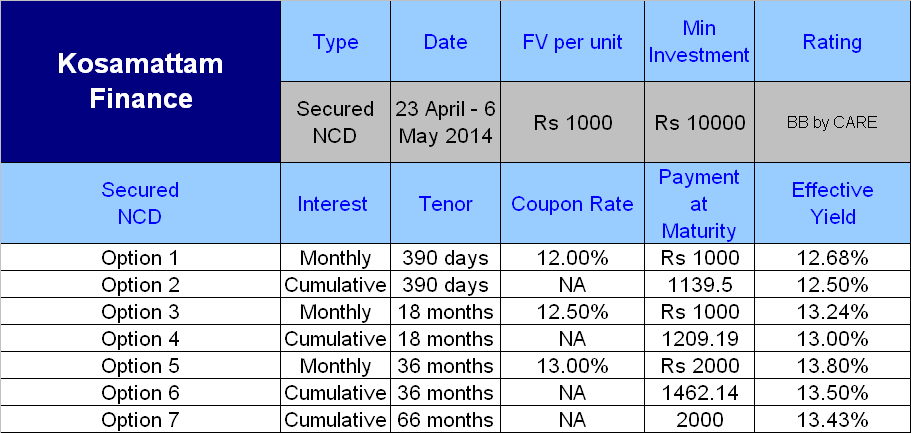

Kosamattam Finance Limited has opened its public issue of NCDs on 23 April 2014 and it closes on 22 May 2014 ( Closed early on 6-May-2014)

Type of Instruments – Secured Redeemable NCDs

Size of Issue – Rs 100 crores

Listing – Proposed to be listed on BSE

Credit Rating – BB by CARE

Investment option – Monthly/ Cumulative Interest for 390 days, 18 months, 36 months, 66 months

About Company

Kosamattam Finance Ltd, headquartered in the southern Indian state of Kerala, is a NBFC lending money against pedge of used household gold jewellery “Gold Loans” in the state of Kerala, TamilNadu, Karnataka Andra Pradesh, Delhi and in the Union Territory of Poducherry.

The Kosamattam group was originally founded by Mr. Chacko Varkey. His grandson, Mr. Mathew K. Cherian, the present Chairman and managing director of Kosamattam Group is a fourth generation entrepreneur in the family.

As on February 28, 2014, KFL is having a branch network of 781 branches largely spread across southern India. The Gold Loan portfolio of KFL as of Dec 31, 2013 is comprised of 308745 gold loan accounts, aggregating Rs. 950 Cr. which is 96.10% of the total loans and advances.

Gross non-performing glold loan assets were 0.17%, 0.31%, 0.36% and 0.02% of gross Gold Loan portfolio under management as of Dec 31, 2013, Mar 31, 2013, 2012 and 2011 respectively.

Positive Points

- High Coupon rate of 12% as compared to Bank FD rates of 9%

- If you fall in the lower tax bracket, post-tax returns for some options in this NCD are superior to that of tax-free bonds.

Negative factors

- For an investor in the highest tax bracket, it doesn’t make sense to invest in these as the net returns are comparable with that of the tax-free bonds.

- NCDs are illiquid. If the interest rates fall, it may be difficult for investors to capitalise on falling interest rates. If you invest in govt bonds / short medium term debt funds, and if the interest fall in 2-3 years time frame, they may give you better returns than these NCD offering 12.5%.

Taxation Aspects

- NCDs taken in the demat form will NOT attract any TDS on the interest income. However, if NCD are taken in physical form, TDS will be applicable if the interest amount exceeds Rs. 5,000

| Interest earned on NCD | Taxable as per tax slab of Investor |

| If sold on exchange (before 12 months) | Short term capital gain / loss – Taxable as per tax slab of Investor |

| If sold on exchange (after 12 months) | Long term capital gain / loss – Taxable @ 10.30% without indexation |

How to Apply

- Physical Form – You can download the Form and submit to designated bank branches alongwith cheque. Kosamattam Finance NCD Application Form Download

- Online – You can invest online in DMAT form through your online share trading account or through your broker.

Summary

- Investors in lower tax slab can consider investing in these NCD, but not more than 10% of their debt allocation.

- Investors in the 30% tax bracket should invest in tax-free bonds or go for debt funds or FMPs.

Allotment Date –

Listing date –