NRE Fixed Deposit is one of the best investment for NRI, if they are looking to invest their money in India. In this post, I have compared the NRE FD Rates offered by different banks in India.

Benefits of NRE FD

- 1) Interest earned on NRE FD is tax free in India.

- 2) Currently exchange rates for INR are higher, so you will get more INR for your foreign currency.

- 3) Banks are offering good Interest rates on NRE FD, as RBI wants more foreign currency inflows into the country.

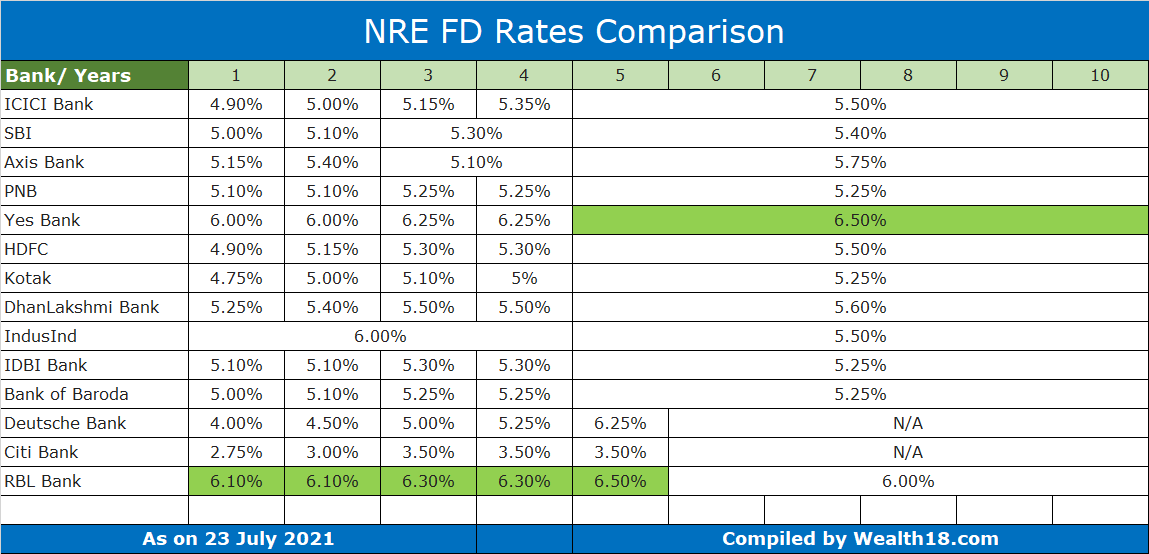

NRE FD Rates Comparison July 2021

- Latest ICICI Bank NRE FD Rate – Link

- Latest SBI Bank NRE FD Rate – Link

- Latest Axis Bank NRE FD Rate – Link

- Latest PNB Bank NRE FD Rate – Link

- Latest Yes Bank NRE FD Rate – Link

- Latest HDFC Bank NRE FD Rate – Link

- Latest Kotak Bank NRE FD Rate – Link

- Latest Dhanlakshmi Bank NRE FD Rate – Link

- Latest IndusInd Bank NRE FD Rate – Link

- Latest IDBI Bank NRE FD Rate – Link

- Latest Bank of Baroda NRE FD Rate – Link

- Latest Deutsche Bank NRE FD Rates – Link

- Latest CitiBank NRE FD Taes – Link

- Latest Union Bank of India UBI NRE FD Rates – Link

- Latest RBL Bank NRE FD Rates – Link

Key points to note

- Minimum duration for NRE FD is 1 year. Bank will not pay any interest if you withdraw FD before 1 year.

- If you withdraw money from FD pre-maturely, then bank may deduct penalty of 0.5-1% from the interest paid.

- If the FD rates at your bank are lower than other banks, please make sure that the difference is good enough for opening a new bank account. A difference of 0.50% on Rs 1 lakh FD will be Interest of Rs 500 per year.

- Also, keep in mind at the end of FD tenure, exchange rates may depreciate further. So if you want to take money back from India at end of FD tenure, then your earning may be wiped out because of unfavorable exchange rates.

- Though NRE FD Interest is tax free in India, it may be possible that your global income is taxable in your home country (USA, etc).