Windlas Biotech IPO is opening on 4th Aug 2021. Windlas Biotech, one of the top five companies in the domestic pharmaceutical formulations contract development and manufacturing organization (CDMO),

Issue Details of Windlas Biotech IPO IPO:

| IPO Opens on | 04 Aug 2021 |

| IPO Closes on | 06 Aug 2021 |

| Issue Price band | Rs 448 – Rs 460 |

| Any Discount | NA |

| Issue Size | Rs 406 crore |

| Minimum Investment | 30 shares lot (min amount 13800) |

| Max Investment (Retail) | 14 lots / 420 shares (amount Rs 1,93,200) |

| Registrar | Link Intime |

| Book Running Lead Managers | SBI Cap, DAM Capital |

| Listing | BSE/NSE |

| Download | Red Herring Prospectus |

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Windlas Biotech IPO Grey market Premium :

- As per market observers, Windlas Biotech IPO grey market premium (GMP) was at around ₹XX (trades yet to happen)

IPO Issue Allocation:

- QIB = Not More than 50% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 35% of the offer

Background:

Windlas Biotech, one of the top five companies in the domestic pharmaceutical formulations contract development and manufacturing organization (CDMO).

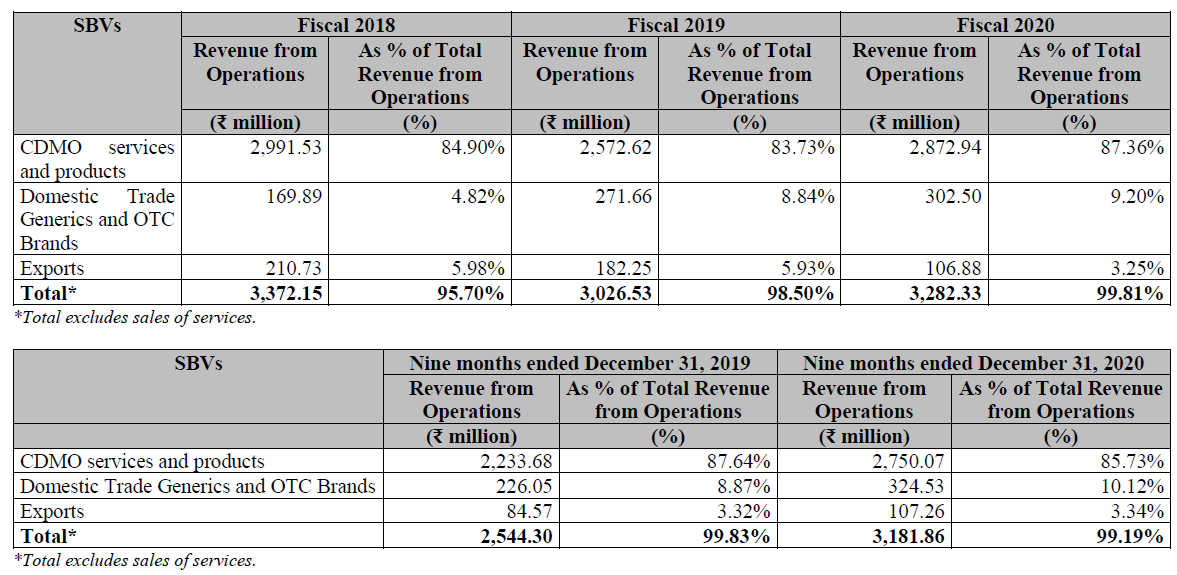

- Our CDMO Services and Products SBV is focused on providing products and services across a diverse range of pharmaceutical and nutraceutical generic products for Indian and multinational pharmaceutical companies who market such products under their own brand names to the end users. In Fiscal 2020 and the nine months ended December 31, 2020, our CDMO Services and Products SBV accounted for 87.36% and 85.73%, respectively, of our total revenue from operations.

- In addition, our revenue from CDMO Services and Products SBV has historically been derived from a small customer base. In Fiscals 2018, 2019 and 2020, and in the nine months ended December 31, 2019 and 2020, our top 10 customers represented 60.47%, 57.01%, 57.14%, 58.01% and 56.82%, respectively, of our total revenues from operations in such periods. Our largest customer represented 15.27%, 12.33%, 11.65%, 11.36% and 12.13%, respectively, of our total revenues from operations in Fiscals 2018, 2019 and 2020, and in the nine months ended December 31, 2019 and 2020, respectively.

- All of our manufacturing facilities are located in Dehradun, Uttarakhand along with our Registered Office.

- Our capacity utilization was 39.88%, 4.48% and 46.28% for tables/ capsules, pouch/ sachet and liquid bottles, respectively, in the nine months ended December 31, 2020, respectively.

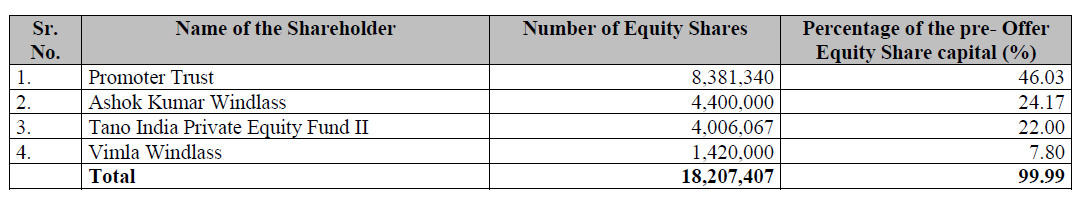

Top Shareholdings:

Objective of the issue:

- The IPO comprises a fresh issue of Rs 165 crore, and an offer for sale of 51,42,067 equity shares by existing selling shareholders.

- The offer for sale consists of a selling of 11.36 lakh equity shares by promoter Vimla Windlass, and 40,06,067 equity shares by investor Tano India Private Equity Fund II.

- Tano India Private Equity Fund will exit the company by selling its entire 22 percent stake through the offer for sale.

- Windlas Biotech will utilise net proceeds from its fresh issue for purchase of equipment required for capacity expansion of existing facility at Dehradun Plant – IV, & addition of injectables dosage capability at existing facility at Dehradun Plant-II (Rs 50 crore); working capital requirements (Rs 47.56 crore); and repaying of certain borrowings (Rs 20 crore).

Anchor Investors:

- Windlas Biotech has raised over Rs 120 crore from anchor investors ahead of its IPO that opens on Wednesday.

- The company has decided to allocate 26,18,706 equity shares at Rs 460 apiece to 22 funds aggregating to Rs 120.46 crore, according to a circular uploaded on BSE website.

- Among the anchor investors who participated in the bidding are ICICI Prudential Mutual Fund (MF), UTI MF, Sundaram MF, Kuber India Fund, BNP Paribas Arbitrage, Elara India Opportunities Fund and Canara HSBC Oriental Bank of Commerce Life Insurance Company.

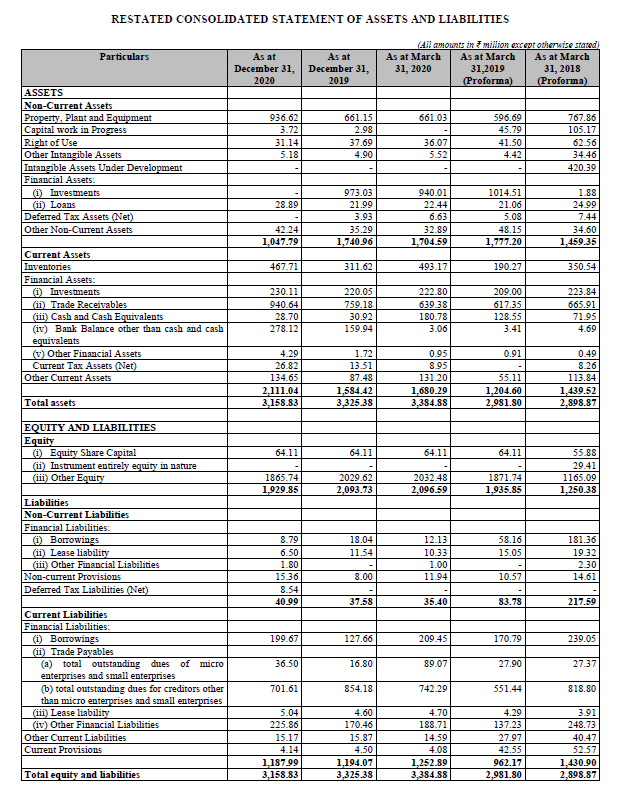

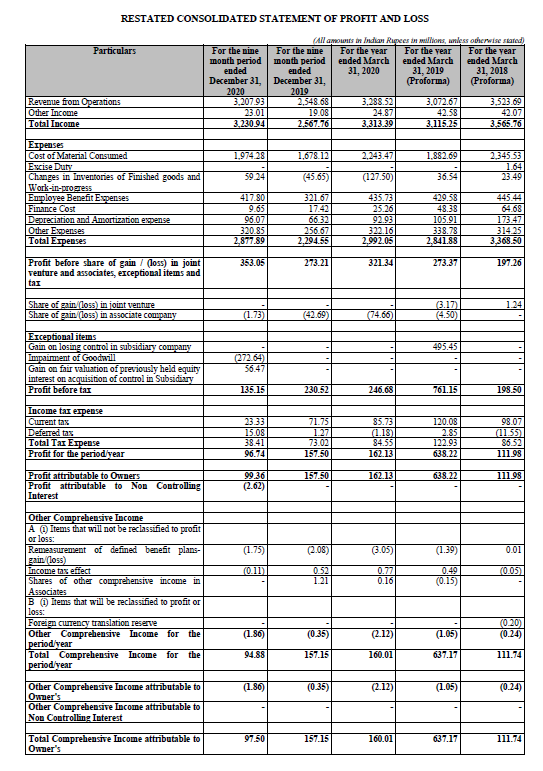

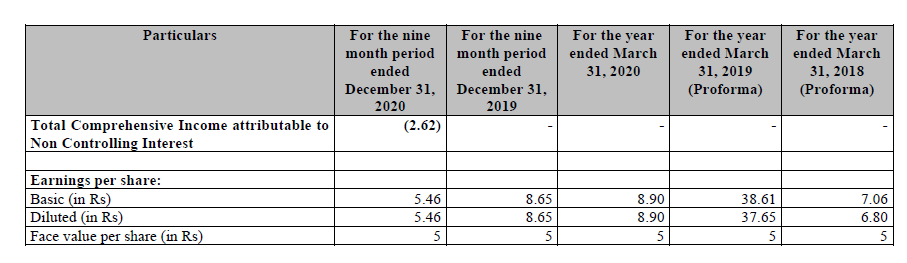

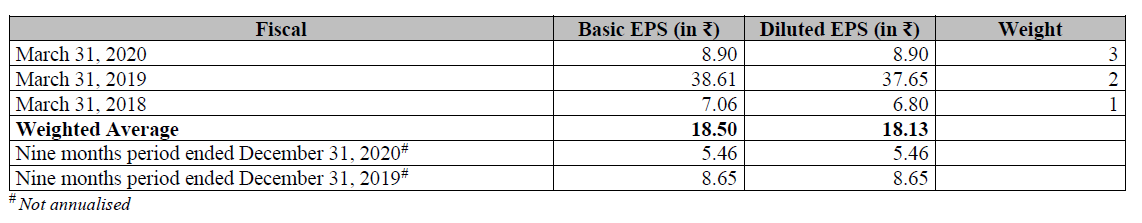

Financials:

Valuation as compared to its peers:

Risks

- high competition from organised and unorganised players

- majority of the revenue comes from top 10 customers

Brokerage Recommendations:

| Brokerage | Recommendations |

| KR Choksey | Subscribe |

Should you invest:

- the company supplies to 7 out of top 10 Indian pharma companies.

- one of the leading pharmaceutical formulations contract development and manufacturing organizations (CDMO) in India

- Stable revenue growth

With current euphoria in stock market and IPO listings, it is expected that this IPO will also see considerable interest. You can consider to invest in this IPO for listing gains.

Some of the recently listed IPOs have given 100-300% returns in 2021. Also check the list of upcoming IPOs in 2021.

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | |

| Initiation of Refunds | |

| Credit of Equity Shares: | |

| Listing Date: |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | 24.4 | |||

| NII | 15.73 | |||

| Retail | 24.22 | |||

| Employee | ||||

| TOTAL | 22.44 |

How to apply for Windlas Biotech IPO through Zerodha

Zerodha customers can apply online in Windlas Biotech IPO using UPI as a payment gateway. Zerodha customers can apply in Windlas Biotech IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘Devyani International IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.