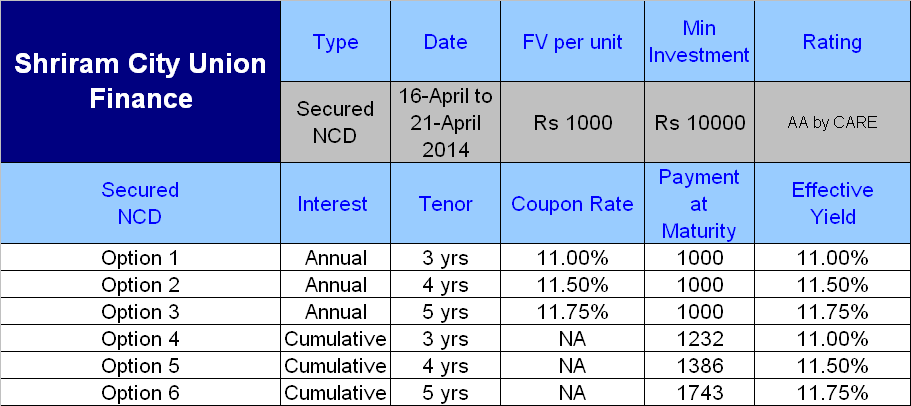

Shriram City Union Finance has opened its public issue of NCDs on 16th April 2014 and it closes on 16-May-2014 ( Closed early on 21-April-2014)

Type of Instruments – Secured Redeemable NCDs

Size of Issue – Rs 200 crores

Listing – Proposed to be listed on BSE & NSE

Credit Rating – AA by CARE

Investment option – Annually / Cumulative Interest for 3 yrs, 4 yrs, 5 yrs

About Company

Shriram City Union Finance Limited (SCUF) is a part of the Chennai based Shriram group of companies and the sister concern of Shriram Transport Finance. They are entering the debt market second time.

SCUF is incorporated in 1986 and is registered with the Reserve Bank of India as a deposit-taking non-banking finance company (NBFC) with its presence in gold loans, small business finance loans, auto loans, two-wheeler loans, personal loans and consumer durable loans. The promoter group companies hold 54.95% stake in the company at present. The company has a network of 927 branches as on June 30, 2012, out of which 654 branches are located in the southern states and 85 branches are located in Maharashtra.

The positive is that the advances book for the company is well diversified with the largest contribution coming from gold loans of around 40%.

Financials

For FY2012, the company has consolidated total income of Rs 2057 crore and PAT of Rs 338 crore. As on 31 Mar 2012, the company has AUM of Rs 13431 crore and the company’s capital adequacy stood at 17.4% (vs RBI stipulated 15%). Net NPA of company is 0.38%

Positive Points

- High Coupon rate of 11.75 % as compared to Bank FD rates of 9%

- If you fall in the lower tax bracket, post-tax returns for some options in this NCD are superior to that of tax-free bonds.

Negative factors

- For an investor in the highest tax bracket, it doesn’t make sense to invest in these as the net returns are comparable with that of the tax-free bonds.

- NCDs are illiquid. If the interest rates fall, it may be difficult for investors to capitalise on falling interest rates. If you invest in govt bonds / short medium term debt funds, and if the interest fall in 2-3 years time frame, they may give you better returns than these NCD offering 12.5%.

Taxation Aspects

- NCDs taken in the demat form will NOT attract any TDS on the interest income. However, if NCD are taken in physical form, TDS will be applicable if the interest amount exceeds Rs. 5,000

| Interest earned on NCD | Taxable as per tax slab of Investor |

| If sold on exchange (before 12 months) | Short term capital gain / loss – Taxable as per tax slab of Investor |

| If sold on exchange (after 12 months) | Long term capital gain / loss – Taxable @ 10.30% without indexation |

How to Apply

- Physical Form – You can download the Form and submit to designated bank branches alongwith cheque. Shriram City Union Finance NCD Application Form Download

- Online – You can invest online in DMAT form through your online share trading account or through your broker.

Summary

- Investors in lower tax slab can consider investing in these NCD, but not more than 10% of their debt allocation.

- Investors in the 30% tax bracket should invest in tax-free bonds or go for debt funds or FMPs.

Allotment Date – 03 May 2014

Listing date – 7 May 2014

Check Allotment Status for this NCD

| Series I | Series II | Series III | Series IV | Series V | Series VI | |

| COUPON Cat II & III | 11.00% | 11.50% | 11.75% | 11.00% | 11.50% | 11.75% |

| Period | 3 yrs | 4 yrs | 5 yrs | 3 yrs | 4 yrs | 5 yrs |

| ISIN No | INE 722A07521 | INE 722A07539 | INE 722A047 | INE 722A07554 | INE 722A07562 | INE 722A07570 |

| BSE Script | 935042 | 935044 | 935046 | 935048 | 935050 | 935052 |

| BSE Script ID | 105SCUF16 | 1075SCUF17C | 1085SCUF19 | 0SCUF16 | 0SCUF17 | 0SCUF19 |

| Maturity | 1000 | 1000 | 1000 | 1232.1 | 1386.2 | 1742.76 |

| Maturity Date | 03/05/2016 | 03/05/2017 | 03/05/2019 | 03/05/2016 | 03/05/2017 | 03/05/2019 |

| Interest Frequency | Annual | Annual | Annual | Maturity | Maturity | Maturity |