Salasar Techno Engineering, a steel fabrication and infrastructure solutions is coming up with its IPO on XXXX.

Issue Details of Salasar Techno Engineering IPO:

- IPO Open :

- Issue Price band:

- Issue Size:

- Market lot :

- Minimum Investment:

- Book Running Lead Managers :

- Registrar –

- Listing: BSE/NSE

IPO Issue Allocation

- Non-institutional investors (NIIs) – 50% of the issue size.

- The retail quota limit in the issue = 50% of the issue size.

Background

Salasar Techno Engineering Limited provides customised steel fabrication and infrastructure solutions in India. Its products include Telecommunication Towers, Power Transmission Line Towers, Smart Lighting Poles, Monopoles, Guard Rails, Substation Structures, Solar Module Mounting Structures and Customized Galvanized & Non-galvanized steel structures. Its services include providing complete engineering, procurement and control for projects such as Rural Electrification, Power Transmission Lines, and Solar Power Plants.

The company commenced its manufacturing/fabrication activities in the Financial Year 2006-07 when first unit became operational. With the addition of a second unit in 2008-09, it now provides all kinds of steel fabrication and infrastructure solutions and its projects have been executed in all kinds of geographical locations nationally. It has full in house fabrication and Hot Dip Galvanizing facilities to manufacture galvanized towers.

The company recently increased its installed annual manufacturing/fabrication capacity from 50,000 MT to 1,00,000 MT with the installation of new Galvanizing plant at its wholly owned subsidiary – Salasar Stainless Limited. From a 44% capacity utilisation in FY 2012-13, the company has reached a level of 79% capacity utilisation in FY 2015- 16. It has 2 manufacturing units spanning a cumulative area of approximately 1,00,000 square yards in the heart of National Capital Region’s industrial hub on the National Highway-24.

In addition to manufacturing/fabrication, it also undertakes civil foundation work, erection of towers both telecom & transmission at site including painting. It has also undertaken EPC Turnkey projects for solar mounting structures for its clients.

Some of the company’s key projects include establishing Transmission and Substation for U.P. Power Transmission Corporation Ltd., Tata Power Delhi Distribution Ltd., Unitech Power Transmission Ltd., executing orders of Telecom Towers including erection of towers for ATC India Tower Corporation Pvt Ltd., Indus Towers Ltd., ATC Telecom Infrastructure Pvt Ltd., Bharti Infratel Ltd., Reliance Jio Infocomm Ltd., Tower Vision India Pvt Ltd., Viom Networks Ltd., and supplying Solar Mounting Module Structures for Jakson Engineers Ltd., Prayatna Developers Pvt Ltd., Welspun Renewables Energy Pvt Ltd., Insta Power Energy Efficiency Pvt Ltd. etc.

The company is one of the country’s manufacturing/fabrication partners for Ramboll’s technical expertise in Telecom towers structural design. Ramboll is a Denmark based company and is one of the leading consulting firms for Buildings, Transport, Environment, Energy, Oil & Gas and Telecom markets in the world.

Promoters holdings:

The list of the top shareholders of the company and the number of equity shares held by them is as below:

- Hill View Infrabuild Limited : 28.87%

- Shalabh Agarwal : 12.86%

- Shikhar Fabtech Private Limited : 9.89%

- Alok Kumar : 8.98%

- Shashank Agarwal : 7.14%

- Anshu Agarwal : 5.81%

- Kamlesh Gupta : 5.02%

- Base Engineering Private Limited : 4.68%

- More Engineering Private Limited : 4.68%

- Tripti Gupta : 4.02%

Objective of the issue:

The company proposes to utilize the funds which are being raised towards funding the following objects:

- To meet the working capital requirements of the Company including margin money;

- General Corporate Purpose;

- To meet the Issue Expenses.

The company believes that listing will enhance its corporate image, brand name and create a public market for its Equity Shares in India.

Anchor Investors: Will be available one day before the IPO opens

Risks:

- In recent past,

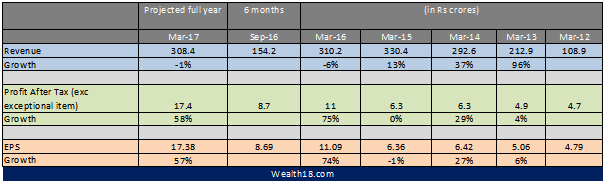

Financials:

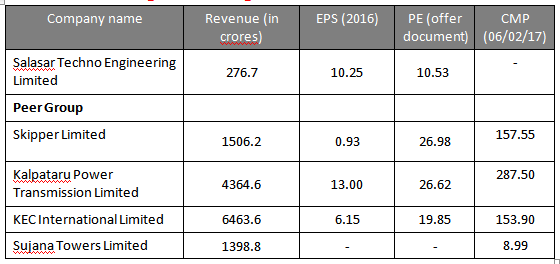

Valuation as compared to its peers:

Brokerage Recommendations:

Should you invest:

[xyz-ihs snippet=”ad1″]

Disclaimer: The articles or analysis on this website should not be constituted as Investment advice. Please consult your financial advisor before making any investments.