Day 1: 0.49 times subscription (Retail subscribed 2.56 times)

Sapphire Foods was set up in September 2015, by the acquisition of about 250 KFC and Pizza Hut Stores in India and Sri Lanka, by a group of leading Private Equity firms and is managed by a team of professionals.

Issue Details of Sapphire Foods IPO:

| IPO Opens on | 09 Nov 2021 |

| IPO Closes on | 11 Nov 2021 |

| Issue Price band | Rs 1120 – Rs 1180 |

| Any Discount | NA |

| Issue Size | Rs 2073 crore |

| Market Capitalisation | approx Rs XXX crores |

| Minimum Investment | 12 shares lot (min amount 14160) |

| Max Investment (Retail) | 14 lots / 168 shares (amount Rs 1,98,240) |

| Registrar | Link Intime |

| Book Running Lead Managers | JM Financials, BoFA |

| Listing | BSE/NSE |

| Download | Red Herring Prospectus |

Sapphire Foods Grey market Premium :

- As per market observers, grey market premium (GMP) was at around ₹XX

[sc name=”ad1″][/sc]

IPO Issue Allocation:

- QIB = Not More than 70% of the offer

- NII = Not less than 15% of the offer

- Retail = Not less than 15% of the offer

Background:

Sapphire Foods India is YUM brand’s largest franchise operator in the Indian subcontinent in terms of revenue as of FY’20. It is also Sri Lanka’s largest international QSR chain in terms of revenue for FY’ 2021 and the number of restaurants operated as of March 31, 2021.

As of March 31, 2021, the company owned and operated 204 KFC restaurants in India and the Maldives, 231 Pizza Hut restaurants in India, Sri Lanka and the Maldives, and 2 Taco Bell restaurants in Sri Lanka. The company’s total number of restaurants in the subcontinent region grew from 376 in 2019 to 437 in 2021.

Sapphire Foods is the largest franchisee of Yum Brands in the Indian subcontinent, is backed by marquee investors such as Samara Capital, Goldman Sachs, CX Partners and Edelweiss. It may be noted that Devyani International, which is the other franchisee of Yum! Brands in India, operates 297 Pizza Hut stores and 264 KFC stores. It launched its Rs 1,838-crore IPO in August this year.

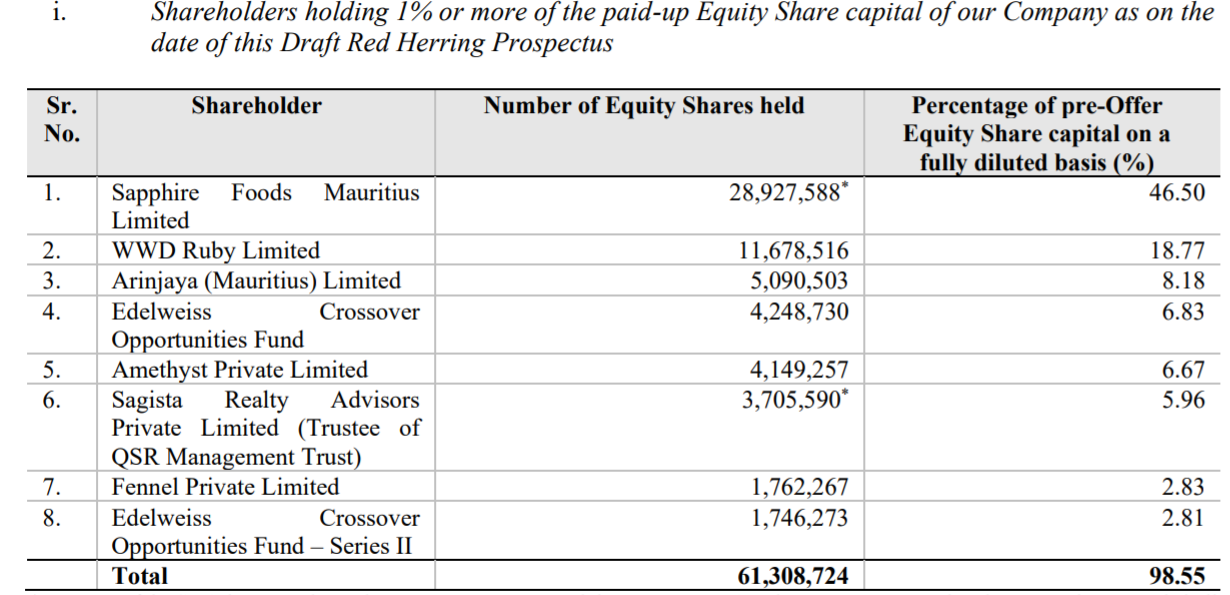

Top Shareholdings:

Our Promoters are QSR Management Trust and Sapphire Foods Mauritius Limited.

As a part of the OFS, QSR Management Trust will sell 8.50 lakh shares, Sapphire Foods Mauritius Ltd will offload 55.69 lakh shares, WWD Ruby Ltd will divest 48.46 lakh shares and Amethyst will offer 39.62 lakh shares. In addition, AAJV Investment Trust will sell 80,169 shares, Edelweiss Crossover Opportunities Fund will offload 16.15 lakh shares and Edelweiss Crossover Opportunities Fund-Series II will divest 6.46 lakh shares.

Objective of the issue:

- Carry out the offer for sale of up to 17,569,941 equity shares by the selling shareholders,

- Achieve the benefits of listing the equity shares on the stock exchanges, and

- Enhancement of company’ s brand name amongst existing and potential customers and creation of a public market for equity shares in India.

Anchor Investors:

Anchor investors are big institutional investors and have a 30-day lock-in period which means they can’t sell their shares before 30 days from the date of allotment.

The company allotted total of 79,06,473 equity shares to 53 Anchor investors at a upper price band ₹1180. The anchor investors list includes 2 Mutual Funds through a total of 19 scheme.

Marquee investors who participated in the anchor book were the Government of Singapore, Monetary Authority of Singapore, Fidelity Funds, Abu Dhabi Investment Authority, Crestwood Capital Master Fund, Ontario Teachers’ Pension Plan Board, Carmignac Portfolio, HSBC, Societe Generale, Morgan Stanley, Segantii India, and Affin Hwang.

Among others, ICICI Prudential, Sundaram MF, IIFL Special Opportunities Fund, Bajaj Alliance Life Insurance, HDFC MF, Kotak MF, and Reliance General Insurance also invested in the company through the anchor book.

[sc name=”ad1″][/sc]

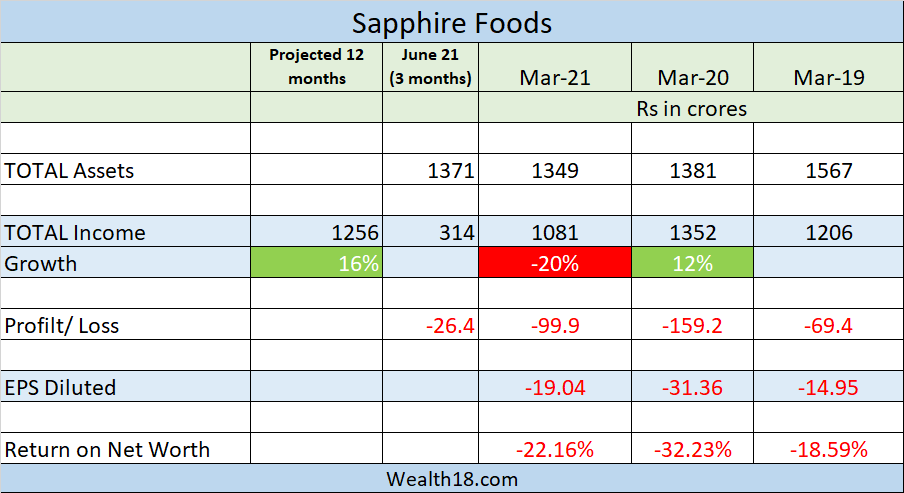

Financials:

Valuation as compared to its peers:

The company is valued at a market cap to FY21 sales of around 7 times at the price band of ₹1120 – ₹1180.

- Devyani was valued at 9.5 times at the time of its IPO, which has now risen to 15.5 times. The stock has gained about 60 per cent since the IPO.

- Peers such as Westlife Development (Mc Donald’s) trades at 9.3 times its market cap to sales. Burger King and Jubilant FoodWorks (Domino’s) trade at 12.5 times and 15 times respectively.

Strengths:

- Sapphire Foods has a lower debt to equity ratio of 1.82 as of FY21

- It is YUM’s largest franchise operator in the Indian subcontinent in terms of revenue

Cons:

- Loss making company

Should you invest:

Important Dates:- IPO Schedule (Tentative)

| Finalization of Basis of Allotment | Nov 16, 2021 |

| Initiation of Refunds | Nov 17, 2021 |

| Credit of Equity Shares: | Nov 18, 2021 |

| Listing Date: | Nov 22, 2021 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | 0.02 | |||

| NII | 0.05 | |||

| Retail | 2.56 | |||

| Employee | ||||

| TOTAL | 0.49 |

How to apply for Sapphire Foods through Zerodha

Zerodha customers can apply online in this IPO using UPI as a payment gateway. Zerodha customers can apply in this IPO by login into Zerodha Console (back office) and submitting an IPO application form.

- Visit the Zerodha website and login to Console.

- Go to Portfolio and click the IPOs link.

- Go to the ‘Sapphire Foods IPO’ row and click the ‘Bid’ button.

- Enter your UPI ID, Quantity, and Price.

- ‘Submit’ IPO application form.

- Visit the UPI App (net banking or BHIM) to approve the mandate.

Disclaimer: This article is for educational purposes and should not be treated as investment advice. Please consult with your investment advisor before making any investment decisions.