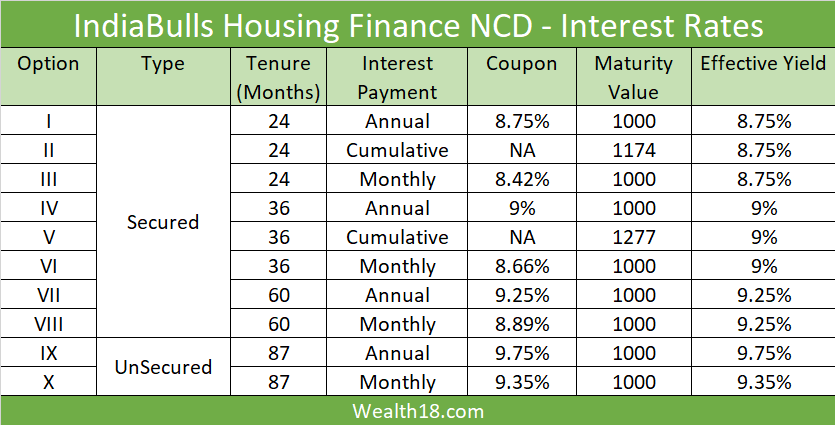

Interest Rate options for Indiabulls Housing Finance NCD Sep 2021

Note that the issue has been split into two parts — secured and unsecured. Unsecured NCDs are riskier than the secured NCDs as the bonds are not backed by the company’s assets.

There are no PUT & Call options for these Secured NCDs. (which means the NCD issuer cannot redeem before bond’s maturity and the investor cannot sell the bond to the issuer. Investor can however sell the bonds in the secondary market on exchanges.

About Company and NCD Issue

Indiabulls Housing Finance is one of India’s largest housing finance companies and has assets under management (AUM) of ₹79,213 crore with more than one million customers as of 30 June 2021. The company has a diversified financial portfolio with services offered in housing finance and loans against properties to salaried and self-employed individuals , and micro, small and medium-sized enterprises (MSMEs). The company also offers mortgage loans to real estate firms.

As of March 31, 2021, Housing loans and Non-housing loans make up 65% and 35% of Indiabulls consolidated AUM. The company has a Pan-India presence with 135 offices in 92 cities. In terms of employee strength, the company has a direct sales team of over 1,363 employees

| Particulars | For the year/period ended (₹ in Crore) | ||||

|---|---|---|---|---|---|

| 31-Mar-21 | 31-Mar-20 | 31-Mar-19 | |||

| Total Assets | 93,237.87 | 102,872.03 | 130,103.92 | ||

| Total Revenue | 10,030.12 | 13,223.23 | 17,027.04 | ||

| Profit After Tax | 1,201.59 | 2,165.92 | 4,057.79 | ||

Note: the Profile has been reducing over last 3 years, hence this company has higher risk.

Taxation Aspect

Interest:

-

- The interest earned is to be added to one’s total income, and hence is entirely taxable as per one’s income tax slab.

- NCDs taken in the DMAT form will NOT attract any TDS on the interest income. However, if NCD are taken in physical form, TDS will be applicable if the interest amount exceeds Rs. 5,000. Investors, if eligible, can submit For 15 G/H to avoid TDS.

Taxation for Cumulative Interest Option:

For the cumulative option, you do not get periodic (monthly / annual ) interest. Instead you get a lumpsum amount at the maturity period. Investors are often confused if this cumulative interest received on maturity is to be treated as a capital gain or interest income. Many advisors incorrectly mis-sell saying that the income from cumulative option can be treated as Capital Gain rather than Interest income.

Note that even for Cumulative option, the amount should be treated as Interest income. This was also clarified by the experts at Moneycontrol.

| Income | Taxation |

| Interest earned on NCD | Taxable as per tax slab of Investor |

| If sold on exchange (before 12 months) | Short term capital gain / loss Taxable as per tax slab of Investor |

| If sold on exchange (after 12 months) | Long term capital gain / loss Taxable @ 10% without indexation

In case of an individual or HUF, being a resident, where the total income as reduced by such long-term capital gains is below the maximum amount which is not chargeable to income-tax, then, such long-term capital gains shall be reduced by the amount by which the total income as so reduced falls short of the maximum amount which is not chargeable to income-tax and the tax on the balance of such long-term capital gains shall be computed at the rate mentioned above. |

Tax Saving in case of Long term capital Gains

| By investment in Capital Gain Bonds | Under Section 54EC of the I.T. Act, long term capital gains arising to the debenture holders on transfer of their debentures in the company shall not be chargeable to tax to the extent such capital gains are invested in certain notified bonds within six months after the date of transfer. |

| By investment in residential property | As per the provisions of Section 54F of the I.T. Act, any long-term capital gains on transfer of a long term capital asset (not being residential house) arising to a Debenture Holder who is an individual or Hindu Undivided Family, is exempt from tax if the entire net sales consideration is utilized, within a period of one year before, or two years after the date of transfer, in purchase of a new residential house, or for construction of residential house within three years from the date of transfer |

How to Apply

- Online – You can invest online in DMAT form through your online share trading account or through your broker.

Comparison

There are other NCDs available in the secondary market that are giving better yield (YTM). However, these NCDs have lower balance duration and the purchase will incur small brokerage cost.

https://www.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

Select – “Bonds in CM”

https://www.bseindia.com/markets/debt/tradereport.aspx

Positive factors of this NCD

- Attractive Interest rates of 9.75% in the market where the interest rates are declining.

Negative factors of this NCD

- NCDs are not risk free and have default risk. Particularly, unsecured NCD have higher risk.

- NCDs are not very liquid so it will be difficult to sell it before maturity. Though they are listed on exchanges but trading volumes are low to get right price.

- As the interest is taxable, post tax returns may not be comparable to the tax free bonds (if you are in higher tax bracket). It may be better to opt for the cumulative option.

The interest on NCDs is taxed at the slab rate. Hence, investors in the highest tax bracket of 30% are likely to get a post-tax yield of 6.8%. So you can opt for Debt funds that offers diversity.

Summary

- Attractive Interest: Investors who are willing to take high risk can consider the “secured” option of this NCD. As the company’s profits are declining and there could be a hit from the lockdowns over the past 18 months, investors should stay away from the unsecured investment.

- Capital Gain: If the interest rates fall (most likely), these bonds are most likely be traded at premium, thereby having chance of capital gain as well (in addition to the coupon interest). However, the interest rate are already very low and chances of further reduction is less.

Though the interest rate is quite attractive, remember that the NCDs are not very liquid in the market. If you are ready to lock in money for that duration without much risk, then you can go for these NCD. Also, note that the NCD interest is taxable, so investor in higher tax brackets need to consider the post tax returns.

If you looking for Debt instruments only, then you can consider investing in Debt mutual funds, PPF etc. If you are looking for better returns over long term, you should consider investing in Equity Mutual funds.