Type of Instruments – Secured Redeemable NCDs

Size of Issue – Rs 250 crore through this issue, with an option to retain oversubscription upto Rs 250 crore, aggregating to a total of upto Rs 500 crore.

Listing – Proposed to be listed on NSE & BSE

Credit Rating – AA/stable by CRISIL and AA+ by CARE

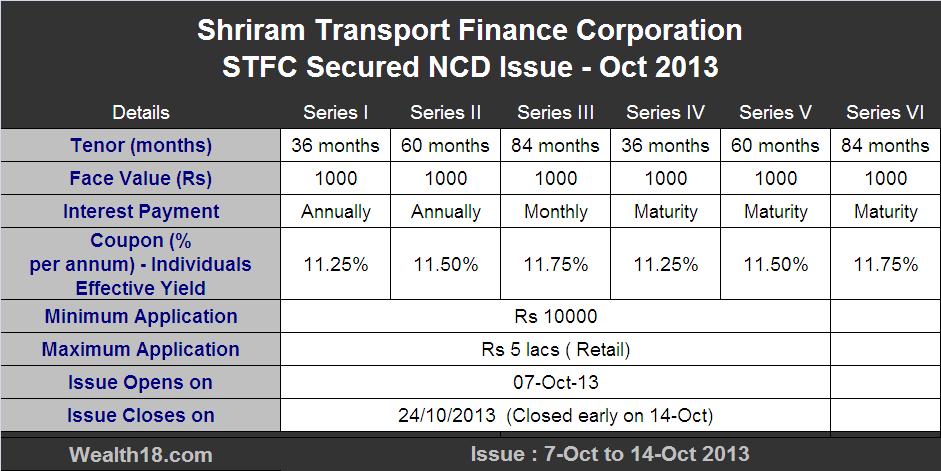

Investment options – Annually / Cumulative Interest for 36 months, 60 months , 84 months

About Company

STFC is one of the largest asset financing NBFCs in India

STFC is part of the “SHRIRAM” conglomerate which has significant presence in financial services viz., commercial vehicle financing business, consumer finance, life and general insurance, stock broking, chit funds and distribution of financial products such as life and general insurance products and units of mutual funds. Apart from these financial services, the group is also present in non-financial services business such as property development, engineering projects and information technology.

Taxation Aspects

- NCDs taken in the demat form will NOT attract any TDS on the interest income. However, if NCD are taken in physical form, TDS will be applicable if the interest amount exceeds Rs. 5,000

| Interest earned on NCD | Taxable as per tax slab of Investor |

| If sold on exchange (before 12 months) | Short term capital gain / lossTaxable as per tax slab of Investor |

| If sold on exchange (after 12 months) | Long term capital gain / lossTaxable @ 10.30% without indexation |

Positive Points

- High Yiled of AA- instrument

- If you fall in the lower tax bracket, post-tax returns for some options in this NCD are superior than that of tax-free bonds.

Negative factors

- For an investor in the highest tax bracket, it doesn’t make sense to invest in these as the net returns are comparable with that of the tax-free bonds.

- NCDs are illiquid. If the interest rates fall, it may be difficult for investors to capitalise on falling interest rates. If you invest in govt bonds / short medium term debt funds, and if the interest fall in 2-3 years time frame, they may give you better returns than these NCD offering 12.5%.

How to Apply

- Physical Form – You can download the Form and submit to designated bank branches alongwith cheque.

- Online – You can invest online in DMAT form through your online share trading account or through your broker.

Summary

- Investors in lower tax slab can consider investing in these NCD, but not more than 10% of their debt allocation.

- Investors in the 30% tax bracket should invest in tax-free bonds or go for debt funds or FMPs